In the intricate financial markets, options trading emerges as a powerful tool that empowers investors to navigate the complexities of risk management and profit potential. Among the diverse array of options, put options stand out as a cornerstone for discerning investors seeking downside protection and profit-making opportunities.

Image: www.hotelgurupokhara.com

This comprehensive guide will delve into the fundamentals of put options trading, guiding you through the intricacies of this sophisticated financial instrument. As we embark on this journey, we will illuminate the essence of put options, their vital purpose, and the practical know-how required to harness their potential.

Understanding Put Options: A Haven of Downside Protection

A put option bestows upon its holder the right, but not the obligation, to sell a specific number of shares of an underlying asset at a predetermined price, known as the strike price, before a specified expiration date. This versatile tool serves as a valuable shield against plummeting asset values, shielding investors from substantial losses.

In essence, put options act as insurance policies for your investment portfolio. By acquiring a put option, you effectively purchase the peace of mind that comes with knowing you have the option to sell your assets at a fixed price, thus mitigating potential losses in the event of an adverse market downturn.

Unveiling the Dynamics of Put Options Trading

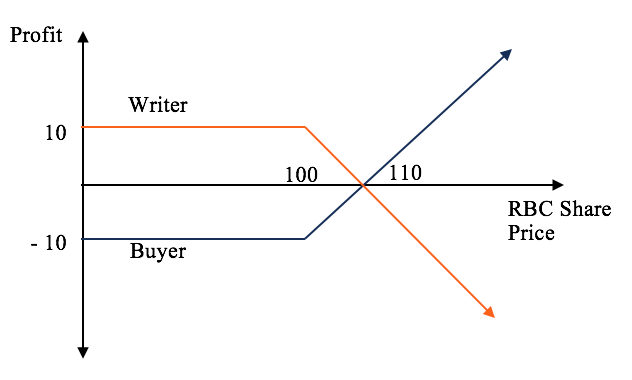

To successfully trade put options, it is imperative to grasp the intricacies of their pricing and profit potential. The premium paid to acquire a put option encapsulates the market’s estimation of the likelihood that the underlying asset’s price will decline below the strike price by the expiration date.

Hence, when the underlying asset’s price languishes below the strike price, the value of the put option soars, rendering a profit for the astute investor. Conversely, if the underlying asset’s price rallies, the value of the put option diminishes, potentially resulting in a loss for the investor.

Insights from the Trading Trenches: Tips for Enhanced Options Trading

Navigating the labyrinth of options trading demands a blend of strategic acumen and the wisdom culled from experienced practitioners. Here, we present invaluable tips to fortify your trading prowess:

- Embrace Due Diligence: Before venturing into the options trading arena, it is imperative to conduct thorough research on the underlying asset, understanding its historical price movements and key market dynamics.

- Choose Your Strike Price Wisely: The strike price of a put option plays a crucial role in determining your profit potential. Select a strike price that aligns with your risk tolerance and market expectations.

- Monitor Market Conditions: Staying abreast of market fluctuations and news events that could impact the underlying asset’s price is crucial for informed trading decisions.

Image: www.transparenttraders.me

Expert Insights: Unveiling the Secrets of Successful Put Options Trading

To further illuminate the intricacies of put options trading, we sought the wisdom of seasoned experts. Their invaluable insights offer a glimpse into the minds of successful options traders:

“Trading is not about making the right decision every time. It is about managing your risk and protecting your capital.”

This profound quote underscores the paramount importance of risk management in options trading. By implementing robust risk management strategies, you can significantly mitigate potential losses and safeguard your investment capital.

Common Questions and Concise Answers: Unraveling the Mysteries of Put Options

To address lingering questions and enhance your understanding of put options trading, we present a comprehensive FAQ section:

- Q: What is the maximum profit potential of a put option?

A: The maximum profit potential of a put option is limited to the difference between the strike price and the underlying asset’s price at expiration, minus the premium paid. - Q: What is the maximum loss potential of a put option?

A: The maximum loss potential of a put option is limited to the premium paid to acquire the option. - Q: When should you consider buying a put option?

A: Put options can be an appropriate investment strategy when you anticipate a decline in the underlying asset’s price.

A Beginners Guide To Put Options Trading

Embracing the Power of Put Options: A Call to Action

Put options trading empowers investors with a versatile financial tool that can enhance portfolio resilience and uncover profit-making opportunities. By embracing the knowledge imparted in this comprehensive guide, you can take your first steps toward harnessing the potential of put options and navigating the financial markets with greater confidence.

Are you ready to delve deeper into the world of put options trading? Explore our additional resources and continue your journey towards financial empowerment.