Introduction

In the fast-paced and potentially lucrative world of option trading, many traders explore the option of using borrowed money, also known as margin trading, to amplify their returns. While margin trading can indeed magnify profits, it also magnifies losses, making it a high-risk, high-reward endeavor.

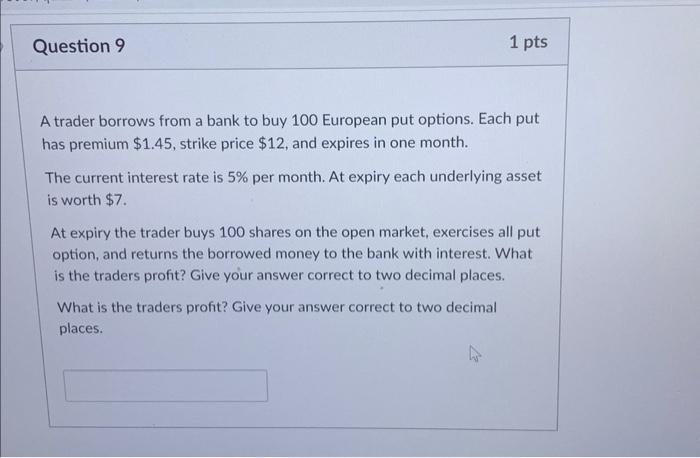

Image: www.chegg.com

This article delves into the intricacies of borrowed money in option trading, exploring its mechanics, strategies, and the potential risks and rewards associated with it. Whether you’re a seasoned trader or just starting to navigate the world of options, understanding the ins and outs of margin trading is crucial for informed decision-making.

Understanding Margin Trading

When trading options on margin, a trader borrows money from their broker to increase their purchasing power. This allows them to control a larger number of contracts than they could with their own capital alone, potentially multiplying their potential profits. In essence, it’s like using a loan to invest in options.

The amount of leverage a trader can access depends on their broker and the margin requirements set for the specific options contracts they wish to trade. For instance, a broker may allow a 2:1 leverage ratio, meaning a trader can borrow up to $2 for every $1 they invest.

Strategies for Effective Margin Trading

Margin trading is not a strategy itself but rather a tool that can enhance specific trading strategies. Some popular strategies that utilize borrowed money include:

- Covered Call: In this strategy, a trader sells (or “writes”) a covered call option against an underlying stock that they own. They receive a premium for selling the option, and if the stock price remains below the strike price, they keep the premium while maintaining ownership of the stock.

- Naked Call: A more aggressive strategy, naked calls involve selling a call option without owning the underlying stock. If the stock price rises above the strike price, the trader must buy the stock at a higher price to fulfill the obligation to sell at the strike price.

- Vertical Spreads: Vertical spreads involve combining multiple options to create a specific risk-reward profile. By buying one option at a lower strike price and selling another at a higher strike price, traders can limit their potential losses while still capturing potential profits.

Risks and Rewards of Margin Trading

While margin trading offers the allure of amplified profits, it comes with significant risks that must be acknowledged:

Magnified Losses: The primary risk of margin trading is that it magnifies not only potential profits but also potential losses. If an option trade moves against a trader’s favor, they may end up owing more money than they initially invested.

Margin Calls: If an option trade experiences significant losses, a broker may issue a margin call, demanding additional collateral or liquidation of the position. This can lead to hasty decisions or substantial losses if the trader is unable to fulfill the margin call.

Unlimited Liability: Naked call options carry unlimited liability, meaning a trader can lose more than their initial investment. If the stock price rises excessively, the trader may have to purchase a large number of shares at a higher cost to fulfill their obligation.

Image: rattibha.com

Borrowed Money In Option Trading

Image: www.youtube.com

Conclusion

Borrowed money in option trading can be a double-edged sword, offering the potential for both amplified profits and substantial losses. By trading on margin, traders essentially increase their risk-reward ratio, magnifying their potential returns while also magnifying their potential losses.

Before venturing into margin trading, traders should have a solid understanding of option pricing and trading strategies. It’s important to carefully consider their risk tolerance, financial situation, and investment goals. As with any investment strategy, due diligence and prudent risk management are essential to minimize losses and maximize the potential benefits of borrowed money in option trading.