As financial markets fluctuate, investors and traders alike seek innovative ways to maximize returns while mitigating risks. Amidst this dynamic landscape arises the intriguing world of Oracle options trading, where savvy traders can capitalize on the implied volatility and price movements of underlying assets.

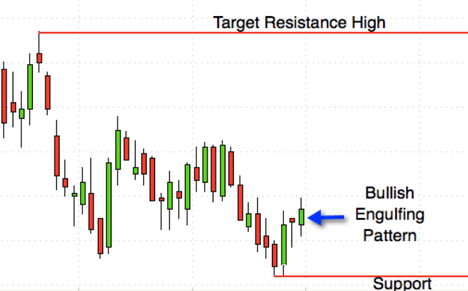

Image: themarketguys.com

Oracle options trading involves acquiring contracts that grant the holder the right, but not the obligation, to buy (call option) or sell (put option) a specified amount of the underlying asset at a predetermined price (strike price) by a certain expiration date. This versatile trading strategy empowers traders with flexibility and allows them to navigate the uncertain waters of the markets.

Delving into the Mechanics of Oracle Options Trading

To grasp the intricacies of Oracle options trading, a thorough understanding of its fundamental components is imperative. Call options afford the holder the right to purchase an underlying asset at the strike price, while put options provide the right to sell at the strike price. These options have a predetermined expiration date, beyond which they become worthless.

The value of an Oracle option is influenced by an intricate interplay of factors, including the underlying asset’s price, the strike price, the time until expiration, and the prevailing implied volatility. Careful analysis of these variables is crucial for successful Oracle options trading.

Practical Applications in Real-World Markets

The versatility of Oracle options trading enables traders to employ a diverse range of strategies to capitalize on market conditions. Bulls who anticipate an upswing in the underlying asset’s price may purchase call options, granting them the right to buy at a favorable strike price. Conversely, bears who foresee a decline can acquire put options, securing the right to sell at a profitable strike price.

Neutral strategies, such as covered calls or cash-secured puts, are favored by sophisticated traders seeking a more balanced approach. These strategies involve both holding the underlying asset and selling options contracts, providing a steady stream of income while mitigating potential losses.

Trading Trends and Emerging Developments in the Oracle Options Market

The Oracle options market is continuously evolving, influenced by technological advancements, regulatory changes, and the ever-shifting global economic climate. Traders must remain abreast of emerging trends and developments to adapt their strategies and stay ahead of the curve.

Artificial intelligence (AI) and machine learning (ML) algorithms are increasingly utilized by traders to analyze market data, identify trading opportunities, and make informed decisions. These technologies enhance the efficiency and accuracy of trading, catering to the ever-changing market landscape.

Moreover, the advent of sophisticated risk management tools allows traders to mitigate potential losses and preserve capital in volatile markets. These tools provide real-time monitoring, automated trade execution, and stop-loss mechanisms, ensuring that traders can navigate market fluctuations with greater confidence.

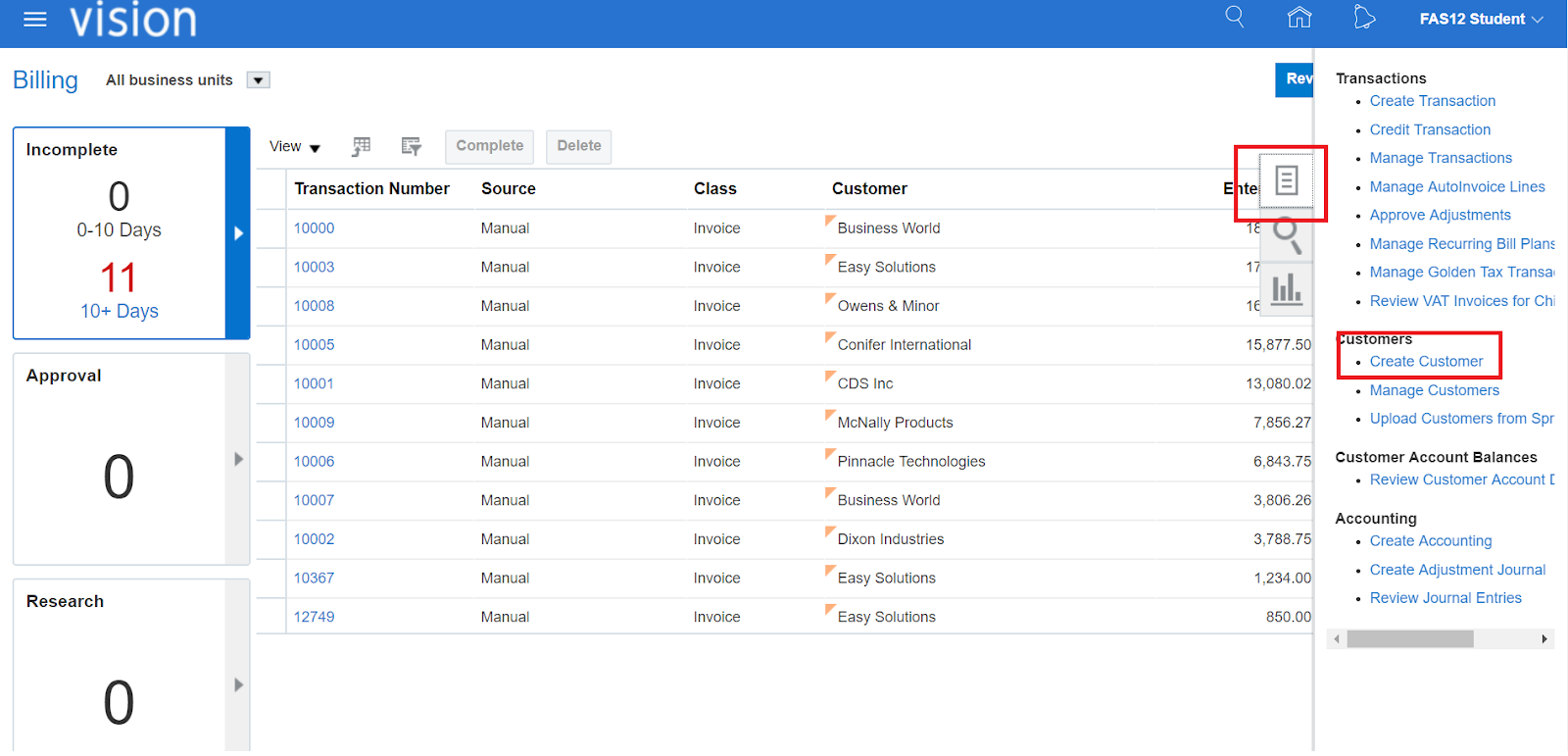

Image: lifeofanoracleprodigy.blogspot.com

Oracle Options Trading

Conclusion

Oracle options trading offers a powerful tool for investors and traders seeking to capitalize on volatility and uncertainty in the financial markets. By understanding the mechanics, practical applications, and emerging trends in Oracle options trading, individuals can harness the opportunities and navigate the challenges presented by this dynamic market.

Remember to approach Oracle options trading with a strategic mindset, thorough research, and a prudent risk management approach. With the right combination of knowledge, experience, and discipline, traders can uncover the full potential of this exciting and rewarding financial instrument.