Unveiling the Opportunities and Risks of IRA Options Trading

Options trading, a sophisticated investment strategy, has gained immense popularity among investors seeking amplified returns. However, a critical question arises: can you harness the potential of options trading within the confines of your Individual Retirement Account (IRA)? This comprehensive guide will delve into the intricate details of IRA options trading, empowering you to make informed decisions.

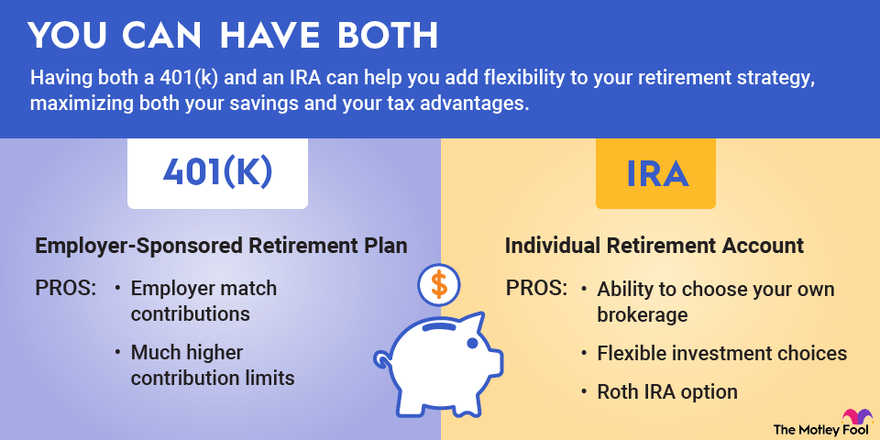

Image: www.fool.com

Navigating the IRA Options Landscape

An IRA, designed as a tax-advantaged retirement savings vehicle, offers various investment options, including stocks, bonds, and mutual funds. Options, however, present a unique asset class with distinct characteristics. Options are financial contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date).

In the context of an IRA, options trading can be conducted within certain parameters established by the Internal Revenue Service (IRS). These guidelines aim to ensure that IRA funds are used primarily for retirement savings and not speculative ventures. Understanding these regulations is crucial before embarking on IRA options trading.

Eligibility and Restrictions

To qualify for IRA options trading, your account must be an active, self-directed IRA. This type of IRA provides greater control over investment decisions compared to traditional IRAs. However, not all IRA custodians offer options trading capabilities. It’s essential to inquire with your custodian about their specific rules and requirements.

Additionally, the IRS imposes certain restrictions on IRA options trading. These restrictions include:

a) Prohibited Transactions: IRA funds cannot be used to purchase options on certain assets, such as collectibles, precious metals, or real estate.

b) Margin Trading Prohibition: Buying options using borrowed funds is not permitted within an IRA. Options must be purchased with cash available in your account.

c) Wash Sale Rule: IRA options trades that result in a wash sale are disallowed. A wash sale occurs when you sell an option at a loss and acquire a substantially identical option within 30 days.

Understanding the Risks and Rewards

Options trading, while potentially rewarding, carries significant risks that must be carefully considered. The following risks are inherent to IRA options trading:

a) Loss of Principal: Options trading involves the potential loss of the entire investment amount. Unlike stocks, which can fluctuate in value but retain the possibility of recovery, options can expire worthless, resulting in a total loss.

b) Unlimited Risk: Unlike other IRA investments, options trading carries unlimited risk. The potential losses in options strategies can exceed the initial investment amount.

c) Complex Nature: Options trading requires a sophisticated understanding of financial markets and options strategies. Misinterpreting market dynamics or choosing inappropriate strategies can lead to substantial losses.

Image: www.fool.com

Maximizing IRA Options Trading Success

Despite the risks, IRA options trading can provide opportunities for enhancing returns and meeting specific financial goals. Here are some strategies to maximize your chances of success:

a) Education and Research: Thoroughly understand options trading concepts, strategies, and risks before engaging in any trades. Consult with a financial advisor to assess your risk tolerance and investment objectives.

b) Specific Goals: Define clear financial goals before entering options trades. Determine the desired return, time horizon, and risk level that aligns with your overall investment plan.

c) Strategic Diversification: Diversify your IRA portfolio by allocating funds across various asset classes, including stocks, bonds, and options. This strategy aims to mitigate risks and improve overall returns.

d) Long-Term Perspective: Options trading should be approached as a long-term investment strategy. Avoid short-term speculation and focus on strategies with higher probabilities of success over extended periods.

Can I Use Ira Account For Options Trading

Image: osatajuvod.web.fc2.com

Conclusion

Exploring IRA options trading can be a powerful tool for sophisticated investors seeking enhanced returns. Thoroughly understanding the risks and rewards, adhering to IRS guidelines, and implementing sound strategies are critical to navigating this complex investment landscape. By embracing these principles, you can harness the potential of IRA options trading while preserving the integrity of your retirement savings. Remember to consult with a qualified financial advisor to determine if IRA options trading aligns with your individual investment goals and risk tolerance.