Embrace the Power of Patience for Success

Like a seasoned investor navigating the stormy seas of the financial markets, I discovered the transformative potential of long-term options trading many years ago. In the treacherous waters of short-term fluctuations, I found solace in the tranquil depths of longer time frames, where careful planning and a touch of patience could lead to substantial gains. In this comprehensive guide, I will unravel the secrets of long-term options trading, empowering you to unlock the gateway to sustained profitability.

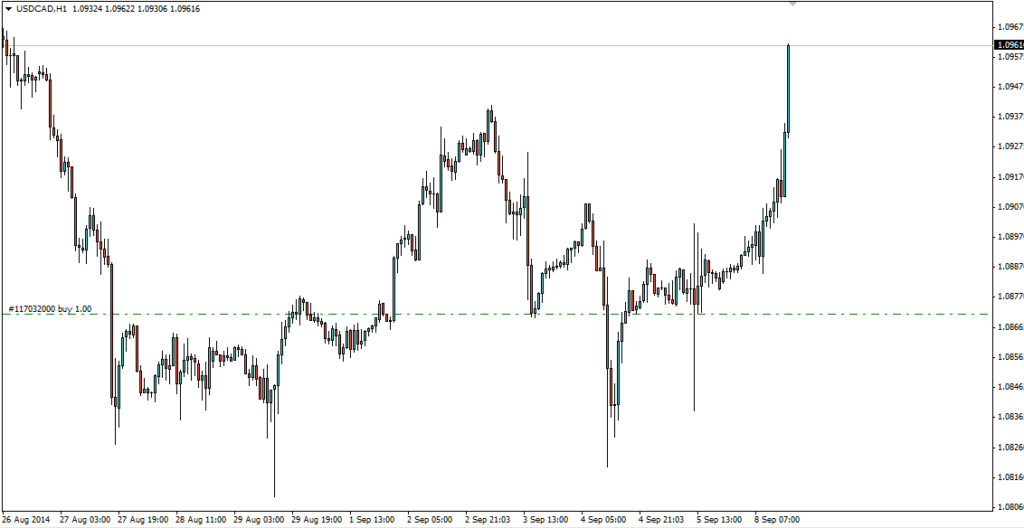

Image: preferforex.com

Defining Long-Term Options Trading: A Strategic Perspective

Long-term options trading involves holding options contracts for extended periods, often spanning months or even years. Unlike short-term trading, which aims for quick profits from short-lived market movements, long-term strategies target secular trends, fundamental shifts, and macroeconomic developments. By focusing on the underlying asset’s long-term performance rather than day-to-day noise, these strategies minimize volatility risks and enhance the probability of sustainable returns.

Unveiling the Mechanics: A Journey Through Options Basics

Before embarking on our long-term options trading odyssey, it’s essential to grasp the fundamental concepts. Options are financial instruments that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). Consider an example: if you buy a call option with a strike price of $100 expiring in six months, you secure the right to purchase the underlying asset at $100 within the six-month period.

Navigating the Options Landscape: Call and Put Strategies

Understanding call and put options is pivotal for long-term trading. Call options are leveraged instruments that allow investors to profit from an increase in the underlying asset value. If the asset price rises above the strike price, the call option gains value. Conversely, put options provide a hedge against declining asset prices. If the asset price falls below the strike price, the put option gains value.

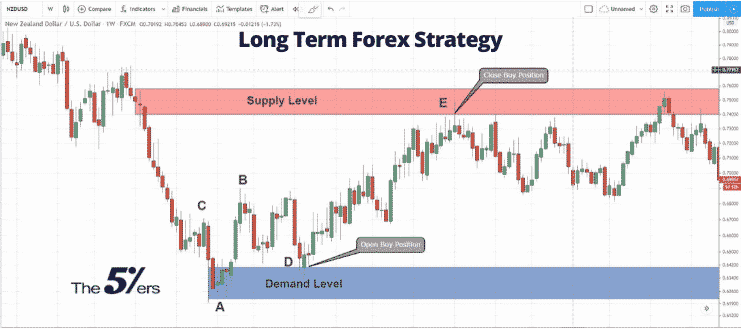

Image: www.tradersvaults.com

Crafting Long-Term Options Strategies: A Blend of Art and Science

Long-term options trading necessitates a comprehensive understanding of the underlying asset, market conditions, and potential risks. Selecting the appropriate options strategy is paramount, with popular choices including:

-

Covered Calls: Selling a call option against an underlying stock that you own. This strategy generates premium while limiting potential upside.

-

Cash-Secured Puts: Selling a put option backed by cash. If the asset price falls below the strike price, you are obligated to purchase the asset at the strike price.

-

Bull Call Spreads: Buying a lower strike price call option and simultaneously selling a higher strike price call option. This strategy limits potential profit but reduces overall risk.

Embracing Expert Insights: Time Value, Volatility, and Greeks

Expert advice is invaluable in the world of options trading. Veteran traders emphasize the importance of considering time value, volatility, and Greeks (option pricing variables). Time value decays as the option approaches its expiration date, limiting the potential for profit in long-term strategies. Volatility, on the other hand, enhances option premiums but also magnifies the potential for losses. Greeks, such as Delta and Theta, provide valuable insights into an option’s behavior under various market conditions.

Long Term Trading With Options

Image: the5ers.com

Mastering the Art of Patience and Discipline

Patience and discipline are the hallmarks of successful long-term options traders. Avoid being swayed by market fluctuations or emotional impulses. Stick to your predetermined trading plan and periodically review your portfolio, adjusting positions as needed based on evolving market conditions. Remember, the financial markets are constantly evolving, requiring adaptability and a willingness to learn and grow.