In the labyrinth of retirement planning, Fidelity 401(k) options trading stands as a veritable pathway to financial empowerment. This sophisticated investment strategy empowers participants to actively manage their retirement funds, potentially unlocking greater returns and maximizing long-term wealth. Grasping the nuances of Fidelity 401(k) options trading is pivotal, especially for those aiming to bolster their retirement savings and achieve their financial aspirations.

Image: www.reddit.com

Imagine embarking on a transformative journey where you assume an active role in shaping the destiny of your retirement funds. Fidelity 401(k) options trading allows you to do just that, providing an arsenal of investment options at your fingertips. Options, as financial derivatives, bestow upon you the privilege of speculating on the price movements of underlying assets, akin to stocks or bonds. By understanding the mechanics and strategic applications of options, you can unlock the potential for customized portfolio management that aligns with your risk tolerance and financial goals.

Understanding Options Trading: From Basic Concepts to Advanced Strategies

Traversing the realm of options trading demands a firm grasp of its foundational principles. An option is essentially a contract that grants you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specific price (strike price) on or before a predefined expiration date. This right comes at a premium, which represents the cost of acquiring the option.

Options trading empowers you to express market views and tailor investment strategies with surgical precision. By contemplating the direction of the underlying asset’s price, you can capitalize on market fluctuations or hedge against potential losses. Moreover, options offer a nuanced approach to risk management, enabling you to define your potential reward and loss parameters.

Demystifying Fidelity 401(k) Options Trading: Advantages and Considerations

Integrating options trading into your Fidelity 401(k) plan unlocks a myriad of potential benefits. Options trading offers a potent tool to potentially enhance portfolio returns, capitalize on market movements, and mitigate risk. By leveraging options, you can tailor investment strategies to align with your specific financial objectives and risk appetite.

However, venturing into options trading within your 401(k) plan entails considerations that demand careful evaluation. Firstly, not all 401(k) plans permit options trading. You must ascertain if your plan extends this optionality. Secondly, options trading inherently carries a higher degree of risk compared to traditional investments. Thorough comprehension of options trading strategies and risk management techniques is imperative to mitigate potential losses.

Executing Options Trading Within Your Fidelity 401(k) Plan

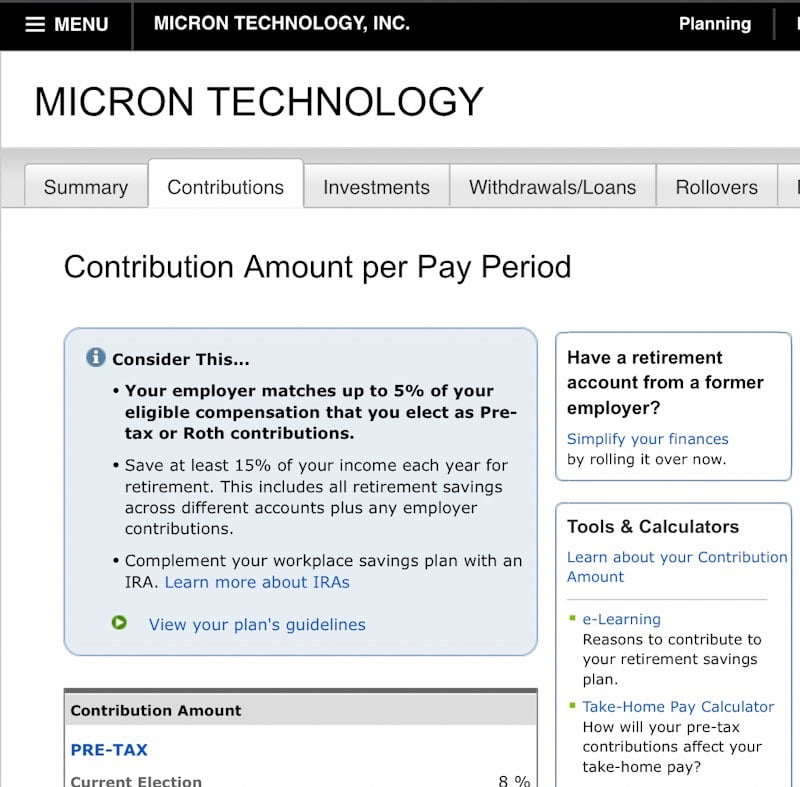

To commence options trading within your Fidelity 401(k) plan, you must ensure your plan allows such transactions. Subsequently, familiarize yourself with the plan’s specific rules and restrictions pertaining to options trading. These may encompass eligibility requirements, trading frequency limitations, and permissible option types.

Once you possess the necessary knowledge and meet your plan’s eligibility criteria, you can initiate options trades through Fidelity’s dedicated trading platform. By accessing your online account or via phone, you can execute trades seamlessly. Fidelity offers an array of resources and educational materials to assist you in navigating the options trading landscape.

Image: www.ourdebtfreelives.com

Unveiling the Nuances of Options Trading Strategies: A Tactical Approach

Options trading encompasses a diverse array of strategies, each tailored to specific market conditions and investment goals. Covered calls, for instance, are designed to generate income by selling (writing) call options against a portion of your underlying asset position. Conversely, protective puts aim to safeguard against potential losses by purchasing (buying) put options that grant the right to sell the underlying asset at a predefined price.

In addition to these basic strategies, more advanced techniques exist, such as spreads and multi-leg strategies. These strategies combine multiple options to create tailored risk and reward profiles. However, pursuing advanced strategies requires a comprehensive understanding of options trading principles and risk management techniques.

Real-World Applications: Unleashing the Potential of Fidelity 401(k) Options Trading

In the arena of retirement planning, Fidelity 401(k) options trading serves as a versatile tool for pursuing diverse investment objectives. Whether you seek to generate additional income, enhance portfolio growth potential, or safeguard against market downturns, options trading can empower you to tailor a strategy that aligns with your aspirations.

For instance, if you anticipate a prolonged market uptrend, you may consider employing a covered call strategy. By selling call options on a portion of your stock holdings, you can generate income from the premium received while maintaining exposure to potential upside in the underlying asset. Alternatively, if you anticipate market volatility or a potential downturn, you could utilize a protective put strategy to hedge against potential losses.

Fidelity 401k Options Trading

Conclusion: Harnessing Fidelity 401(k) Options Trading for Retirement Success

In conclusion, Fidelity 401(k) options trading empowers you with a versatile tool to actively manage your retirement funds. By understanding the foundational concepts, strategic applications, and risk management techniques associated with options trading, you can unlock the potential for customized portfolio management and enhanced returns. However, it is imperative to exercise due diligence in assessing your individual risk tolerance, investment goals, and the specific rules governing your Fidelity 401(k) plan before incorporating options trading into your retirement strategy. Embracing this sophisticated investment strategy can transform your 401(k) plan into a dynamic wealth-building vehicle, propelling you towards financial independence and a secure retirement future.