For those navigating the complexities of foreign exchange markets, exotic FX options offer a potent tool to mitigate risks and optimize currency exposure strategies. Unlike their vanilla counterparts, exotic options possess customizable features, allowing traders to tailor hedging solutions to specific market dynamics. This article delves into the realm of exotic FX options, shedding light on their history, types, advantages, and practical applications.

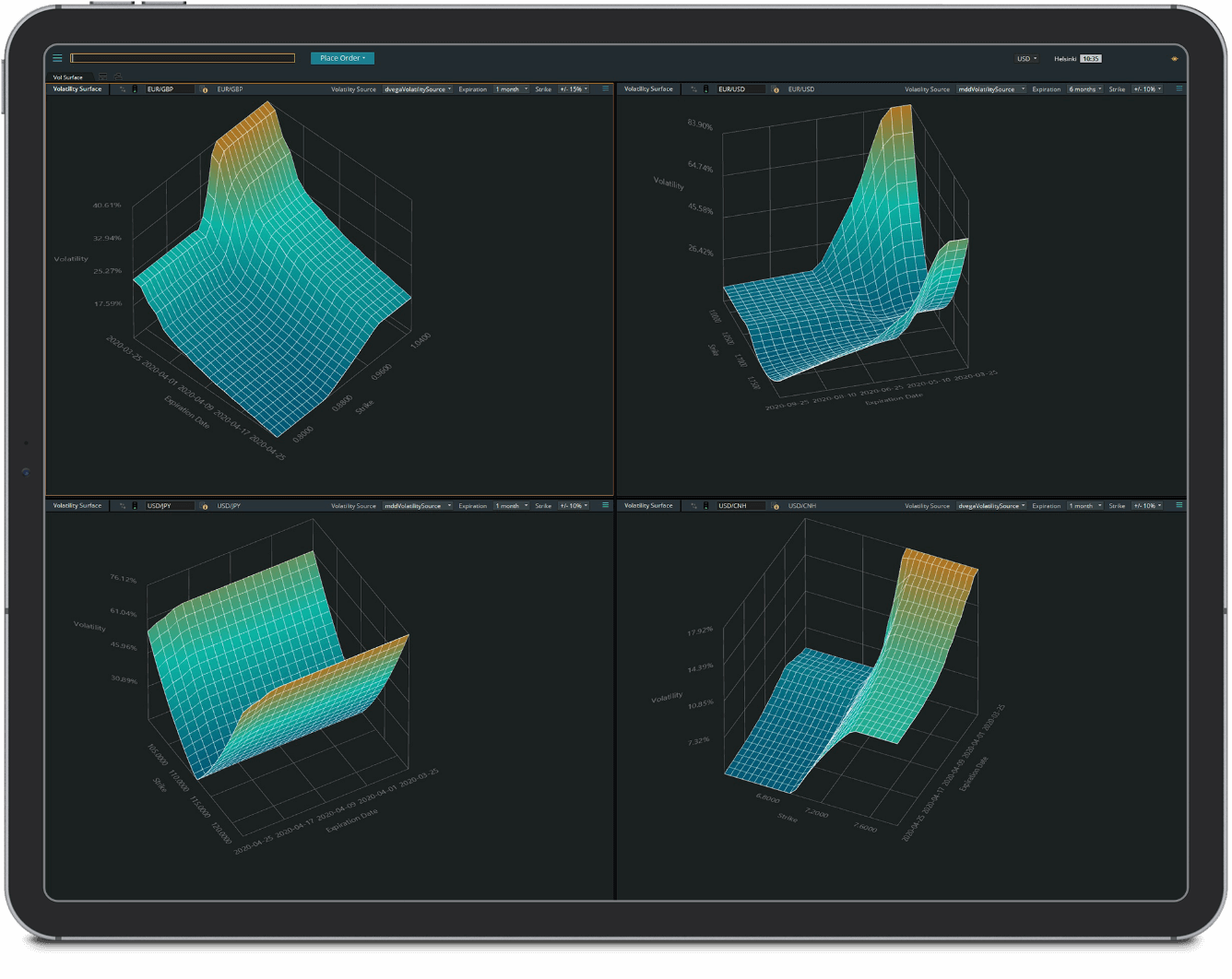

Image: devexperts.com

A Journey Through the Evolution of Exotic FX Options

Exotic FX options emerged as a response to the growing need for sophisticated risk management tools in the global FX market. In the 1980s, the financial landscape underwent a profound transformation with the liberalization of capital flows and the advent of over-the-counter (OTC) markets. These developments spurred demand for customized currency derivatives that could address the unique needs of market participants.

A Taxonomy of Exotic FX Options

The world of exotic FX options encompasses various types, each tailored to distinct market conditions and risk profiles. Here’s a glimpse into their diverse characteristics:

-

Barrier options: These options offer a payout if the underlying exchange rate crosses a specified barrier level during the option’s life.

-

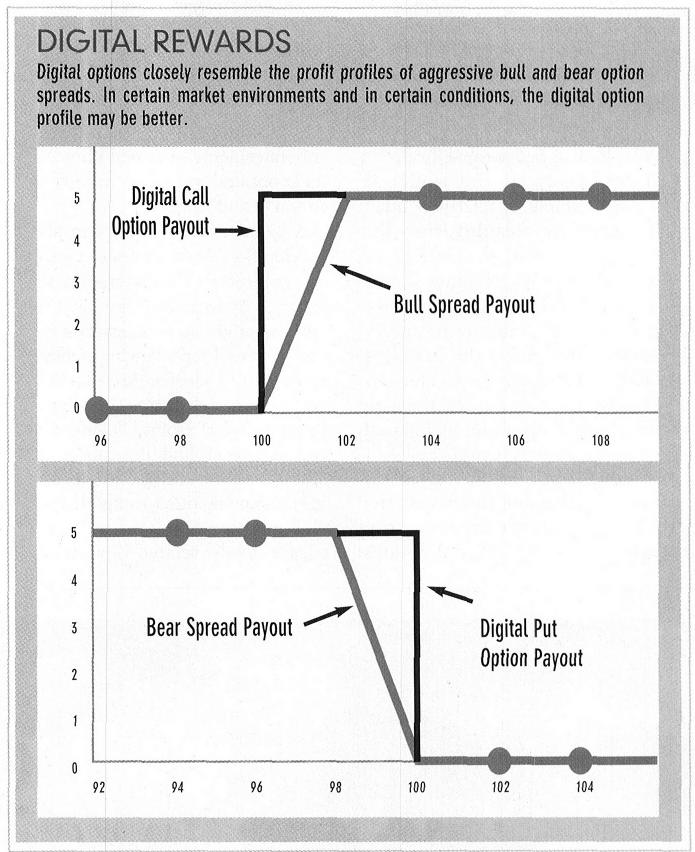

Binary options: Characterized by a fixed payout upon maturity, binary options pay out a predetermined amount if the underlying exchange rate meets a predefined condition.

-

Chooser options: These options grant the holder the right to choose between different strike prices or expirations, providing flexibility in exercise decisions.

-

Compound options: As the name suggests, compound options combine two or more simpler options, creating complex payout structures that align with specific risk management objectives.

Unlocking the Advantages of Exotic FX Options

The adoption of exotic FX options has proliferated due to their inherent advantages:

-

Tailored risk management: Exotic options allow traders to sculpt risk management strategies that align precisely with their exposure profiles and market outlook.

-

Enhanced efficiency: By hedging specific risks, traders can optimize capital allocation, reducing the need for more generic and potentially inefficient hedging instruments.

-

Increased flexibility: Exotic options provide traders with the flexibility to adjust their hedging positions as market conditions evolve, empowering them to adapt to dynamic currency markets.

Image: www.financial-spread-betting.com

Real-World Applications in Exotic FX Options

Exotic FX options have gained traction in various financial applications, including:

-

Hedging foreign exchange exposure: Traders can use exotic options to protect against adverse currency fluctuations, such as sudden depreciations or significant appreciations.

-

Speculation on currency movements: Some exotic options, such as binary options, offer opportunities for speculative trading based on directional views on exchange rates.

-

Structured products: Exotic options serve as building blocks for sophisticated structured products that combine different risk-return profiles and complexities.

Exotic Fx Options Trading

Image: www.youtube.com

Embracing Exotic FX Options: A Path to Currency Risk Mastery

The realm of exotic FX options presents a transformative approach to currency risk management, empowering traders with customizable hedging solutions and enhanced trading opportunities. Whether seeking to mitigate risks or capitalize on market movements, exotic options offer a powerful arsenal of tailored instruments to navigate the dynamic waters of foreign exchange markets. As the financial landscape continues to evolve, the adoption of exotic FX options is poised to play an increasingly crucial role in the pursuit of currency risk management mastery.