Naked Puts: A Risky but Potentially Rewarding Strategy

Image: www.youtube.com

Imagine a scenario where you are particularly bullish on a particular stock or index. You believe that the price will continue to rise or remain within a specific range for a set period of time. However, you want to earn a return on your belief without actually purchasing the underlying asset, as this could tie up significant capital.

Enter the world of naked put options. This article will delve into the intricate details of naked put options, unraveling the complexities of this high-risk, high-reward strategy and providing expert insights and tips to empower you in your trading endeavors.

Understanding Naked Put Options

Definition

A naked put option is a unique type of option strategy where the seller (writer) does not possess the corresponding underlying asset (e.g., shares, bonds, etc.). The seller grants the buyer (holder) of the put option the right, but not the obligation, to sell the underlying asset to the seller at a specified price (strike price) on or before a defined date (expiration date).

Mechanism

When a naked put option is sold, the seller receives a premium from the buyer. The seller benefits if the underlying asset price remains above the strike price, allowing them to keep the premium. However, if the asset price falls below the strike price at expiration, the seller is obligated to purchase the underlying asset at the strike price, potentially incurring losses.

Advantages and Disadvantages of Naked Put Options

Advantages:

- Income Generation: Selling naked puts allows traders to earn a premium even if the underlying asset price remains stagnant or increases.

- Limited Risk: The maximum potential loss for the seller is limited to the strike price minus the premium received.

Disadvantages:

- High Risk: Unlike covered puts, naked puts have unlimited profit potential, but also unlimited risk if the underlying asset price falls below the strike price.

- Margin Requirement: Selling naked puts requires a significant margin account to cover potential losses.

Tips and Expert Advice for Naked Put Trading

Understanding Market Dynamics: Thoroughly analyze the underlying asset, market trends, and potential catalysts that may influence its price movement.

Choosing Strike Prices and Expiration Dates: Select strike prices that align with your bullish outlook and expiration dates that provide an optimal balance of risk and reward.

Portfolio Diversification: Spread your naked puts across various underlying assets to mitigate risks and improve chances of profitability.

Risk Management: Always calculate and manage your potential losses based on market volatility and your own risk appetite. Consider protective measures such as stop-loss orders.

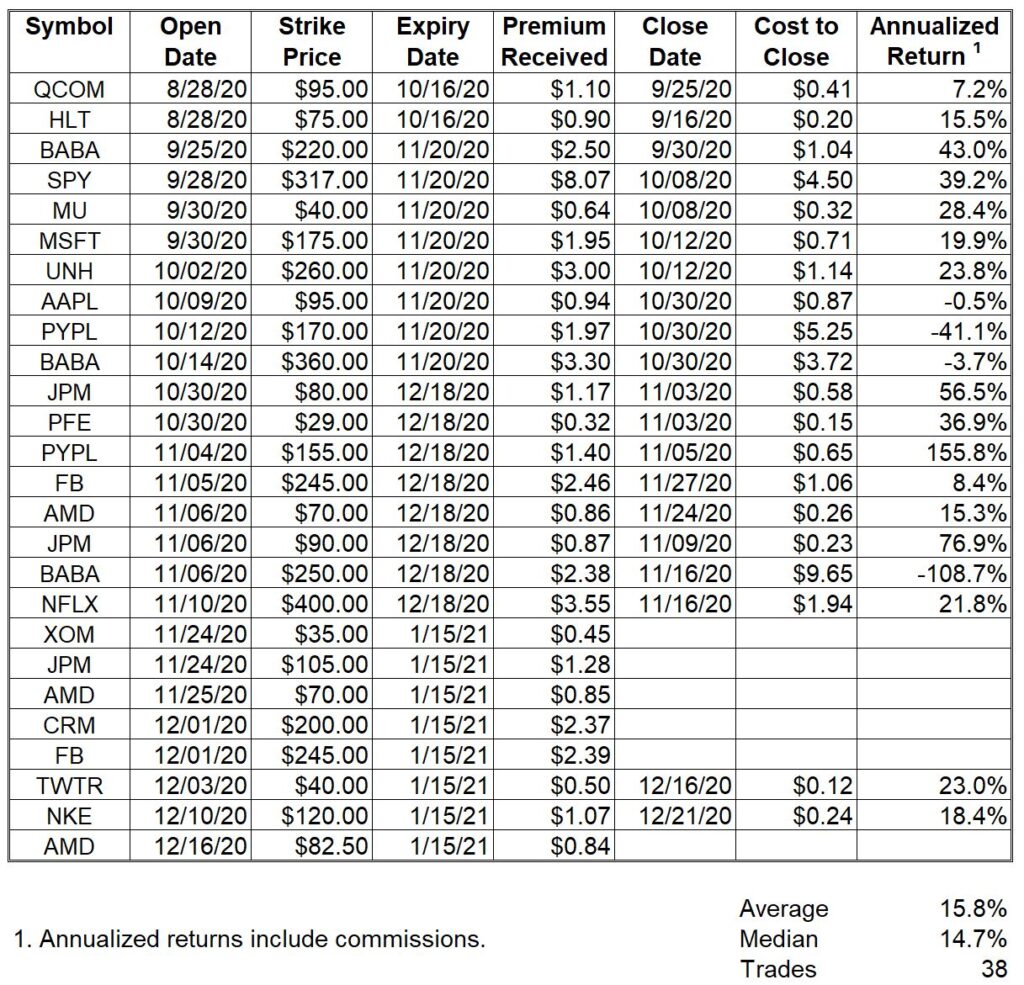

Image: thesystematictrader.com

Frequently Asked Questions (FAQs)

Q: What is the primary risk of naked put trading?

A: The primary risk is that the underlying asset price could fall below the strike price, obligating the seller to purchase it at a potentially higher cost than the market price.

Q: How can I minimize the risks of naked put trading?

A: Use proper risk management techniques, such as careful strike price selection, diversification, and margin account management.

Option Trading Naked Put

Image: optionalpha.com

Conclusion

Naked put option trading is a powerful strategy that can generate income and provide a defined maximum loss, but it also carries substantial risks. By understanding the mechanics, advantages, and disadvantages of this strategy, and implementing appropriate tips and risk management measures, traders can harness its potential while mitigating potential pitfalls.

If the concept of naked put options intrigues you, consider delving deeper into various resources and seeking professional guidance to further enhance your knowledge and make informed decisions.