Are you ready to delve into the alluring world of options trading and unlock its boundless potential? As a novice, you might be feeling overwhelmed by the complexities of options trading, but fear not! This comprehensive guide will equip you with the essential strategies and insights to navigate the Indian options market with confidence.

Image: www.youtube.com

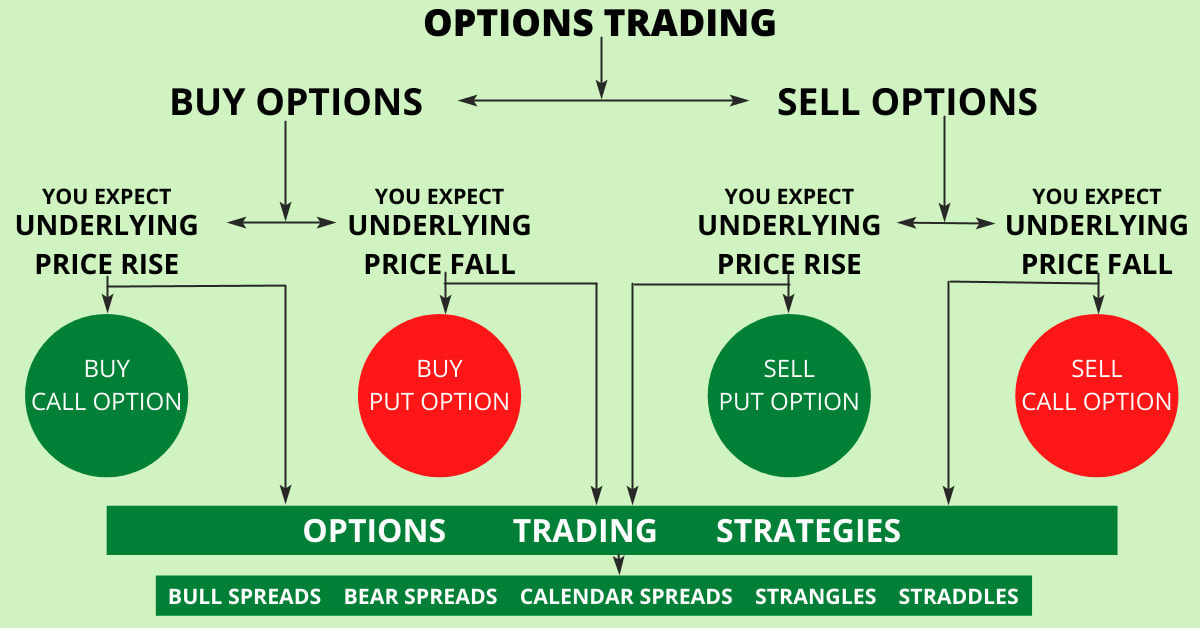

Options trading offers a plethora of opportunities to enhance your investment returns and manage risks. In essence, an option is a contract that grants you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. By harnessing the power of options, you can speculate on the price movements of stocks, indices, or other financial instruments to generate profits.

Understanding the Basics of Options Trading

Initially, let’s decode the fundamental concepts of options trading. There are two main types of options: calls and puts. Call options confer the right to buy an asset, while put options bestow the right to sell an asset. The agreed-upon price at which the transaction will take place is known as the strike price. The date on which the option expires is called the expiration date.

In the Indian options market, you have three prominent players: the option buyer, the option seller, and the options exchange. The option buyer purchases the right to buy or sell an asset. The option seller, on the other hand, undertakes the obligation to fulfill the contract if the buyer decides to exercise their right.

Unveiling Popular Options Trading Strategies

Now, let’s explore some popular options trading strategies that you can employ to maximize your returns. One widely used strategy is the covered call. This strategy involves selling a call option while simultaneously owning the underlying asset. As the underlying asset appreciates in value, the call option becomes more valuable, and you can reap profits from the option premium.

Another popular strategy is the naked call or put, which involves selling an option without owning the underlying asset. This strategy is more speculative and carries higher risks, but it also offers the potential for greater returns. For those seeking income generation, the dividend capture strategy is worth exploring. This entails buying a call option on stocks that are expected to pay dividends. The aim is to capture the premium from the option while also profiting from the underlying dividend payment.

Staying Ahead in the Options Trading Arena

To excel in options trading, it’s imperative to stay abreast of the latest market trends. Keep a close eye on economic indicators, financial news, and company announcements. By gathering this information, you can gain insights into the potential price movements of underlying assets and make informed trading decisions.

Furthermore, continuously refine your trading knowledge and skills. Attend workshops or webinars, read books and articles, and connect with experienced traders. The more you learn, the better equipped you’ll be to identify and execute profitable options trading strategies.

Image: stewdiostix.blogspot.com

Learn Options Trading Strategies India

Image: www.pinterest.fr

Conclusion

Options trading in India presents a wealth of opportunities for investors to multiply their wealth and mitigate risks. By understanding the basics, implementing proven strategies, and staying updated on market trends, you can unravel the complexities of options trading and harness its full potential. Remember, the journey to becoming a successful options trader is one of continuous learning and adaptation. Embark on this adventure with enthusiasm, and may your trading endeavors bear fruit!