The world of financial trading encompasses a vast array of instruments and strategies, catering to the diverse risk appetites and investment goals of traders. Forex and options trading stand as two prominent avenues in this arena, each offering its unique set of advantages and complexities. Navigating the intricacies of forex and options trading requires a comprehensive understanding of their respective nuances and distinctions, and this article aims to provide just that.

Image: howtotradeonforex.github.io

Understanding Forex Trading

Forex, short for foreign exchange, involves the exchange of currencies between different countries. It’s the most liquid and largest financial market globally, with an average daily trading volume exceeding trillions of dollars. The primary motivation behind forex trading is the quest for profit from currency fluctuations. Traders speculate on the price movements of various currency pairs based on economic data, political events, and market sentiment.

Forex trading offers several advantages. It provides high leverage, allowing traders to control substantial positions with relatively small capital. Forex markets operate around the clock, offering traders the flexibility to trade at their convenience. Additionally, currency pairs may exhibit high volatility, presenting potential opportunities for substantial gains but also carrying heightened risks.

Unveiling Options Trading

Options trading, on the other hand, involves contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predefined price within a specified time frame. Options contracts can be exercised or sold in the market, providing traders with a range of strategies to capitalize on market movements.

Options trading offers traders the flexibility to tailor their positions according to their risk tolerance and market expectations. Holding an option provides limited but defined risk, in contrast to the potentially unbounded losses associated with forex trading. Furthermore, options offer the potential for income generation through premiums collected by option sellers.

Comparing Forex and Options Trading

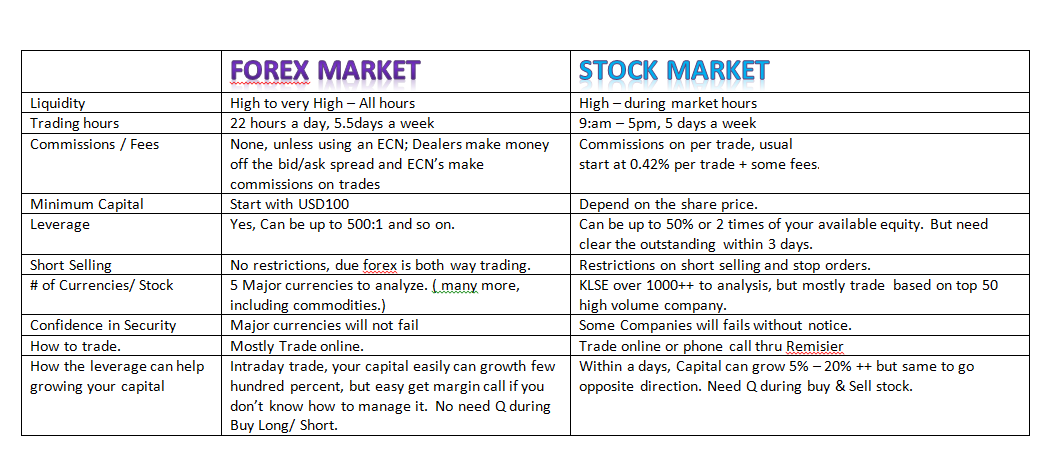

Both forex and options trading offer unique opportunities and challenges, and the choice between the two depends on the individual’s trading style, risk appetite, and investment objectives. Here’s a comparative overview of the key differences:

- Underlying Asset: Forex trading involves trading currency pairs, while options trading provides flexibility to trade a wide range of underlying assets, including stocks, bonds, commodities, and currencies.

- Risk Profile: Forex trading carries higher potential risks due to the high leverage often employed. Options trading offers more defined risk parameters, as the losses are limited to the premium paid for the contract.

- Trading Strategies: Forex trading primarily involves speculating on currency price movements, while options trading offers a wider spectrum of strategies, including hedging, speculation, and income generation through option premiums.

- Regulation: Forex markets are largely decentralized and subject to varying degrees of regulation across different jurisdictions. Options trading, on the other hand, is subject to regulatory oversight by exchanges and clearinghouses.

- Skillset and Learning Curve: Both forex and options trading require specialized knowledge and skills. Forex trading demands proficiency in technical analysis and currency market dynamics, while options trading necessitates a deeper understanding of options pricing, contract mechanics, and risk management.

Image: www.finyear.com

Forex Vs Options Trading

https://youtube.com/watch?v=al7rDhsuOyw

Choosing the Right Path

Determining the optimal trading path hinges on one’s individual circumstances and preferences. Those with a high risk tolerance, seeking potentially high returns and rapid execution, may find forex trading more appealing. Individuals prioritizing capital preservation, measured returns, and flexibility may prefer the defined risk and strategic options inherent in options trading.

Regardless of the chosen path, it’s imperative to approach trading with a well-informed and disciplined mindset. Education, risk management, and continuous learning are key pillars for success in the dynamic and ever-changing world of financial markets.