Introduction

In the realm of personal finance, the allure of options trading has surged on popular platforms like Reddit and Robinhood. Options offer investors the potential for amplified returns, but their complexity can also lead to steep losses. This comprehensive guide will delve into the world of options trading on these platforms, enabling you to grasp the fundamentals, navigate the complexities, and make informed decisions in your investment journey.

Image: www.youtube.com

Understanding Options Basics

Options contracts represent a unique type of financial security that grants the buyer the right (but not the obligation) to buy or sell an underlying asset at a predetermined price on or before a specific date. This right comes at a premium, which is the cost of the contract. There are two main types of options: calls and puts.

Call options provide the buyer with the right to purchase an asset, while put options give the right to sell. When an investor believes the asset’s price will rise, they might buy a call option to potentially reap profits from the increase. Conversely, if they anticipate a price decline, they could buy a put option to capitalize on the depreciation.

Reddit’s Role in Options Trading

Reddit has fostered a thriving community of options traders who share knowledge, strategies, and insights. Subreddits like r/options and r/wallstreetbets have become popular hubs for discussing options trading opportunities. Redditors often engage in lively debates, providing diverse perspectives and fostering a sense of camaraderie among like-minded individuals.

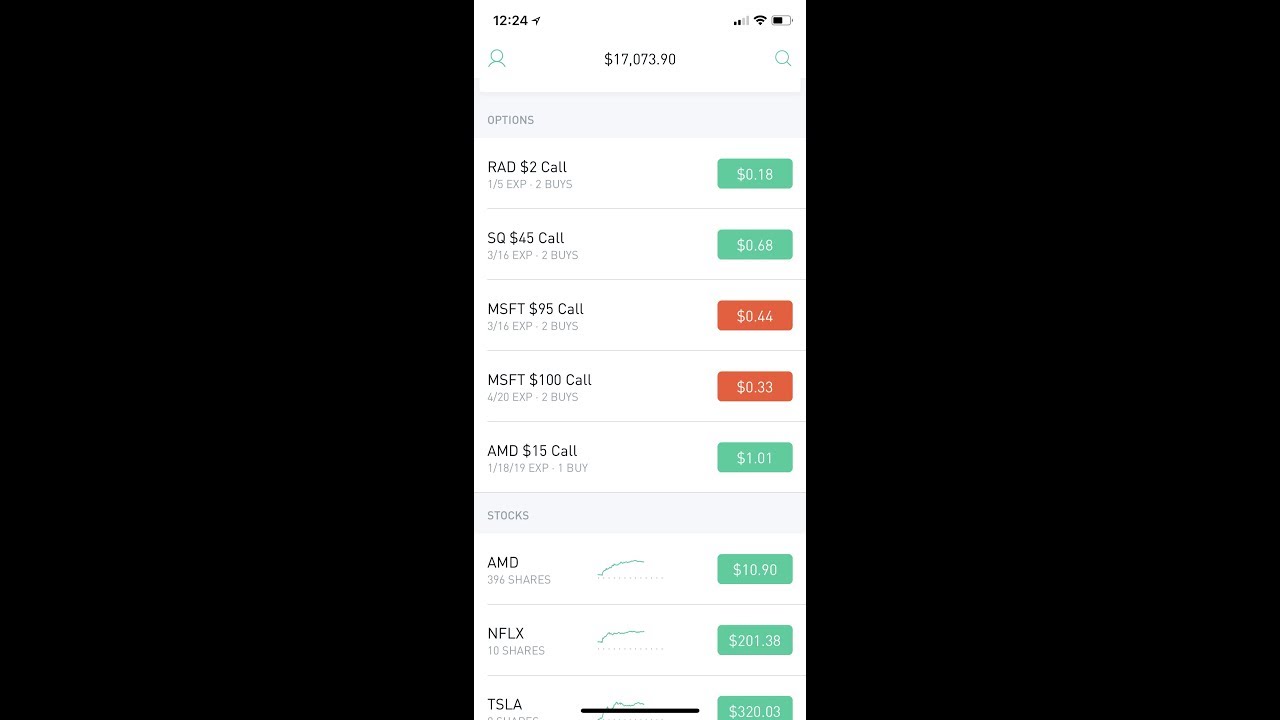

Robinhood: A User-Friendly Platform for Options Trading

Robinhood revolutionized the options trading landscape by offering a user-friendly platform with no commission fees. This has made it accessible to a wider range of investors, including beginners and those with limited capital. Robinhood’s intuitive interface simplifies the process of placing options orders and provides access to real-time market data and educational resources.

Image: www.youtube.com

Key Considerations for Options Trading

While options trading can be lucrative, it’s essential to approach it with caution. Key considerations include:

- Risk Management: Options trading carries inherent risks. It’s crucial to manage your risk by carefully selecting strikes, calculating potential losses, and setting appropriate limits.

- Time Decay: Options contracts have an expiration date. Time value, known as theta, gradually decays as the expiration approaches. Consider the impact of time decay on your strategy.

- Volatility: Options prices are closely tied to the volatility of the underlying asset. Understand how volatility influences option premiums and adjust your strategies accordingly.

- Stock Selection: Choosing the right stocks to trade options on is crucial. Consider the stock’s liquidity, volatility, and overall market conditions when making your selections.

Tips for Successful Options Trading

To increase your chances of success in options trading:

- Educate Yourself: Learn about options trading strategies, risk management techniques, and market trends. Understand the terminology and nuances of the market.

- Start Small: Begin by trading small positions with low premiums. Gradually increase your commitment as you gain experience and confidence.

- Use Limit Orders: Place limit orders to protect yourself from unfavorable price movements. This helps control your risk and prevents large losses.

- Don’t Chase Losses: Resist the temptation to double down on losing positions. Instead, acknowledge losses and adjust your strategy accordingly.

- Monitor Your Positions Closely: Regularly review your options positions and make adjustments as needed. Stay informed about market conditions and company news that may impact your investments.

Options Trading Reddit Robinhood

Image: www.youtube.com

Conclusion

Options trading on Reddit and Robinhood can empower you to unlock the potential of financial markets. By embracing the knowledge shared within Reddit’s online communities, utilizing Robinhood’s user-friendly platform, and adhering to sound trading principles, you can navigate the complexities of options trading and pursue your investment goals with greater confidence. Always remember to approach options trading with a strategic mindset, managing risks, and seeking continuous learning to increase your chances of long-term success.