Introduction

Image: www.youtube.com

In today’s volatile financial landscape, options trading has emerged as a powerful tool for investors seeking to navigate risk and amplify returns. Embarking on this thrilling journey requires a comprehensive understanding of the strategies that pave the way to success. Our exclusive PDF guide delves into the intricacies of option trading in the Indian market, empowering you with the knowledge to make informed decisions and unlock the potential of this captivating investment arena.

As seasoned traders know, options provide a unique ability to tailor risk and rewards based on individual investment objectives. Understanding the fundamentals of options pricing, premium structure, and market dynamics is paramount to navigating this dynamic trading environment. Our PDF guide lays bare the intricacies of these concepts in an easy-to-comprehend format, enabling even novice traders to grasp the essence of option trading.

Decoding Option Trading Strategies

The Indian market presents a vast array of option trading strategies, each catering to specific trading styles and market conditions. Our guide comprehensively explores these strategies, providing a detailed breakdown of their mechanics, advantages, and limitations.

Bullish Strategies:

- Call Option Purchase: Gaining bullish exposure by purchasing a call option gives the right but not the obligation to buy the underlying asset at a predetermined strike price on a specified expiration date.

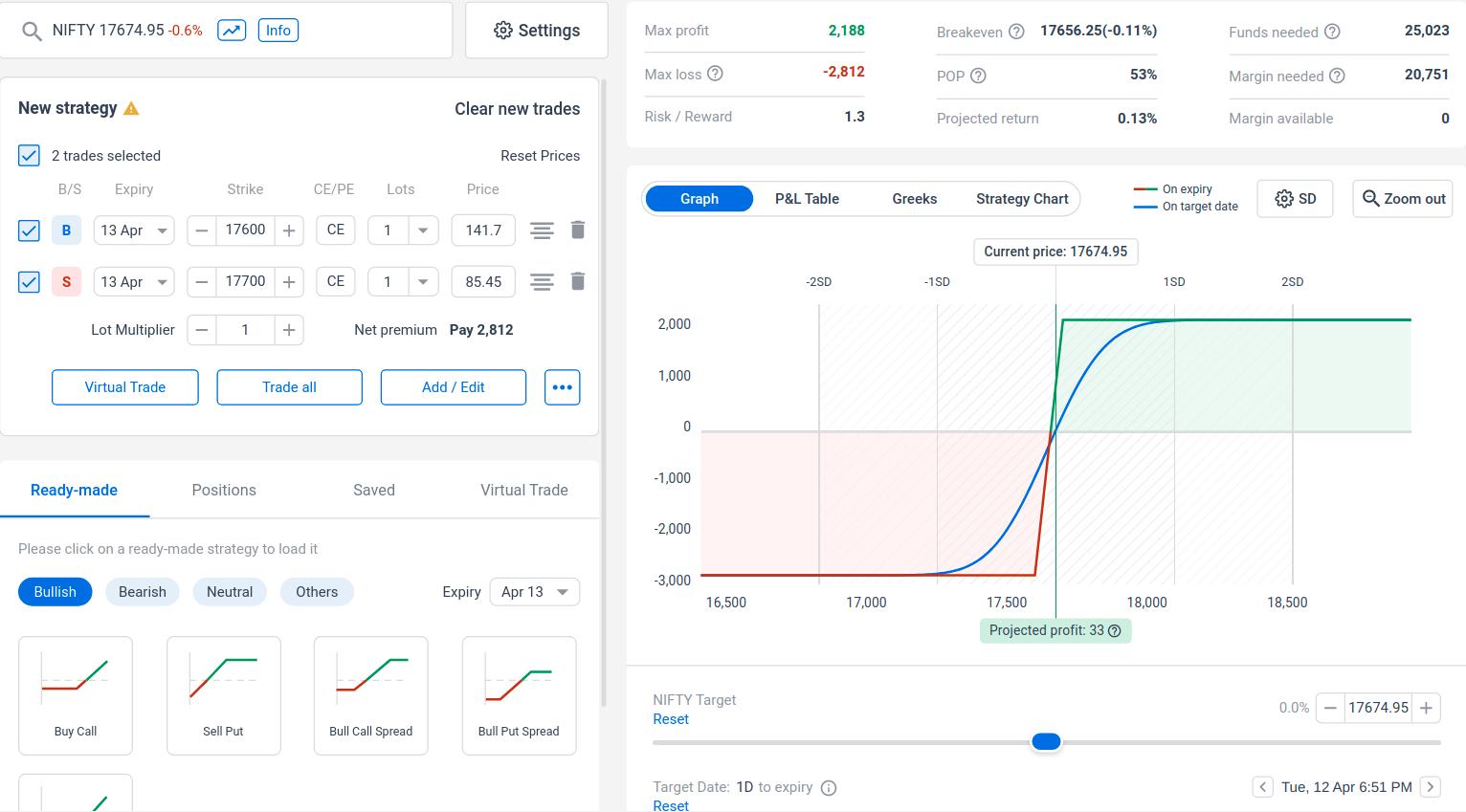

- Bull Call Spread: This strategy combines the purchase of a call option at a lower strike price with the sale of a call option at a higher strike price, creating a range-bound profit potential.

Bearish Strategies:

- Put Option Purchase: Acquiring a put option conveys the right to sell the underlying asset at a predetermined strike price, benefiting from price declines.

- Bear Put Spread: Involving the purchase of a put option at a higher strike price and the sale of a put option at a lower strike price, this strategy thrives in downward trends.

Neutral Strategies:

- Iron Condor: This advanced strategy involves the simultaneous purchase and sale of call and put options at different strike prices to benefit from limited price movements.

- Straddle: Purchasing both a call and put option at the same strike price and expiration date allows traders to profit from significant price volatility in either direction.

Expert Insights and Actionable Tips

Our guide draws upon the wisdom of renowned experts in the Indian financial markets, offering invaluable insights and practical tips to enhance your trading prowess. From analyzing market trends to managing risk effectively, these insights provide a roadmap for navigating the ever-changing trading landscape.

Conclusion

The Indian market offers a fertile ground for option trading, teeming with lucrative opportunities for discerning investors. Our comprehensive PDF guide unlocks the secrets of this dynamic trading arena, equipping you with the knowledge and strategies to harness its full potential. Embrace the journey today, and witness the transformative power of options trading in the Indian market. Remember, the key to success lies in diligent research, a disciplined trading approach, and the unwavering pursuit of knowledge.

Image: stewdiostix.blogspot.com

Option Trading Strategies In Indian Market Pdf