Have you ever dreamt of turning a modest investment into a substantial fortune overnight? While the allure of quick riches is tempting, the world of options trading requires meticulous planning, a keen understanding of market dynamics, and a healthy dose of risk tolerance. However, before you dive headfirst into the unpredictable waters of options trading, consider equipping yourself with a powerful tool – an options trading simulator.

Image: www.warriortrading.com

An options trading simulator mirrors the real-world experience of trading options contracts. Through simulated scenarios, it allows you to experiment with different strategies, refine your decision-making, and, most importantly, minimize financial risk. The beauty of these simulators lies in their ability to recreate the complexities of the options market without the burden of real-world financial repercussions. If you’re ready to enhance your options trading prowess and navigate this intricate world with confidence, jump into the world of options trading simulators.

Delving Deeper: What Are Options Trading Simulators?

Options trading simulators are essentially virtual platforms that replicate the environment of a real options market. These platforms offer a safe and controlled space where users can practice their options trading skills without risking their hard-earned money. Think of it as a training ground for aspiring options traders, where you can test your knowledge, refine your strategies, and learn from your mistakes without losing anything but virtual capital.

Most options trading simulators provide users with a virtual brokerage account, allowing them to trade a range of options contracts, including calls, puts, straddles, and more. Users can input real-time market data, set custom parameters, and execute trades, all while observing the impact of their decisions on their virtual portfolios. The results are displayed in real-time, offering valuable insights into the potential risks and rewards of various options trading strategies.

The Advantages of Options Trading Simulators:

The benefits of utilizing an options trading simulator extend beyond simply learning the intricacies of options trading. Let’s explore some of the key advantages these platforms offer:

1. Risk-Free Learning: A Safe Haven for Experimentation

One of the most significant advantages of options trading simulators is the ability to learn and experiment without risking real money. The virtual environment allows users to make mistakes without facing financial consequences, which can be particularly valuable for beginners who are still navigating the complexities of options trading. This risk-free environment encourages exploration, experimentation, and the development of a deeper understanding of the nuances of options trading.

Image: libraryoftrader.net

2. Mastering Strategies and Refinement

Options trading simulators provide a platform for testing and refining different trading strategies. Users can execute various options trades, analyze their performance, and make adjustments based on the simulated results. This iterative process allows traders to identify profitable strategies, optimize their entries and exits, and develop a disciplined approach to trading.

For instance, you can experiment with different strike prices, expiration dates, and option types to see how their performance varies under different market conditions. This hands-on learning approach is crucial in identifying the strategies that best align with your risk tolerance and trading goals.

3. Building Confidence and Developing Discipline

Options trading often involves a significant psychological component. Many traders fall prey to emotional decision-making, which can lead to costly mistakes. Options trading simulators help traders develop discipline and emotional control by providing a safe space to practice managing their emotions and making rational trading decisions.

In the virtual environment, you can simulate real-life scenarios that might trigger emotional responses – such as market volatility or sudden price fluctuations. By observing how you react and adjust your strategy under pressure, you can train yourself to remain calm and make calculated decisions in real-world market conditions.

4. Understanding Market Dynamics and Volatility

Options trading simulators are powerful tools for understanding market dynamics and volatility. By simulating different market conditions, users can observe how options prices react to changes in underlying assets, interest rates, and other market variables.

For example, you can run simulations to observe how options premiums fluctuate in response to news events, earnings announcements, or economic data releases. These insights will help you develop a deeper understanding of market dynamics and how different events impact your trades.

5. Backtesting and Historical Data Analysis

Most options trading simulators offer backtesting capabilities, allowing users to analyze historical market data and assess the performance of different trading strategies over various market conditions. This historical data analysis is crucial for identifying patterns, optimizing entry and exit points, and understanding how your strategies would have performed in the past.

The insights gained from backtesting can be used to refine your trading strategies, identify potential risks, and develop a more robust understanding of the market.

Navigating the World of Options Trading Simulators

The options trading market is saturated with a plethora of simulators, each with its unique features and functionalities. Choosing the right simulator can be a daunting task, so it is essential to consider factors such as ease of use, realism of the platform, availability of features, and customer support.

Factors to Consider When Choosing an Options Trading Simulator:

Here are some key considerations that can help guide your selection:

- **Real-time Market Data:** Look for a simulator that provides real-time market data, ensuring that your simulations reflect current market conditions.

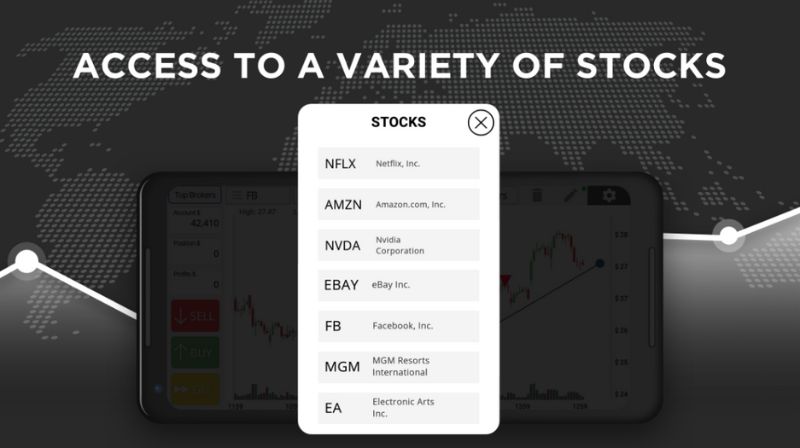

- **Variety of Options Contracts:** Ensure the platform offers a diverse range of options contracts, including calls, puts, spreads, and other complex strategies. This variety will allow you to practice and refine a broader range of trading techniques.

- **Backtesting Capabilities:** The ability to backtest your strategies using historical data is crucial for understanding their performance and refining their effectiveness. Prioritize simulators that offer robust backtesting features.

- **User Interface:** Choose a platform with a user-friendly interface, making it easy to navigate, access information, and execute trades. The interface should be intuitive and not overly complex.

- **Customer Support:** Consider the availability of customer support and the responsiveness of the provider. If you encounter any issues, you want to be confident that you can quickly access assistance.

- **Cost and Features:** Some simulators are free while others require a subscription. Evaluate the costs and features of each simulator to determine the best value for your needs.

Moving Beyond: From Simulator to Real-World Trading

While options trading simulators are invaluable tools for learning and honing your skills, they are not a substitute for real-world trading experience. Once you feel confident in your skills and have developed a solid understanding of options trading, transitioning to real-world trading should be approached carefully and gradually.

Here are some key steps for navigating this transition:

- **Start Small:** When you first enter the real-world market, begin with a small amount of capital and gradually increase your investment as your confidence grows. This approach minimizes risk and allows you to learn from your real-world experiences without incurring significant financial losses.

- **Use Paper Trading:** Before risking real money, consider using paper trading platforms. This allows you to test your strategies in a real-world environment with actual market data, but without real financial consequences.

- **Stay Informed:** Continuously update your knowledge of options trading by staying informed about market trends, news events, and changes in regulations. This ongoing learning process will help you adapt to evolving market conditions and make more informed decisions.

- **Seek Guidance:** If you’re new to options trading, consider seeking guidance from experienced traders or financial advisors. Their insights and expertise can provide valuable support and help you avoid costly mistakes.

Options Trading Simulator

Conclusion

Options trading simulators are valuable tools for both novice and experienced traders, offering a safe and controlled environment to learn, refine strategies, and manage risks. By leveraging the benefits of these platforms, you can develop a deeper understanding of the options market, build confidence, and prepare yourself for the challenges and rewards of real-world options trading. Remember, the key to success lies in a combination of knowledge, discipline, and continuous learning. So, start your journey today by exploring the world of options trading simulators and embark on a path toward mastery in this dynamic and rewarding financial arena.