Have you ever wondered how to harness the potential of options trading to amplify your returns and manage market volatility? In this comprehensive guide, we will delve into the intricacies of options trading, empowering you to place orders strategically and make informed decisions.

Image: www.prorealtime.com

Options trading may seem daunting at first, but it can be a rewarding endeavor when approached with the right knowledge and strategy. By the end of this article, you will have a firm grasp of the nuances of options orders and the confidence to navigate the derivatives market like a seasoned pro.

Understanding Options and Types of Orders

At its core, an option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. There are two main types of options: calls and puts. Call options give the holder the right to buy the underlying asset, while put options grant the holder the right to sell.

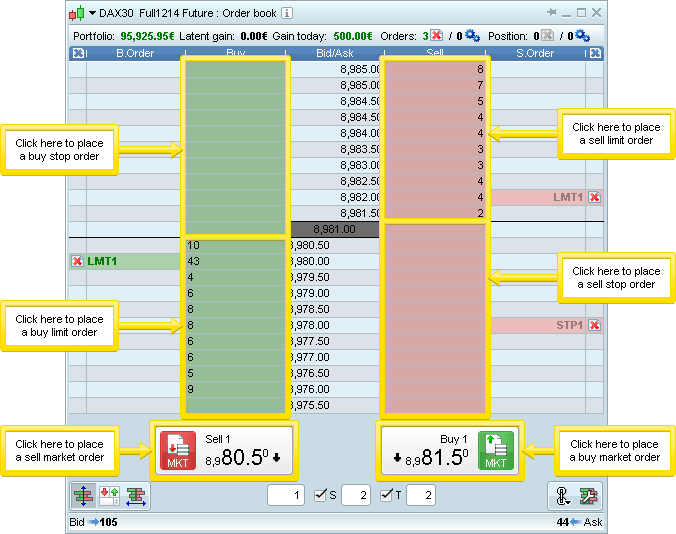

When it comes to placing orders in options trading, there are several types of orders available. Each order type serves a specific purpose and can be tailored to your investment strategy. Some of the most common order types include:

- Market Order: Executes immediately at the current market price.

- Limit Order: Executes only when the price reaches a specified limit.

- Stop Order: Triggers a market order once the underlying asset reaches a certain price level.

- Stop-Limit Order: Combines the features of a stop order and a limit order.

Navigating the Options Order Entry Process

To place an options order, you need to specify several parameters. These include the underlying asset, the option type (call or put), the strike price (the price at which you wish to buy or sell), the expiration date (the day on which the option contract expires), and the quantity of contracts you wish to purchase or sell.

Once you have filled out all the relevant details, you will need to select the order type that aligns with your investment strategy. It is crucial to carefully consider the potential risks and rewards associated with each order type before making a choice.

Expert Insights and Actionable Tips

To enhance your options trading journey, consider seeking advice from seasoned professionals. Attend industry webinars, read books written by experienced traders, and consult with reputable brokerage firms that specialize in options trading.

Here’s an actionable tip: Start by placing small orders to familiarize yourself with the process and gain confidence before venturing into larger trades. Additionally, consider using practice accounts or simulation software to test your strategies before deploying real capital.

Image: www.youtube.com

How To Place Order In Options Trading

Image: stockoc.blogspot.com

Conclusion: Unlock Your Trading Potential

Options trading, when approached with proper knowledge and strategy, can be a powerful tool for savvy investors. By understanding the mechanics of options orders and leveraging the insights shared in this guide, you can make informed decisions and unlock the true potential of the derivatives market.

As you embark on your options trading journey, remember the importance of continuous learning, risk management, and adapting to evolving market conditions. With persistence and a commitment to excellence, you can master the art of placing orders in options trading and harness the opportunities that lie ahead.