Prelude

In the vibrant realm of financial markets, the concept of open interest serves as a beacon of information for traders. It holds significant sway in the world of option trading, guiding traders in making informed decisions and gauging market sentiment. Open interest measures the number of outstanding contracts for a specific derivative, providing valuable insights into market dynamics and potential price movements.

Image: coinalyze.net

Understanding Open Interest

Open interest refers to the total number of option contracts that have been bought and sold but not yet closed or settled. Essentially, it represents the sum total of all buy and sell orders that have not been executed. Each contract represents an underlying asset, and changes in open interest indicate the flow of capital into and out of the option market.

Historical Roots

The concept of open interest traces its origins back to the Chicago Board of Trade (CBOT), where it played a pivotal role in futures markets. In 1864, the CBOT introduced a centralized trading pit, enabling real-time tracking of open orders. This innovation revolutionized market transparency and provided traders with a comprehensive view of market positions.

Types of Open Interest

In the realm of option trading, two types of open interest exist:

Image: www.theassets.io

Long Open Interest

Long open interest represents the total number of option contracts that have been bought but not yet sold. These contracts confer upon the buyer the right to buy the underlying asset at a predetermined price (in the case of a call option) or sell the underlying asset at a predetermined price (in the case of a put option).

Short Open Interest

Short open interest represents the total number of option contracts that have been sold but not yet bought back. With these contracts, the seller has an obligation to sell or buy the underlying asset at the strike price.

Significance of Open Interest

Open interest serves as a multifaceted indicator, providing traders with valuable market insights:

Measuring Market Liquidity

High open interest indicates a liquid option market with many buyers and sellers present. This translates into tighter bid-ask spreads, increased trading volume, and reduced market volatility. Conversely, low open interest suggests a less liquid market, making it more difficult for traders to enter or exit positions quickly.

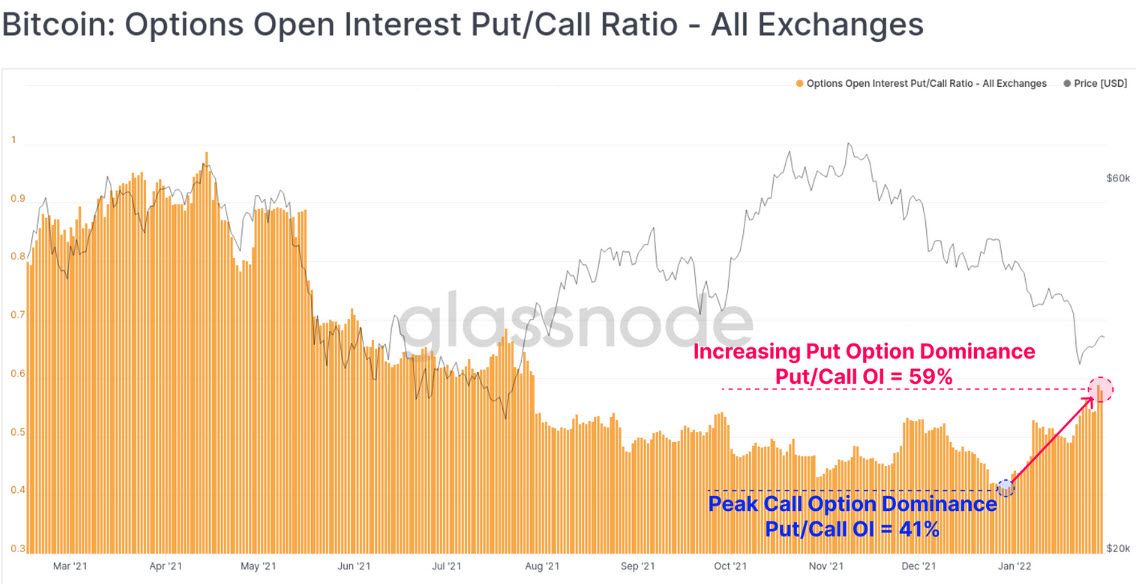

Gauging Market Sentiment

Changes in open interest can reflect market sentiment. An increase in open interest may signal a bullish market outlook, as buyers enter the market anticipating a rise in the underlying asset’s price. Similarly, a decrease in open interest may suggest a bearish market sentiment, as sellers exit the market in anticipation of a price decline.

Identifying Trading Opportunities

Open interest can help traders identify potential trading opportunities. For instance, a significant increase in open interest for call options may indicate that traders are betting on a price increase, providing a buying opportunity for those who share this view. On the flip side, a large increase in open interest for put options may indicate a negative market outlook, presenting a selling opportunity.

What Is Meant By Open Interest In Option Trading

Image: www.pinterest.co.uk

Conclusion

Open interest stands as an indispensable metric in the world of option trading, providing traders with a comprehensive view of market dynamics and sentiment. By understanding the concept and its various facets, traders can make informed decisions, capitalize on trading opportunities, and navigate the complexities of the financial markets with greater precision. Delving deeper into the intricacies of open interest is highly recommended for traders seeking to enhance their trading strategies and maximize their profitability.