Introduction:

In the ever-evolving world of financial markets, there exists a vast array of investment opportunities that can cater to different risk appetites and financial goals. Two prominent options are forex trading and options trading. Forex trading involves buying and selling currencies, while options trading grants the holder the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specified price on or before a specific date. Understanding the nuances of each type of trading is crucial for making informed investment decisions that align with your financial objectives.

Image: howtotradeonforex.github.io

Delving into Forex Trading:

Forex, short for “foreign exchange,” is the largest financial market in the world, facilitating the trading of currencies on an international scale. It operates 24 hours a day, five days a week, offering traders unparalleled liquidity and a multitude of currency pairs to choose from. Major forex trading pairs include EUR/USD (euro against the US dollar), GBP/USD (British pound against the US dollar), and USD/JPY (US dollar against the Japanese yen).

Understanding Options Trading:

Options are financial contracts that grant the holder the option, not the obligation, to buy (call options) or sell (put options) an underlying asset at a pre-determined price known as the strike price. Unlike forex trading, options have an expiration date, and the holder has the flexibility to exercise their right to buy or sell at any time before this date. Options can be based on various underlying assets, including stocks, bonds, currencies, and indices.

Forex vs. Options: A Comparison of Key Features:

Image: www.covetgarden.com

1. Underlying Assets:

Forex trading involves the exchange of currencies, while options trading grants the holder access to a wider range of underlying assets, including commodities, stocks, and indices.

2. Trading Period:

Forex trading is a continuous process that occurs around the clock, while options have a defined expiration date. This difference in duration requires varying levels of attention and monitoring.

3. Risk and Leverage:

Forex trading offers inherent leverage, allowing traders to control a significant amount of currency with a relatively small deposit. Options trading also provides leverage but to a lesser extent compared to forex. However, both types of trading carry their inherent risks.

4. Trading Costs:

Forex trading typically involves lower transaction costs than options trading due to the absence of upfront premiums, which is the cost of acquiring an option contract.

5. Profit Potential:

Forex trading and options trading both offer the potential for substantial profits, but the level of profit is dependent on factors such as market volatility, risk tolerance, and trading strategy.

Deciding Between Forex and Options Trading: Consider Your Goals:

The choice between forex and options trading depends on one’s individual investment objectives and risk tolerance. Forex trading is generally more suitable for traders seeking short-term profits from currency fluctuations, while options trading offers flexibility and can be tailored to different strategies, including hedging, speculation, and income generation.

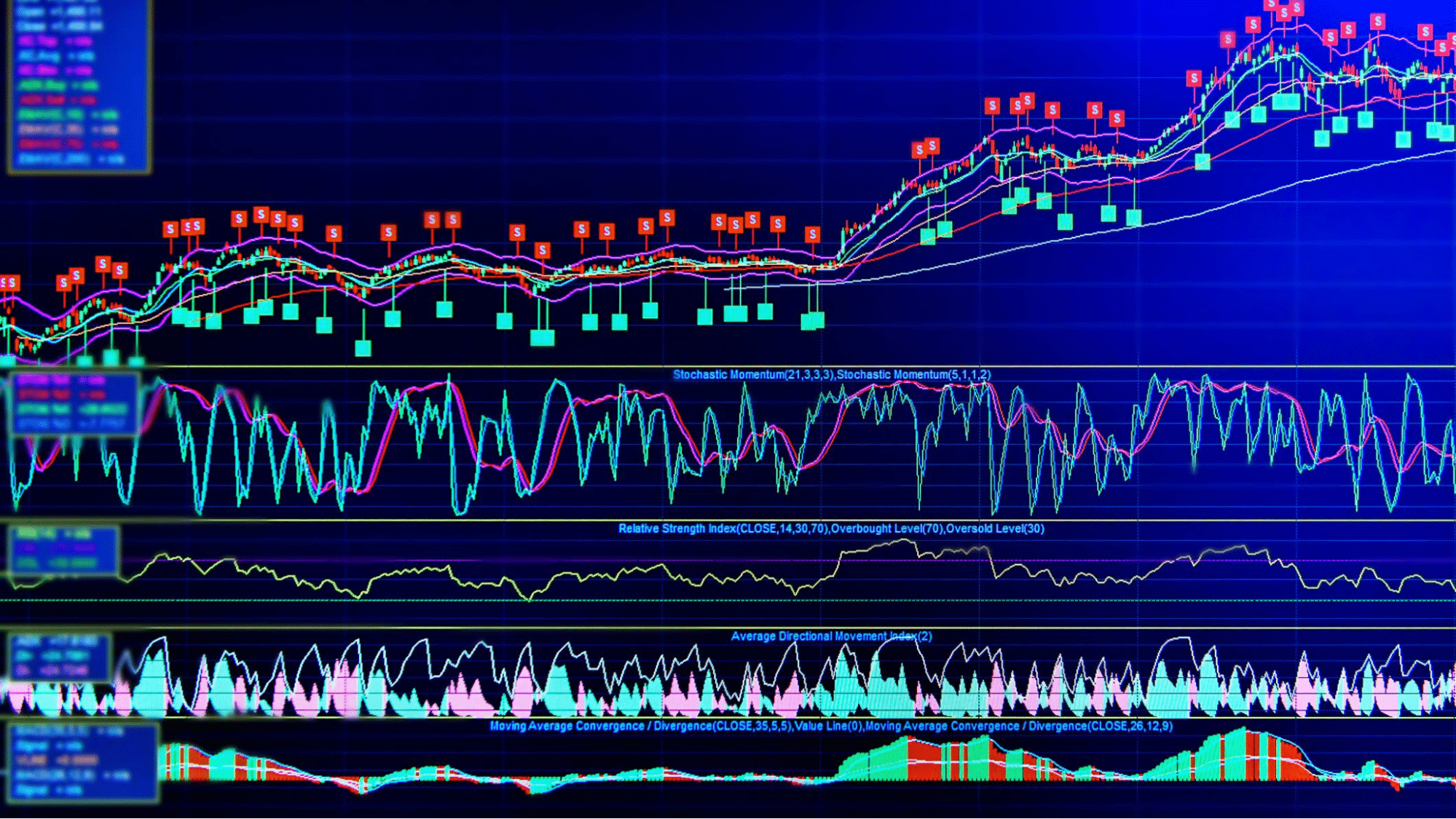

Trading In Forex Market Vs Options

Image: investluck.com

Conclusion: Empowering Your Investment Decisions:

Understanding the similarities and differences between forex and options trading is paramount for making informed investment choices that align with your financial goals. By carefully considering the key features of each type of trading, including underlying assets, trading duration, risk and leverage, transaction costs, and profit potential, you can make an educated decision that maximizes your chances of success in the dynamic world of financial markets.