Options trading presents a unique investment strategy that can add complexity to your tax reporting. When it comes to reporting options trading on Schedule D, tax implications can vary depending on the type of options traded and the timing of transactions.

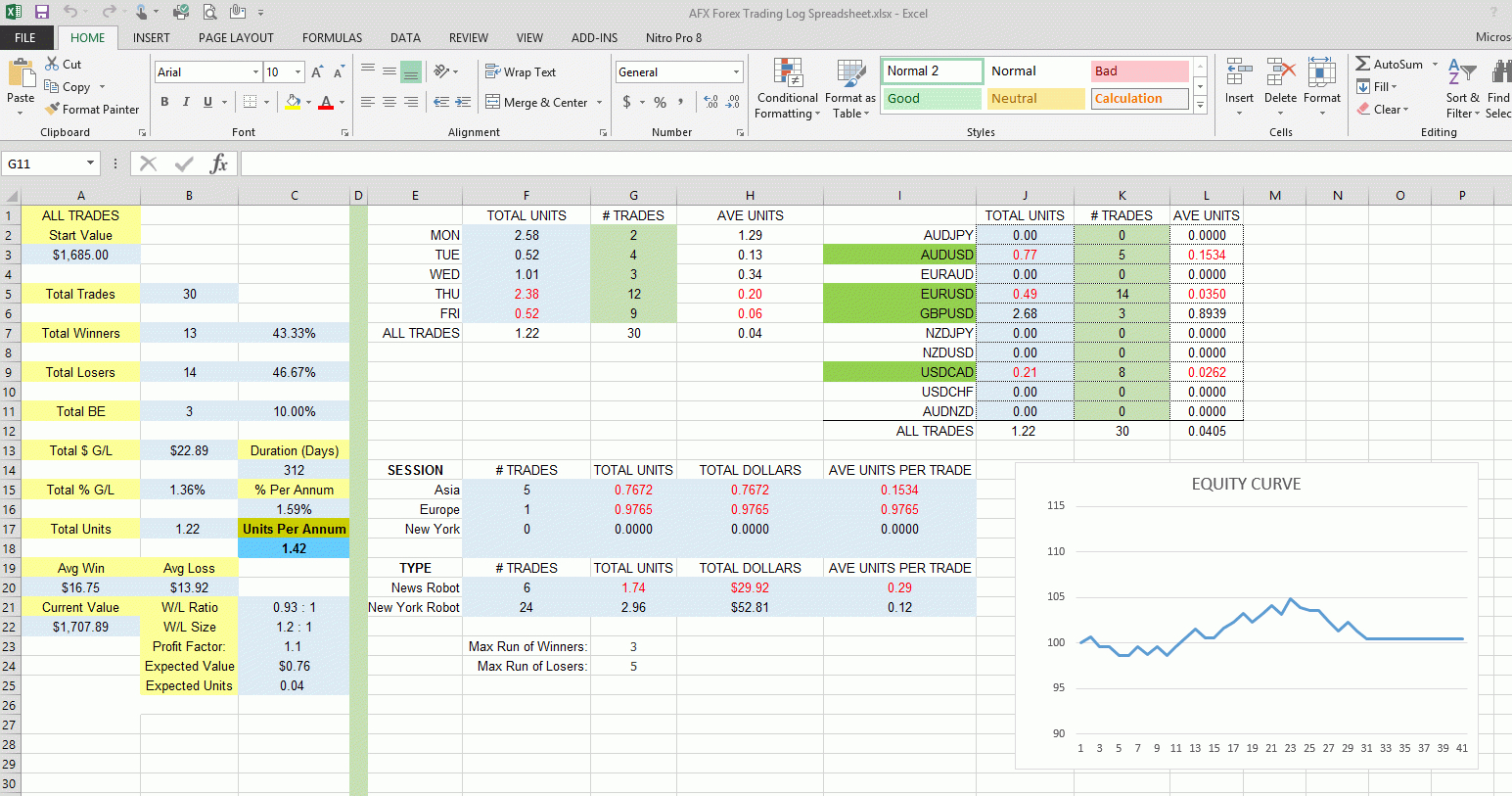

Image: db-excel.com

In this comprehensive guide, we will provide a step-by-step explanation of the reporting requirements for options trading on Schedule D, assisting you in accurately reporting your income and expenses.

Understanding Schedule D Reporting

Schedule D (Form 1040) is a tax form that reports gains or losses from the sale or exchange of capital assets. Capital assets are investments held for more than one year, such as stocks, bonds, and real estate. Options contracts, when held for investment purposes, are also considered capital assets.

Reporting Short-Term and Long-Term Options Trading

The holding period determines whether options trading is reported as short-term or long-term on Schedule D.

Short-term options: An options contract held for one year or less is classified as a short-term capital gain or loss. Short-term options trading is reported on Line 1 of Schedule D.

Long-term options: An options contract held for more than one year is classified as a long-term capital gain or loss. Long-term options trading is reported on Line 8 or 10 of Schedule D.

Determining Cost Basis and Proceeds

The cost basis of an options contract is the total amount paid or credited to acquire the contract. Proceeds from an options contract refer to the total amount received upon its disposition.

Cost basis:

- Purchased options: strike price + premium paid

- Written options: premium received

Proceeds:

- Sold options: premium received + strike price (if a call option)

- Exercised options: strike price + premium paid (if a put option)

- Expired options: premium paid

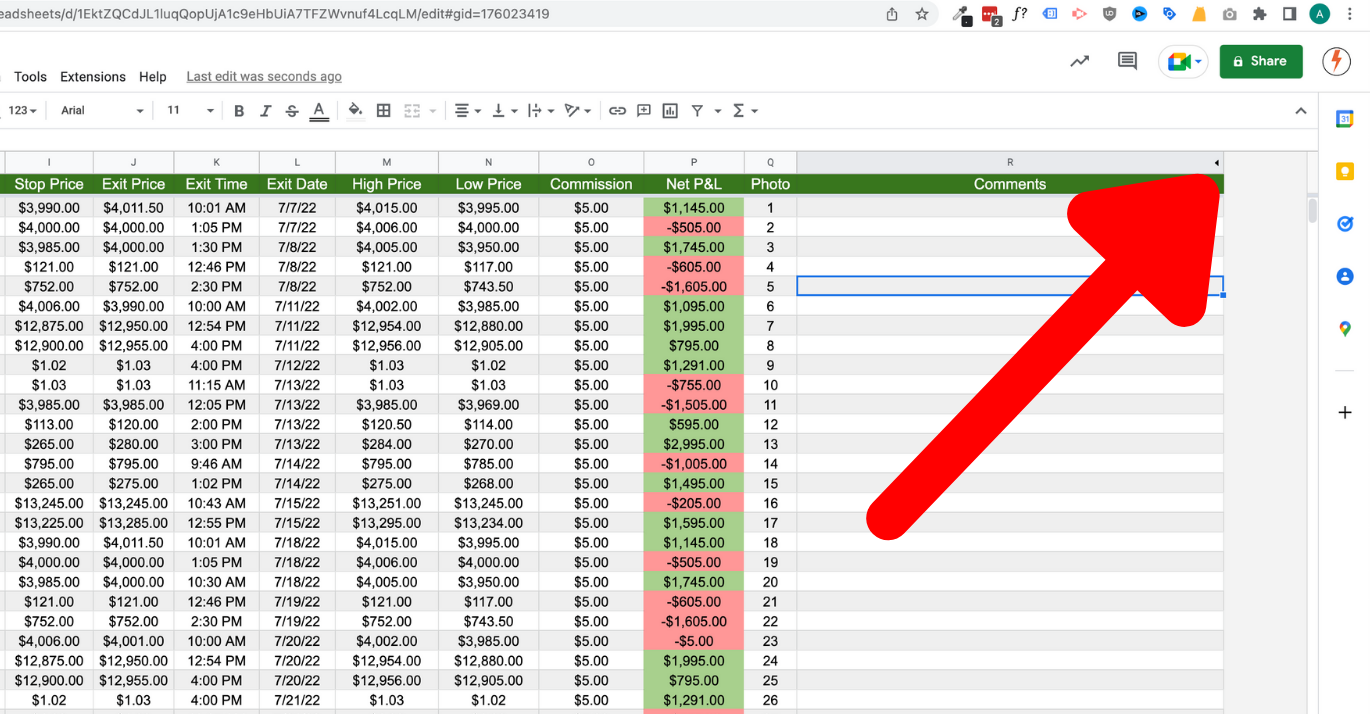

Image: stockoc.blogspot.com

Tips and Expert Advice

To ensure accurate reporting of options trading, consider these tips and expert advice:

Maintain detailed records: Keep a comprehensive record of all options trades, including the type of option, date of acquisition, cost basis, date of disposition, and proceeds.

Identify holding periods: Properly identify the holding period for each options contract to determine if it should be reported as short-term or long-term on Schedule D.

How To Report Options Trading On Schedule D

Image: www.jumpstarttrading.com

FAQ

Q: How do I report a loss on options trading?

A: Losses from options trading are reported in the appropriate row of Schedule D (Line 1 or Line 8/10) as negative values.

Q: What if I close out an options position before expiration?

A: If you sell or exercise an options contract before its expiration date, the transaction is reported as a closed option position. The gain or loss is calculated as the difference between the proceeds received and the cost basis of the contract.

Q: What happens if I let an options contract expire worthless?

A: Allowing an option contract to expire worthless results in a loss equal to the premium paid to acquire the contract. This loss is reported as short-term (Line 1 of Schedule D).

Conclusion

Reporting options trading on Schedule D can be a complex task, but it is essential for accurate tax reporting. By following the outlined steps, referring to expert advice, and utilizing the provided FAQ, you can confidently report your options trading transactions and minimize potential tax issues.

If you have further questions or encounter specific complexities in reporting options trading, consult a tax professional or financial advisor for personalized guidance.

Is this article helpful to you? Please leave a comment or share it with your friends.