The world of finance offers a vast array of investment opportunities, and two popular instruments are forex and options trading. Both offer distinct advantages and challenges, catering to different investment goals and risk appetites. In this article, we will delve into the intricacies of forex and options trading, exploring their definitions, similarities, differences, and considerations for investors.

Image: howtotradeonforex.github.io

We’ll begin by exploring the concept of liquidity in more depth.

Liquidity: A Key Factor to Consider

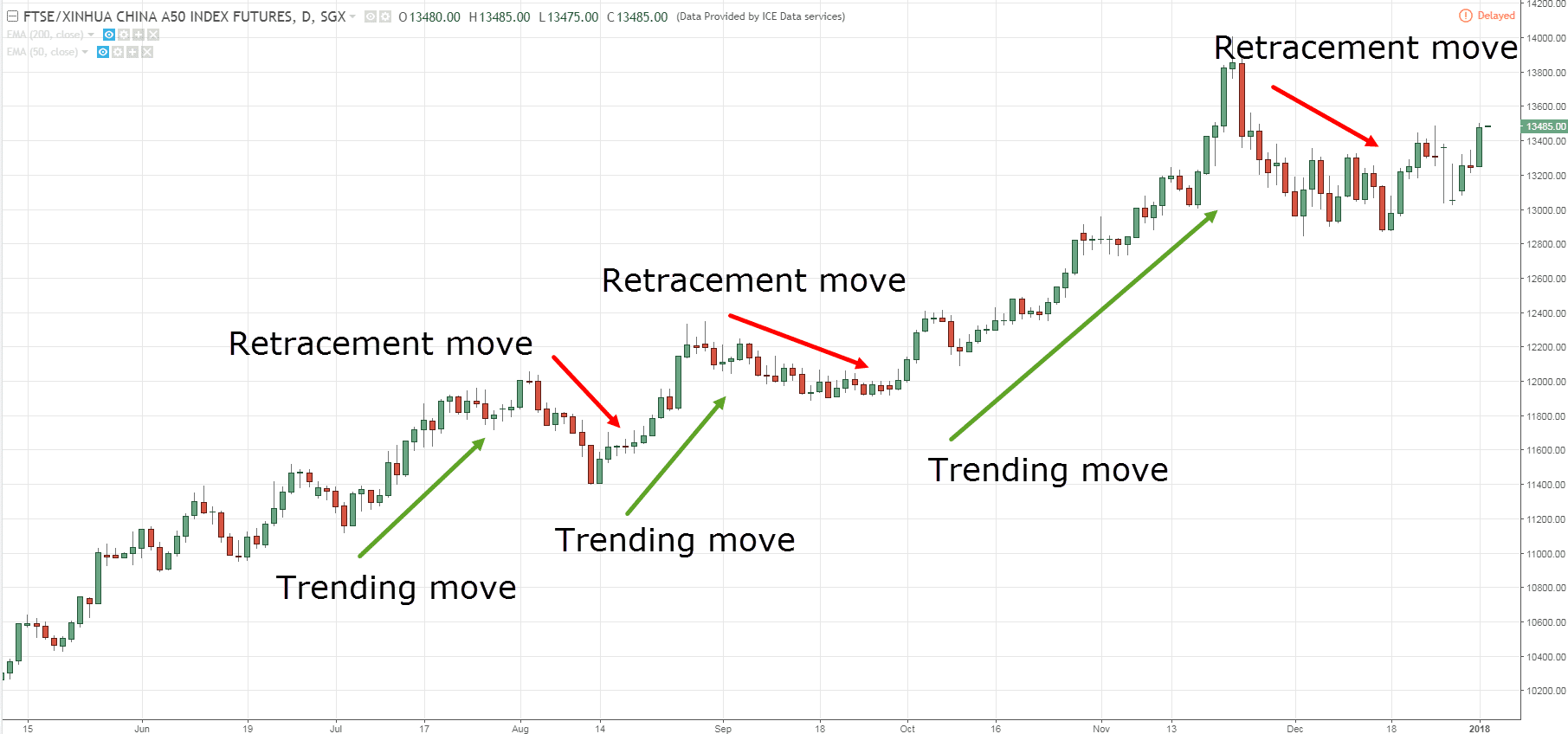

Liquidity refers to the ease with which an asset can be bought or sold without significantly affecting its price. Forex, being the world’s most liquid market, offers unmatched liquidity due to the continuous trading of currencies. This liquidity enables traders to enter and exit positions promptly, minimizing slippage and ensuring price stability.

Options, on the other hand, possess varying levels of liquidity depending on specific market conditions. During periods of high volatility or low trading volume, liquidity may be reduced, leading to potential challenges in executing trades at desired prices. However, for certain popular and standardized options contracts, liquidity can be quite high.

Key Difference: Underlying Asset

One of the fundamental differences between forex and options trading lies in the underlying asset. In forex, traders speculate on the exchange rates of currency pairs, such as EUR/USD or GBP/JPY. In contrast, options trading involves the underlying asset of stocks, commodities, currencies, or indices.

Leverage and Risk

Leverage is a double-edged sword that can magnify both profits and losses. Forex trading often offers higher leverage than options, which can amplify returns but also increase risk. Options, while they typically involve lower leverage, offer more flexibility in managing risk through the use of hedging strategies.

Image: elliottwave-forecast.com

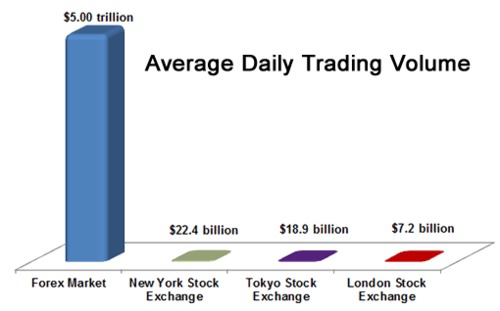

Time Frames and Strategies

The time frames involved in forex and options trading are also distinct. Forex trading is typically short-term, with trades lasting minutes, hours, or days. Options, however, provide longer-term trading opportunities, with expirations ranging from weeks to years. This difference in time frames influences the trading strategies employed and the level of patience required.

Regulation and Oversight

Forex and options trading are subject to different regulatory bodies and oversight measures. Forex trading is decentralized, with no central governing body. However, it is regulated by individual countries through financial authorities such as the FCA in the UK or the CFTC in the US. Options trading, on the other hand, is extensively regulated and overseen by organizations such as the SEC or CFTC, ensuring investor protection and market integrity.

Tips and Expert Advice

Navigating the complexities of forex and options trading requires a thoughtful approach and a commitment to continuous learning. Here are some tips and expert advice to enhance your trading journey:

Thoroughly educate yourself about the markets, trading instruments used, and techniques before committing capital. Stay updated with market news and economic developments that may impact your trading decisions. Strike a balance between risk and reward based on your financial circumstances and risk tolerance.

Adopt a disciplined trading plan that outlines a clear exit strategy, trade management rules, and risk mitigation strategies. Practice risk management techniques such as stop-loss orders and position sizing to minimize potential losses and protect your capital

FAQ

Q: Which is better: forex or options trading?

A: The choice between forex and options trading depends on individual investment goals, risk appetite, and timeframes. Both offer distinct advantages and drawbacks.

Q: Can I trade both forex and options?

A: Yes, many traders diversify their portfolios by participating in both forex and options trading simultaneously.

Q: What is the minimum capital required to start?

A: The required capital varies depending on the leverage offered by brokers, risk tolerance, and trading goals.

Forex Vs Option Trading

Image: www.pinterest.com.mx

Conclusion

Whether you are a seasoned trader or a newcomer to the financial world, understanding the intricacies of forex vs. options trading is crucial for making informed investment decisions. Each instrument offers unique advantages and challenges, catering to differentリスク appetites and trading objectives. By carefully considering the aspects outlined in this article, you can navigate the markets with greater confidence and aim for financial success.

If you found this article informative and would like to delve deeper into the world of forex and options trading, we encourage you to continue researching, exploring trading platforms, learning from experienced traders, and seeking professional advice when necessary. The financial markets are vast and continuously evolving, and continuous learning is the key to adapting and thriving in the ever-changing landscape.