Options trading, a captivating realm of opportunity and potential rewards, is often shrouded in complexities that can challenge even seasoned traders. One of the most enigmatic aspects of options trading is the concept of wash sales. Understanding this rule is crucial for traders to navigate the markets effectively and avoid costly pitfalls.

Image: www.halakoei.academy

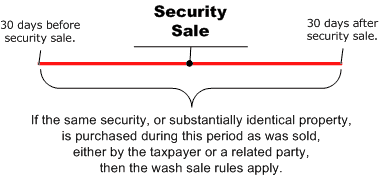

A wash sale arises when an investor sells an asset and then, within 30 days, engages in a substantially identical transaction involving the same asset. In the context of options trading, if an individual sells an option contract and then repurchases an option with substantially similar terms and conditions within 30 days, this transaction would be classified as a wash sale.

Wash Sales: Unraveling the Labyrinth

The wash sale rule emerged as a response to a loophole that allowed taxpayers to artificially lower their capital gains taxes. Investors could “sell” an asset with a high cost basis and immediately repurchase an identical asset, realizing the loss without significantly altering their actual investment position. This practice was deemed to be an abuse of the tax code and led to the introduction of the wash sale rule.

In the realm of options trading, a wash sale occurs when a trader sells an option contract and then subsequently acquires another option contract with comparable parameters, such as the same underlying stock, strike price, and expiration date. This practice is strictly prohibited by the Securities and Exchange Commission (SEC) as it violates the wash sale rule.

Consequences of Mishandling Wash Sales

Traders who engage in wash sales are subject to severe consequences. The primary penalty is the disallowance of losses incurred through wash sales. In such scenarios, the loss is nullified for tax purposes, meaning that it cannot be used to offset capital gains or reduce tax liability. This can result in a significant tax obligation for traders.

In addition to the tax implications, wash sales can also lead to trading restrictions. The SEC and other regulatory bodies may impose trading suspensions or fines on individuals or firms that engage in wash sales. These penalties underscore the gravity with which wash sales are treated within the financial markets.

Distinguishing Wash Sales from Legitimate Trading Strategies

It is essential to differentiate between wash sales and legitimate trading strategies that involve selling and reacquiring similar assets. In options trading, traders often utilize spread trading techniques that involve buying and selling options with different strike prices or expiration dates on the same underlying stock. These strategies are not considered wash sales, provided that the different contracts have distinct risk and reward profiles.

Furthermore, traders may sell an option contract to close an existing position and simultaneously open a new position with different parameters. This practice is not prohibited by the wash sale rule, as the new position represents a unique investment decision with potentially different profit and loss outcomes.

Image: alliancepllc.com

Safeguarding Against Wash Sales: A Guide for Traders

To avoid inadvertent wash sales, traders must exercise caution when executing options trades. Here are some practical tips to guide traders:

- Maintain meticulous trade records: Accurately recording all options trades, including contract details and transaction dates, is crucial for identifying potential wash sales.

- Delegate trade management to professionals: If unsure about the intricacies of the wash sale rule, it is advisable to delegate trade management to a reputable broker or investment advisor.

- Embrace independent research: Conduct thorough research on the wash sale rule and consult reliable sources to gain a comprehensive understanding of its implications.

- Seek expert guidance: Consult with a tax advisor or legal professional to ensure compliance with the wash sale rule and avoid any potential tax consequences.

Options Trading And Wash Sales

Image: ibiyusomiser.web.fc2.com

Conclusion

Understanding the wash sale rule is a fundamental pillar of successful options trading. By navigating the complexities of this regulation, traders can mitigate tax-related penalties, avoid trading restrictions, and safeguard the integrity of their investment strategies. Embracing a proactive approach to wash sales is essential for traders to unlock the full potential of options trading while remaining within the boundaries of regulatory compliance.