In the realm of investing, stock and option trading stand as two potent tools with the potential to amplify financial gains. As a novice trader, embarking on this journey can evoke both excitement and trepidation. In this article, we will equip you with a comprehensive understanding of stock and option trading, empowering you to navigate these markets with confidence.

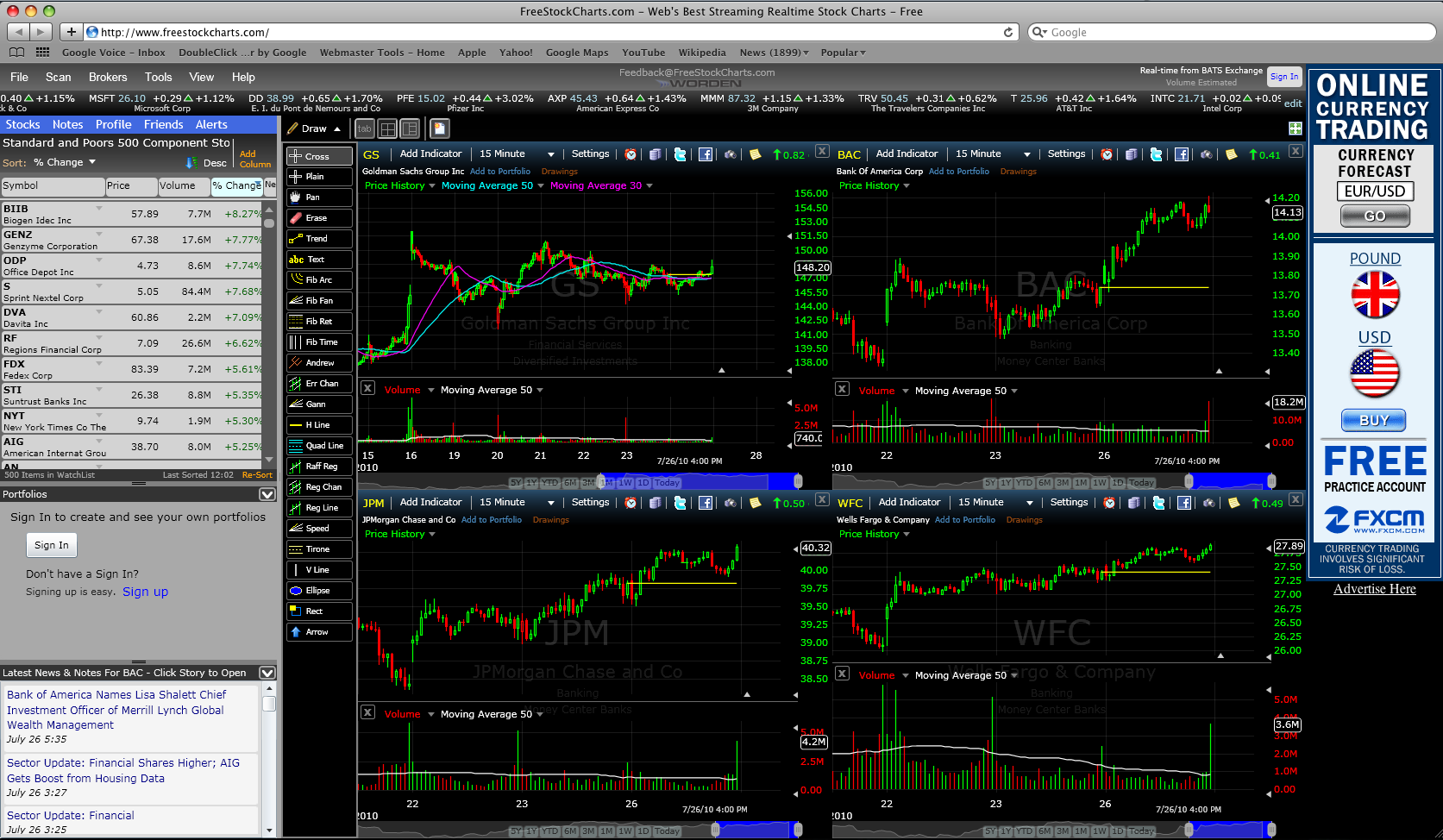

Image: tokenist.com

Unveiling the Stock Market

What is Stock Trading?

Stock trading involves buying and selling shares of publicly-traded companies. When you purchase stock, you become a partial owner of the company, entitled to a portion of its profits. Stock prices fluctuate based on market demand and supply, company performance, and economic conditions.

Options: A Window into Future Trades

Understanding Option Trading

Options grant the holder the right to buy (call option) or sell (put option) an underlying asset, such as a stock, at a specified price (strike price) and on a specific date (expiration date). Options offer traders flexibility and the potential for magnified profits, but they also carry inherent risks.

Diving into the Inner Workings of Markets

The ABCs of Stock and Option Trading

Understanding the basics is crucial for successful trading. Stocks are classified into different types based on factors such as size, industry, and growth potential. Options, on the other hand, possess intricate characteristics, including strike price, expiration date, and premium (price paid). Grasping these nuances is essential for informed decision-making.

Image: s3.amazonaws.com

Strategic Execution: Tactics and Techniques

Successful trading requires a disciplined approach. Employ technical analysis to identify price trends and potential trading opportunities. Fundamental analysis delves into company health, industry dynamics, and economic conditions, providing insights into a stock’s long-term value. By combining these strategies, you can develop robust trading plans.

Unveiling the Latest Trends in Trading

Staying abreast of emerging trends is vital. FinTech advancements, such as algorithmic trading and mobile trading platforms, are reshaping the trading landscape. Cryptocurrency trading has also gained traction, presenting both opportunities and challenges for investors. By staying informed, you can adapt to the evolving market dynamics and optimize your trading strategies.

Unlocking Your Success: Tips from the Experts

Expert Advice for Enhanced Trading

Seasoned traders offer invaluable advice to help you navigate the complexities of stock and option trading. Prioritize risk management by setting clear stop-loss orders and hedging positions to mitigate losses. Embrace meticulous record-keeping to track your progress and identify areas for improvement.

Common Queries: Unraveling the Frequently Asked Questions

Stock And Option Trading

Image: www.fortunebuilders.com

Clarifying Common Doubts

Q: What is the difference between a stock and an option?

A: Stocks represent ownership in a company, while options provide the right to buy or sell an underlying asset at a specified price on a specific date.

Q: Can I get rich quick with stock and option trading?

A: While high returns are possible, stock and option trading involve significant risk. Quick riches are not a realistic expectation.

Q: What resources are available for learning about stock and option trading?

A: Online courses, books, and trading simulators offer valuable resources for expanding your knowledge and gaining practical experience.

Conclusion: Empowering Your Financial Future

Entering the world of stock and option trading can empower you to take control of your financial future. By immersing yourself in this article’s insights, you have laid the groundwork for your trading journey. Remember, continuous learning and adaptation are key to succeeding in this dynamic and ever-evolving market. Are you ready to dive into the thrilling world of stock and option trading? The journey awaits!