In the fast-paced world of investing, there are countless opportunities to make a profit. One such opportunity lies in the realm of long-term options trading, a strategy that can yield substantial returns with patience and a keen eye for market trends.

Image: www.gettogetherfinance.com

Let me share a personal anecdote that sparked my journey into long-term options trading. A few years ago, I witnessed a colleague effortlessly generate wealth by investing in long-term call options. Intrigued, I embarked on a quest to understand this seemingly complex realm.

Long-Term Options Trading: A Long-Term Path to Profitability

Long-term options trading is a strategy that involves purchasing options contracts with expiration dates that extend beyond one year. These contracts provide the buyer with the right, but not the obligation, to buy (call options) or sell (put options) the underlying asset at a predetermined strike price.

By opting for long-term options, traders seek to capitalize on long-term market trends and price movements. This approach allows for a more relaxed and calculated approach, eliminating the need for constant monitoring and frequent trading. Instead, long-term options traders aim to identify long-term biases that align with their investment horizon.

The Art of Patience in Long-Term Options Trading

Long-term options trading is not for the faint of heart or the impatient investor. It requires a fundamental understanding of the underlying asset and market dynamics, as well as the discipline to stay invested through potential market fluctuations.

The key to success in this strategy lies in identifying high-probability setups that align with long-term trends. This may involve analyzing company fundamentals, industry trends, and macroeconomic indicators. The ability to ride out market volatility and stay focused on the long-term goal is essential for reaping the benefits of this approach.

Expert Insights and Practical Tips:

Drawing on my experience as a blogger and insights from industry experts, here are a few key tips for successful long-term options trading:

- Choose the right underlying asset: Select an asset with a clear long-term trend that aligns with your investment thesis. Consider factors such as earnings growth, industry tailwinds, and competitive advantages.

- Determine your entry point carefully: Use technical analysis or other methods to identify potential entry points that offer a favorable risk-reward ratio.

- Manage your risk prudently: Never invest more than you can afford to lose, and use stop-loss orders to limit potential downside.

Additionally, remember that the market is constantly evolving, and so should your trading strategy. Stay updated on market news, company announcements, and economic data to ensure that your positions remain aligned with current market conditions.

Image: mtdownloads.com

FAQs: Demystifying Long-Term Options Trading

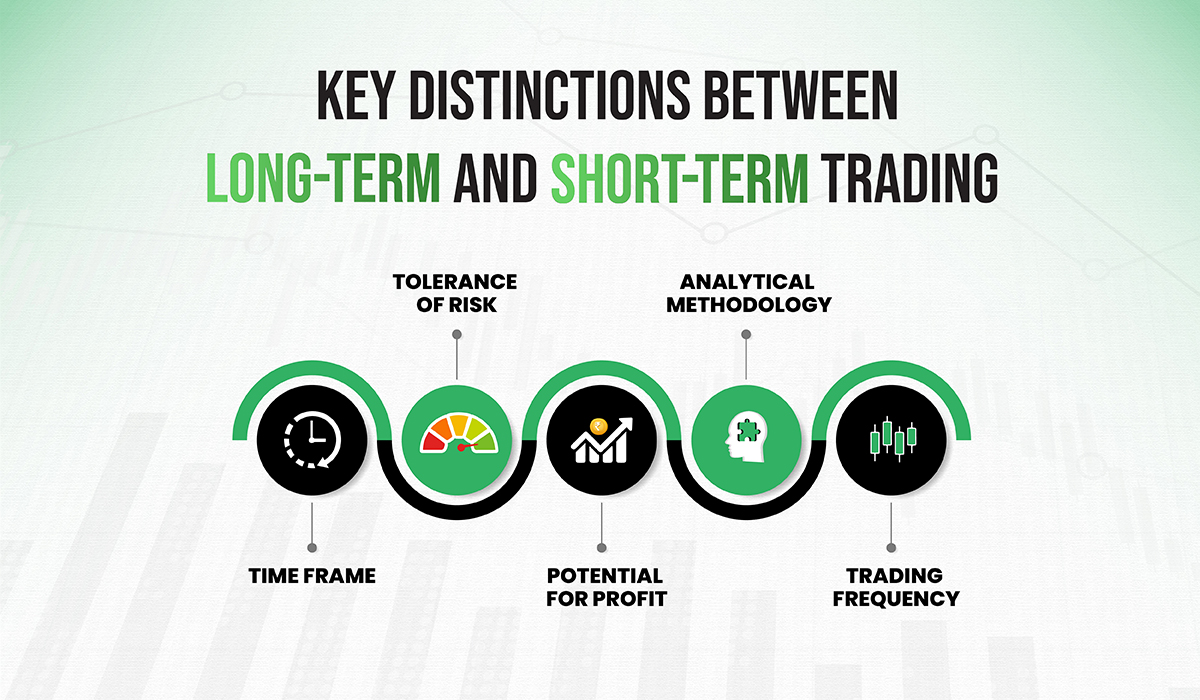

- What is the difference between short-term and long-term options trading? Short-term options have expiration periods of one year or less, while long-term options expire beyond one year, offering greater flexibility and potential for long-term gains.

- How long should I hold long-term options? The optimal holding period depends on the specific trade setup. In general, long-term options provide greater flexibility and can be held for several months or even years.

- Can I trade long-term options on any asset? Long-term options are available on a wide range of underlying assets, including stocks, ETFs, indices, and commodities.

Trading Long Term Options

Conclusion

Long-term options trading offers immense potential for profit, but it demands patience, discipline, and a deep understanding of market dynamics. By embracing the insights and advice outlined in this article, you can enhance your trading capabilities and embark on a long-term journey towards financial success.

Whether you’re just starting your adventure in options trading or seeking to deepen your knowledge, remember that the constant pursuit of knowledge and a commitment to continuous improvement are key to unlocking the power of this transformative strategy.