Binary options trading, a modern facet of the financial realm, has emerged as a means for investors seeking high returns in a short timeframe. Its allure lies in its simplicity, where traders speculate on the outcome of a financial instrument’s price movement within a defined period. Embarking on this trading endeavor demands a thorough understanding of its fundamentals, empowering you with the necessary knowledge to navigate the complexities of the binary options market.

Image: tradingderiv.blogspot.com

Navigating the Binary Options Landscape: Essential Concepts

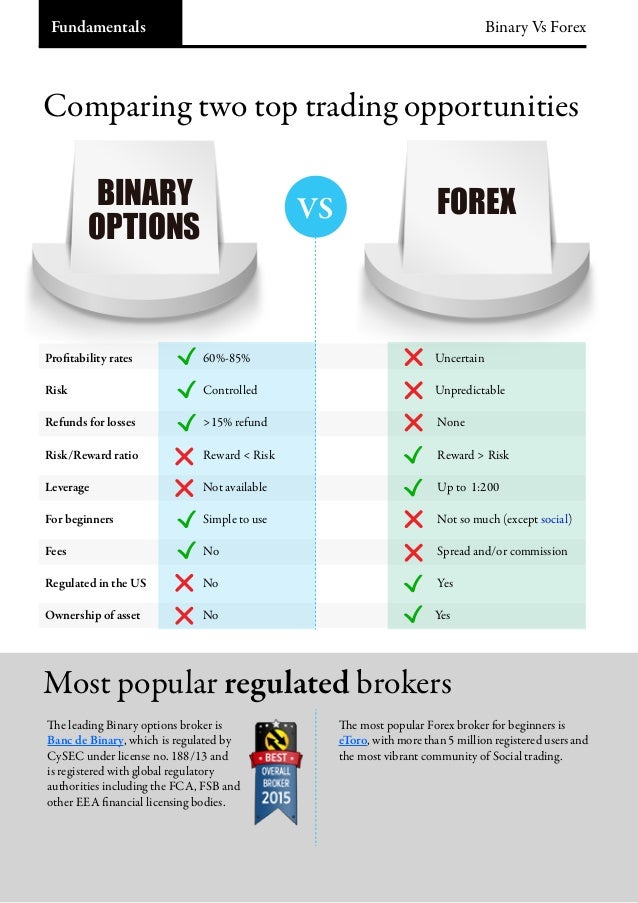

Binary options derive their name from their binary nature: traders either receive a fixed payout or lose their investment based on whether their prediction aligns with the market’s movement. This highly speculative instrument presents a stark contrast to traditional trading, where profits and losses exist on a spectrum. The predefined time frame, typically ranging from minutes to days, adds an element of urgency, compelling traders to make quick, decisive choices.

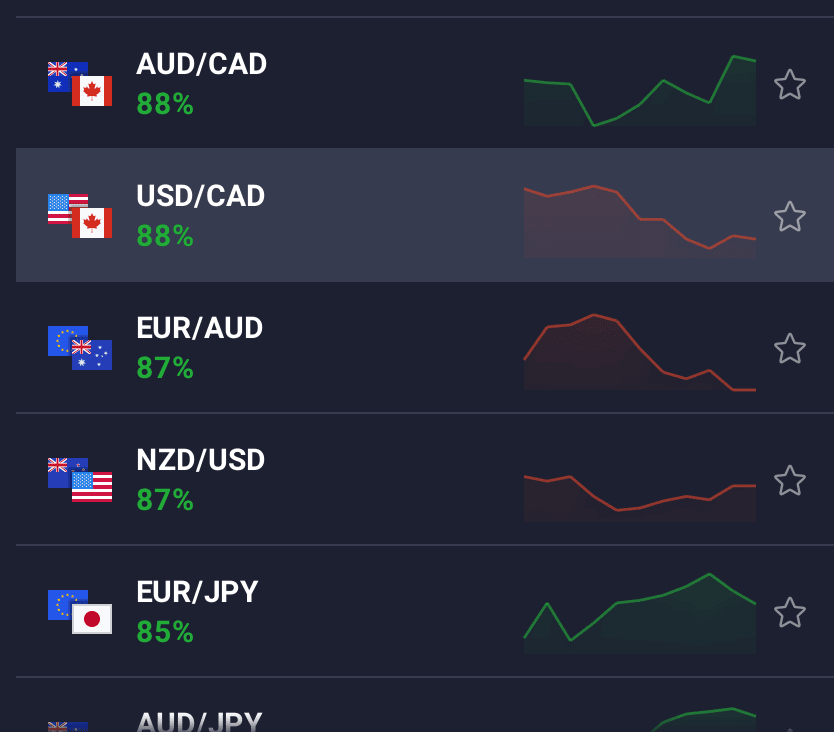

The underlying asset of binary options can be diverse, encompassing forex currencies, stocks, commodities, and indices. Traders predict whether the asset’s price will rise or fall, termed “call” and “put” options, respectively. The payout, should the prediction align with the market’s direction, is typically fixed at a percentage of the investment, ranging from 60% to 95%.

Unveiling the Trading Process: Execution and Beyond

To initiate a binary options trade, one must enlist the services of a binary options broker. These brokers serve as platforms where traders can execute trades, facilitated by intuitive interfaces that streamline the process. The broker’s platform typically offers a range of underlying assets, allowing traders to choose the market that aligns with their interests and trading strategy.

Once the underlying asset and direction of the trade are determined, traders specify the amount they wish to invest, adhering to the minimum and maximum investment limits set by the broker. Subsequently, the trader selects the expiration time, defining the period within which the predicted price movement must occur.

Upon initiating the trade, the broker evaluates the prediction against the actual market movement at the pre-determined expiration time. If the prediction aligns with the market’s direction, the trader receives the agreed-upon payout. In a scenario where the prediction deviates from the market’s movement, the trader loses the invested capital.

Types of Binary Options: Embracing Variety

The realm of binary options extends beyond the confines of traditional call and put options. An array of variations exists, catering to different trading preferences and risk appetites:

- Touch/No Touch: Traders speculate whether the underlying asset’s price will touch or remain beyond a specified level within the predetermined timeframe.

- Up/Down: The trader predicts whether the underlying asset’s price will rise or fall by a specific amount at the expiration time.

- Range: With this variation, traders wager whether the underlying asset’s price will remain within a predefined range at the expiration point.

Image: blog.iqoption.com

Trends and Evolution: The Dynamic Landscape of Binary Options

The binary options market is perpetually evolving, with technological advancements and regulatory initiatives shaping its trajectory. The advent of mobile trading platforms has revolutionized accessibility, empowering traders to execute trades on the go. Moreover, the proliferation of social trading platforms has fostered knowledge sharing and collaboration among traders.

on the regulatory front, the introduction of stricter measures aims to protect investors from fraudulent and unethical practices. This regulatory landscape is poised to facilitate greater transparency and accountability within the industry.

Basics Of Binary Options Trading

Conclusion: Unveiling the Potential of Binary Options

Binary options trading offers an intriguing opportunity for investors seeking high returns in a short timeframe. However, approaching this market demands a firm grasp of its fundamental concepts and an ongoing exploration of its nuances. By embracing a multifaceted approach, encompassing diligent research, strategic planning, and judicious risk management, traders can enhance their chances of success in this dynamic and potentially lucrative market.