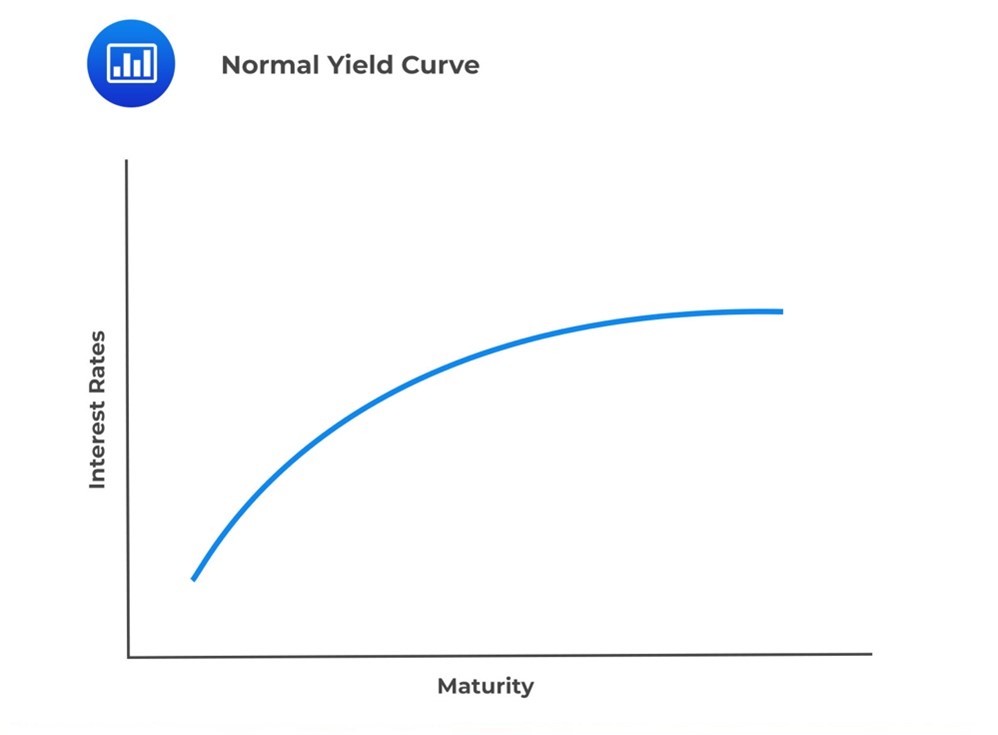

In the realm of fixed income, the yield curve has long been a valuable tool for investors seeking to understand the market’s outlook on interest rates. The shape of the yield curve can provide insights into future economic conditions, monetary policy expectations, and inflation pressures.

Image: analystprep.com

Delving into the Art of Curve Trading

Traditionally, yield curve trading has been the domain of institutional investors with access to sophisticated fixed income products. However, the rise of options markets has opened up new avenues for retail investors to participate in yield curve strategies. By utilizing options, traders can gain exposure to the relative movements of different points on the yield curve without having to purchase or sell the underlying bonds.

Fundamentals of Curve Trading with Options

At its core, curve trading involves betting on the future shape of the yield curve. A “bull” curve trade is a wager that the curve will steepen, with long-term rates rising relative to short-term rates. Conversely, a “bear” curve trade is a bet that the curve will flatten or invert, with long-term rates falling relative to short-term rates.

Traders can execute curve trades using various option strategies, including call spreads, put spreads, and butterfly spreads. Each strategy provides unique opportunities and risks, and traders must carefully consider their objectives and risk tolerance when selecting an approach.

Navigating Market Expectations

Understanding market expectations is crucial for effective curve trading. Traders should monitor central bank announcements, economic data releases, and geopolitical events that can influence interest rate expectations.

By analyzing the current yield curve shape and market sentiment, traders can develop informed views on the future direction of interest rates. This knowledge empowers them to make judicious trading decisions and capitalize on potential yield curve shifts.

Image: www.researchgate.net

Expert Tips and Insights

To enhance your curve trading skills, consider the following expert advice:

- Thoroughly Understand the Yield Curve: Gain a comprehensive understanding of how different yield curve shapes affect investor behavior and market expectations.

- Choose Appropriate Option Strategies: Carefully select option strategies aligned with your trading objectives and risk profile. Research and analyze various strategies to determine the most suitable ones.

Frequently Asked Questions (FAQs)

- Q: What is the benefit of using options in curve trading?

- A: Options provide leverage and flexibility in curve trading. They allow traders to express views on the yield curve without taking on direct exposure to the underlying bonds.

- Q: Which factors should be considered before executing a curve trade?

- A: Traders should consider their trading goals, risk tolerance, prevailing market expectations, and the historical behavior of the yield curve before entering a trade.

Trading Yield Curves Using Options

Image: finite.io

Conclusion

Trading yield curves using options offers investors a powerful tool to speculate on the direction of interest rates and potentially generate returns. By understanding market expectations, utilizing appropriate option strategies, and following expert advice, traders can enhance their curve trading skills and navigate the dynamic world of fixed income markets.

Are you intrigued by the world of yield curve trading? Share your thoughts and questions in the comments below!