Introduction

In the realm of financial markets, options trading presents a powerful tool for enhancing returns and managing risk. Among the various options strategies, naked options trading stands out for its potential for substantial profits. However, it’s crucial to approach this strategy with ample knowledge and meticulous risk management, as the stakes can be as high as the rewards.

Defining Naked Options

In essence, trading naked options involves selling or buying options contracts without holding the underlying asset. Contrary to covered options strategies, where the trader holds a corresponding position in the stock or futures contract, naked options expose the trader to unlimited potential losses. While this risk can be daunting, it also presents the prospect of substantial gains, making naked options trading both thrilling and inherently high-risk.

Understanding the Mechanics

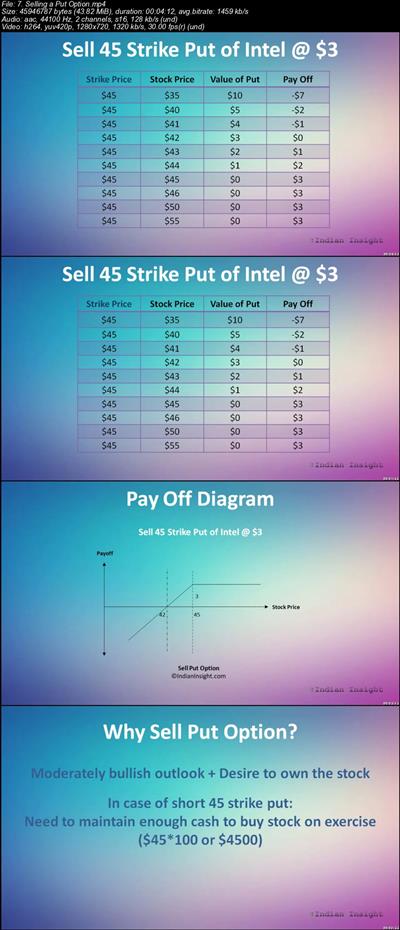

When selling a naked option, the trader receives a premium in exchange for the obligation to buy (if selling a call option) or sell (if selling a put option) the underlying asset at a specified strike price on or before the option’s expiration date. Conversely, when buying a naked option, the trader pays a premium for the right, but not the obligation, to exercise the option at the specified terms.

Types of Naked Options Strategies

The world of naked options encompasses a range of strategies, each with its own risk-reward profile. Common strategies include:

-

Naked Calls: Selling uncovered call options grants the trader a premium but obligates them to sell the underlying asset at the strike price if the option is exercised. This strategy is suitable for bullish market outlooks and aims to profit from limited upside potential.

Image: www.quora.com -

Naked Puts: Involving the sale of uncovered put options, this strategy carries the obligation to buy the underlying asset at the strike price upon option exercise. Naked puts are preferred in scenarios where the trader anticipates a decline in the underlying asset’s value.

Risk vs. Reward: Assessing Your Risk Tolerance

The alluring potential profits of naked options trading come hand in hand with significant risk. Before embarking on this strategy, it’s imperative to carefully assess your risk tolerance and ensure it aligns with the inherent volatility of naked options.

Managing Risk: Strategies for Mitigation

-

Selective Strike Prices: Choosing appropriate strike prices is crucial for risk management. Traders should consider strike prices that align with their market outlook and align with the amount of risk they are willing to take.

-

Expiration Date Selection: The length of time until option expiration can significantly impact risk. Selecting shorter-term options reduces risk, while longer-term options provide more time for potential profit but expose traders to greater potential losses.

-

Margin Account Requirement: Trading naked options typically requires a margin account, which amplifies both potential gains and losses. Traders should carefully manage their margin utilization to avoid margin calls and maintain trading discipline.

Image: freecoursedl.com

Trading Naked Options

Conclusion

Trading naked options presents a tantalizing opportunity for experienced traders to amplify their returns and potentially profit from market swings. However, it’s imperative to approach this strategy with a deep understanding of the mechanics, an astute assessment of risk tolerance, and a comprehensive risk management strategy. By carefully navigating the risks and leveraging advanced trading techniques, traders can unlock the full potential of naked options trading and reap substantial rewards.