Introduction

Imagine a world where your retirement savings have the potential to grow exponentially through the power of options trading. Fidelity Rollover IRA Options Trading offers this intriguing prospect, allowing you to enhance your portfolio’s earning capacity while maintaining the tax-advantaged benefits of an Individual Retirement Account (IRA).

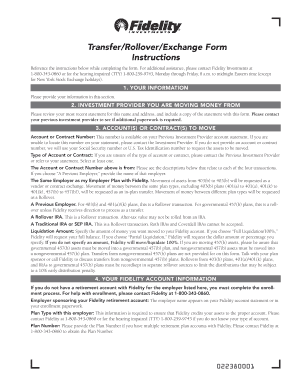

Image: www.pdffiller.com

Options trading, while potentially lucrative, is not for the faint of heart. It requires a deep understanding of the markets and financial instruments. In this article, we will delve into the intricacies of Fidelity Rollover IRA Options Trading, providing you with a comprehensive overview, expert tips, and valuable insights.

Fidelity Rollover IRA Options Trading: A Comprehensive Overview

A Fidelity Rollover IRA Options Trading account allows you to transfer eligible funds from existing retirement accounts, such as 401(k)s or Traditional IRAs, into a brokerage account with Fidelity Investments. With this account, you gain access to a wide range of options contracts, giving you the opportunity to speculate on the future price movements of underlying assets, such as stocks and indices.

Benefits and Considerations

Benefits:

- Enhanced earning potential through options trading

- Tax-advantaged growth

- Investment flexibility

Considerations:

- Involves risk of loss

- Requires knowledge and experience

- May not be suitable for all investors

Understanding Options Contracts

Options contracts are financial instruments that give you the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) on or before a certain date (expiration date). There are two main types of options:

- Calls: Give you the right to buy an asset

- Puts: Give you the right to sell an asset

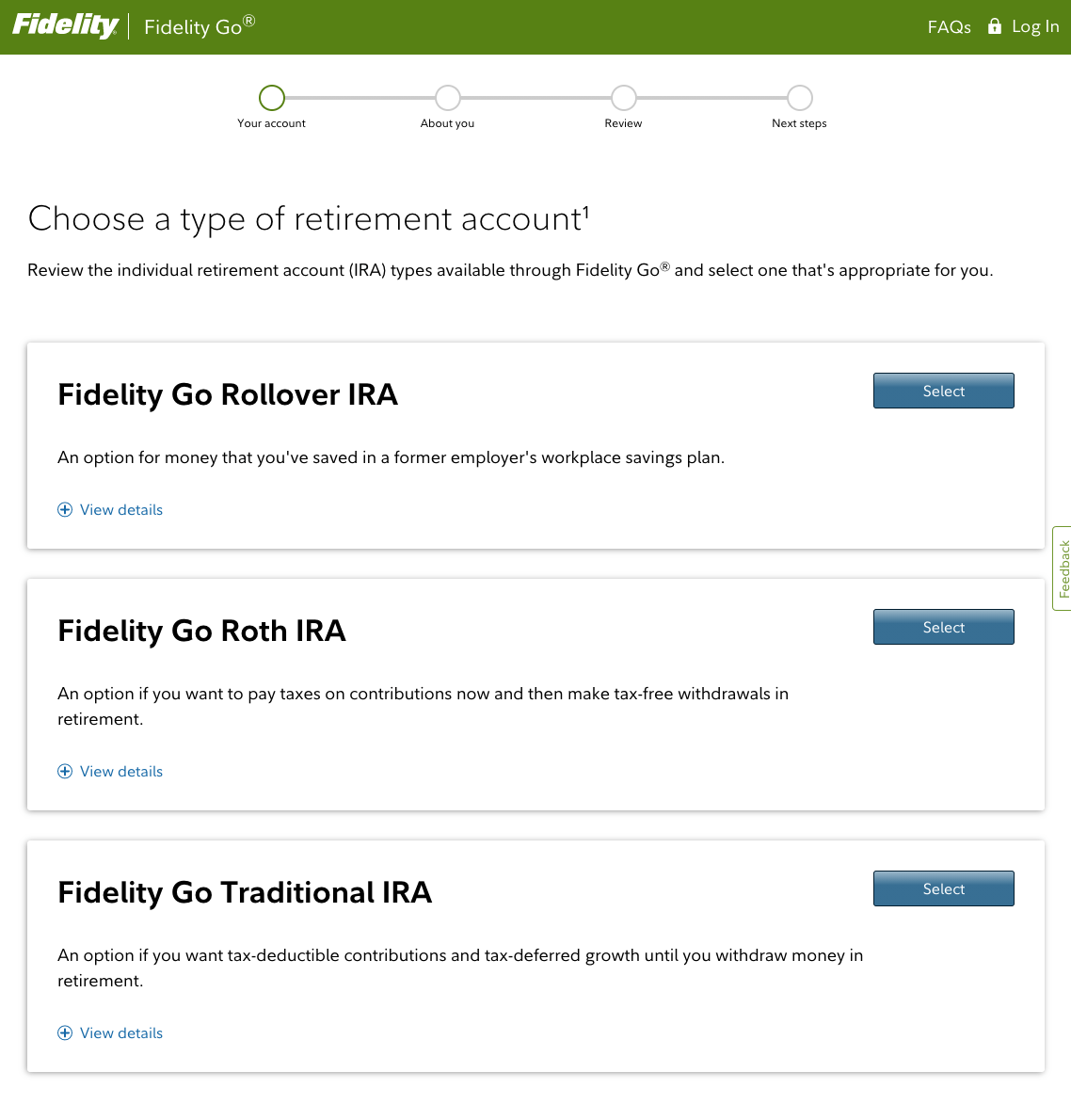

Image: bestiraoptions.com

Expert Tips for Successful Fidelity Rollover IRA Options Trading

Options trading can be a complex endeavor. Here are some expert tips to help you navigate this challenging landscape:

- Educate yourself: Before making any trades, thoroughly research options trading, including strategies, risk management, and market trends.

- Choose appropriate strategies: Select options strategies that align with your risk tolerance and investment goals.

- Monitor the markets: Stay updated on relevant market news and events that can impact the value of your options contracts.

- Manage risk: Use stop-loss orders and position sizing to limit potential losses.

- Seek professional guidance: Consider working with a financial advisor specializing in options trading who can provide personalized advice.

Commonly Asked Questions (FAQs)

Q: What are the tax implications of Fidelity Rollover IRA Options Trading?

A: Options trading gains will be taxed according to the ordinary income tax rate for the year in which the contract is realized.

Q: Can I withdraw funds from my Fidelity Rollover IRA Options Trading account penalty-free?

A: Withdrawals from an IRA before the age of 59½ may incur a 10% early withdrawal penalty.

Q: How do I open a Fidelity Rollover IRA Options Trading account?

A: Visit Fidelity’s website or contact a Fidelity representative to initiate the account opening process.

Fidelity Rollover Ira Options Trading

Image: www.hicapitalize.com

Conclusion

Fidelity Rollover IRA Options Trading presents a compelling opportunity for retirement investors seeking to unlock the potential for enhanced returns. However, it is crucial to approach this strategy with a comprehensive understanding of options trading and a proactive approach to risk management. By embracing the tips and insights shared in this article, you can significantly improve your chances of reaping the rewards of this powerful financial tool.

Are you ready to explore the exciting world of Fidelity Rollover IRA Options Trading and unlock the potential of your retirement savings? If so, take the next step by educating yourself and seeking professional guidance to embark on this potentially lucrative investment journey.