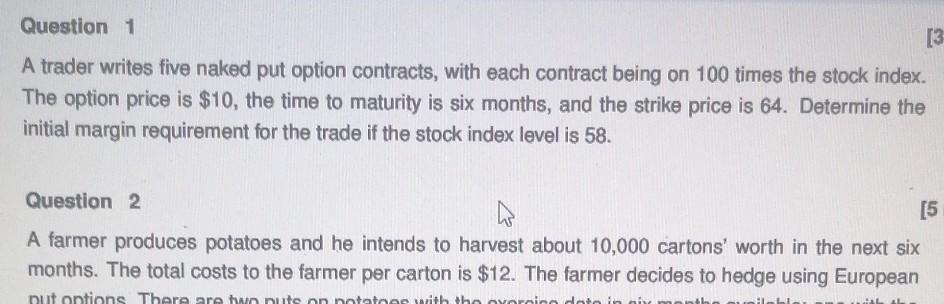

In the realm of options trading, two powerful strategies stand out: naked puts and naked calls. These strategies offer traders the potential for substantial returns, but they also carry significant risks. To navigate these complex concepts, we delve into their intricate differences, empowering you to make informed decisions.

Image: www.pinterest.com

Naked Puts: A Promise to Sell at a Lower Price

Imagine you’re a pessimist, convinced that a particular stock’s price will fall. A naked put strategy allows you to express this conviction. You sell (or grant) someone the right to sell you that stock at a specific price (the strike price) on a set date (the expiration date). If your prediction holds true, you profit as the stock declines. Conversely, if the stock rises above the strike price, you are obligated to buy the stock at the lower price, potentially incurring losses.

Naked Calls: A Promise to Buy at a Higher Price

Now, envision you’re an optimist, anticipating a stock’s rise. A naked call strategy enables you to capitalize on this belief. You sell (or grant) someone the right to buy that stock at a specific price (the strike price) by the expiration date. If the stock price soars beyond the strike price, you profit handsomely. However, if the stock price falls, you may lose the premium you initially received when selling the call.

Risk vs. Reward: Unveiling the Double-Edged Sword

Both naked puts and naked calls offer investors the allure of potentially large returns. However, they also come with inherent risks.

Naked Puts: The risk lies in the obligation to buy the stock if the stock price rises. This obligation can result in potentially unlimited losses if the stock price skyrockets. However, the premium received when selling the put helps offset the potential losses.

Naked Calls: The risk lies in the potential for the stock price to fall. In this scenario, you forfeit the premium received and potentially sustain losses.

Image: www.chegg.com

Understanding the Psychology: Fear vs. Greed

The decision to engage in naked puts and naked calls often hinges on the emotional rollercoaster of fear and greed. Fear drives the sale of naked puts, while greed fuels the sale of naked calls. It’s crucial to balance these emotions with sound judgment and a comprehensive understanding of the risks involved.

Expert Insights: Navigating the Market’s Whims

“Naked options are for experienced traders who fully understand the associated risks,” cautions financial advisor, Emily Carter. “Proper due diligence and a thorough understanding of the underlying stock’s fundamentals are essential.”

“Naked calls have the potential for large profits, but they are also more speculative than naked puts,” adds investment strategist, Mark Jones. “Traders should carefully consider their risk tolerance before engaging in these strategies.”

Actionable Tips: Empowering Your Trading Journey

- Thoroughly research the underlying stock and its industry dynamics before executing naked options.

- Determine your risk tolerance and trade within those limits.

- Consider the volatility of the stock and adjust your strategies accordingly.

- Manage your positions closely to minimize potential losses.

- If unsure, consult a financial advisor for guidance.

Option Trading Difference Between Naked Puts And Naked Calls

Image: www.myxxgirl.com

Conclusion: Embracing Informed Trading

Naked puts and naked calls are powerful tools in the hands of experienced traders who understand their risks and rewards. By delving into the intricacies of these strategies, embracing informed decision-making, and exercising prudence, you can navigate the options market with confidence and potentially enhance your financial well-being. Whether you’re driven by fear or greed, remember that knowledge is the key to unlocking successful trading endeavors.