Introduction

The world of options trading can be a lucrative one, offering investors many opportunities to profit from market fluctuations. However, it’s important to be aware of the tax implications associated with this type of trading, specifically a concept known as a wash sale. A wash sale occurs when you sell a losing option and within 30 days, either before or after the sale, you buy a substantially identical option.

Image: investguiding.com

This article will delve into the intricacies of option trading wash sales, providing a comprehensive understanding of its definition, implications, and how to navigate these tax implications effectively.

Definition of a Wash Sale

As mentioned earlier, a wash sale occurs when a trader sells a losing option and within a 30-day window, purchases an option considered substantially identical. The Internal Revenue Service (IRS) considers any replacement option purchased within that 30-day period to be a wash sale, regardless of whether the initial sale was at a loss or a gain.

Tax Implications of Wash Sales

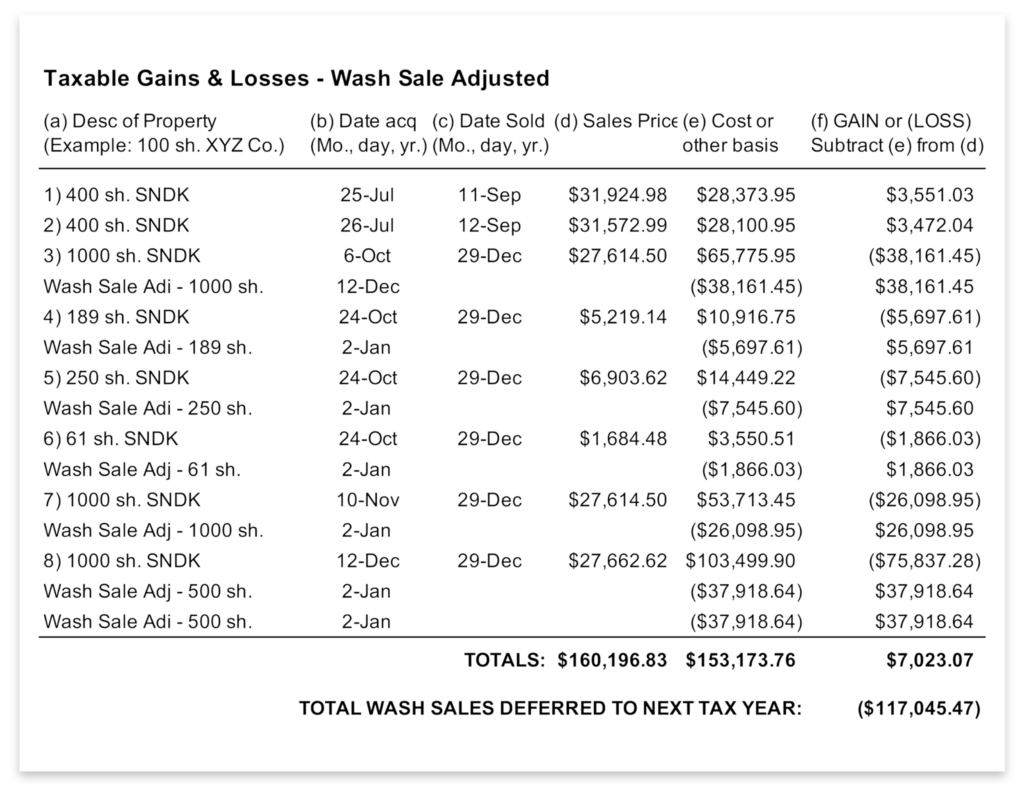

The primary consequence of a wash sale is that the IRS disallows the recognition of the loss incurred from the initial sale. Instead, the loss is added to the cost basis of the newly purchased option. This treatment can have a significant impact on the trader’s tax liability, as it reduces the potential for deductions.

Identifying Substantially Identical Options

Substantially identical options refer to options on the same underlying security with the same exercise price and expiration date. The options must also share the same type (e.g., call or put). Even if minor differences exist, such as trading on different exchanges or having slightly differing strike prices, the IRS may still consider them substantially identical.

Image: allesovercrypto.nl

Strategies to Avoid Wash Sales

To avoid the unfavorable tax implications of wash sales, it’s crucial to be strategic in your option trading activities. Here are some tips:

- Establish a clear holding period: Set a timeline of more than 30 days between the sale and repurchase of any options to avoid wash sale penalties.

- Consider different strike prices: Trade options on the same underlying security but with different strike prices to avoid creating wash sales.

- Monitor your trades: Keep a detailed record of all option trades to track your holding periods and assess potential wash sale implications.

- Consult with a tax advisor: Seeking professional guidance from a tax advisor can help ensure compliance and minimize the impact of wash sales on your tax liability.

Real-World Examples of Wash Sales

To illustrate the impact of wash sales, let’s consider a few scenarios:

- Example 1: An investor sells 10 call options on XYZ stock at a loss and repurchase the same number of call options on XYZ stock within 30 days. This would qualify as a wash sale, and the loss will be disallowed.

- Example 2: An investor buys 5 call options on ABC stock at $50 and sells them at a loss of $1,000. Within 30 days, they purchase 6 call options on ABC stock at $52. While a slightly different strike price, the IRS may still categorize it as a wash sale. The loss from the initial sale will be added to the cost basis of the newly purchased options.

Expert Insights

“Wash sales can significantly impact your tax liability,” cautions financial advisor Mark Smith. “Maintaining a strategic approach to option trading, seeking professional guidance, and understanding the nuances of wash sale rules can help minimize unintended tax consequences.”

Option Trading Wash Sale

Conclusion

Navigating the complexities of option trading wash sales requires careful planning and a clear understanding of the tax implications. By implementing the strategies outlined in this article, you can effectively manage the impact of wash sales on your tax liability. Remember, staying compliant and consulting with a tax expert can help you optimize your trading practices and maximize your financial success.