Introduction

In the ever-evolving world of retirement planning, options trading IRAs have emerged as a powerful tool for maximizing your investment returns while reducing risk. By partnering with a trusted broker like Fidelity, you can harness the potential of options trading to enhance your financial future. In this comprehensive guide, we will delve into the intricacies of Fidelity options trading IRAs, empowering you with the knowledge and insights to make informed decisions for your retirement portfolio.

Image: usefidelity.com

What is an Options Trading IRA?

An options trading IRA is a unique type of Individual Retirement Account that allows you to trade options contracts within the tax-advantaged environment of an IRA. Options contracts provide you with the flexibility to speculate on the future direction of an underlying asset, such as a stock or index, without having to own the asset directly. This versatility opens up a wide range of strategies to generate income, hedge against risk, and enhance the overall profitability of your retirement portfolio.

Benefits of Fidelity Options Trading IRAs

Fidelity stands out as one of the leading brokers for options trading IRAs, offering numerous benefits to investors:

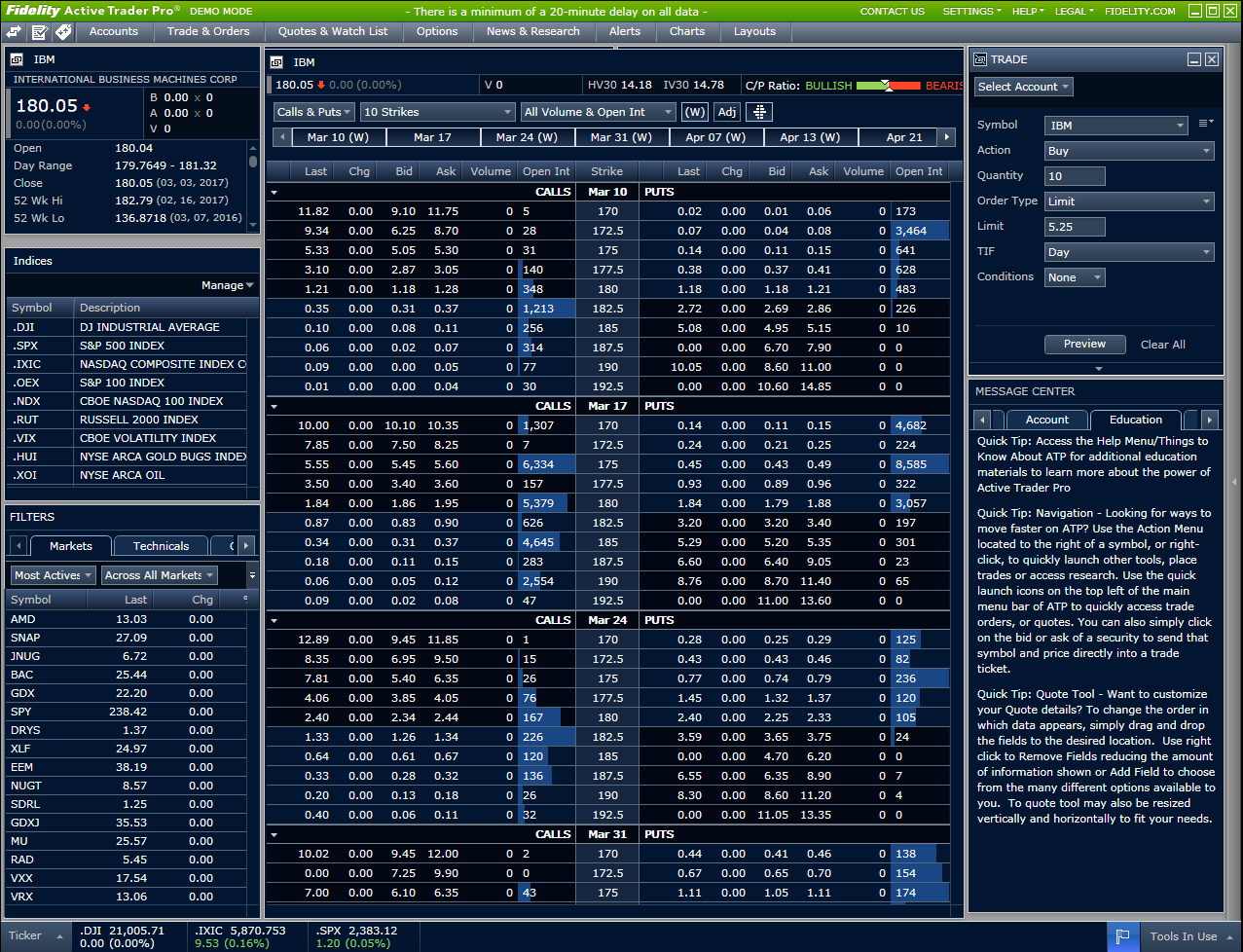

- Expansive Platform: Fidelity provides a robust trading platform with advanced charting tools, real-time data, and a comprehensive range of order types to empower your options trading strategies.

- Tax Advantages: IRAs offer significant tax benefits, allowing your investments to grow tax-deferred or tax-free, depending on the account type. Options trading within an IRA provides an additional layer of tax savings potential.

- Professional Guidance: Fidelity offers dedicated support and educational resources for options traders, ensuring you have the necessary knowledge and expertise to navigate the options market confidently.

Types of Options Strategies

Fidelity options trading IRAs open up a wide array of options strategies to meet your investment goals:

- Covered Calls: Generate income by selling call options against shares you already own, limiting your upside but providing a steady stream of additional income.

- Cash-Secured Puts: Sell put options while holding the necessary cash collateral to potentially acquire an asset at a predetermined price, providing income and the potential for appreciation.

- Protective Puts: Hedge your existing stock positions against potential downturns by purchasing put options, offering downside protection while still allowing for potential upside.

- Bull Call Spreads: Leverage your bullish outlook by purchasing a call option at one strike price and simultaneously selling a call option at a higher strike price, creating limited risk and defined potential profit.

Image: choosegoldira.com

Expert Insights and Actionable Tips

“Options trading can add a layer of sophistication and flexibility to your IRA portfolio, but it’s essential to approach it with proper education and risk management strategies in place,” advises market analyst Susannah Auld.

- Research and Education: Before embarking on options trading, take the time to understand the intricacies of options contracts, different strategies, and risk management techniques. Fidelity provides a wealth of educational resources to empower your learning journey.

- Start Small: Begin with small trades to gain familiarity with the options market and gauge your risk tolerance. As your confidence and knowledge grow, you can gradually increase your position sizes.

- Use Limit Orders: Protect your potential profits and limit your losses by using limit orders to execute your trades at specific price levels.

- Diversify Your Portfolio: Incorporating options trading into your IRA portfolio can provide diversification, reducing your overall investment risk and enhancing your potential returns.

Fidelity Options Trading Ira

Image: www.mymoneyblog.com

Conclusion

Fidelity options trading IRAs offer a powerful and tax-advantaged approach to grow your retirement savings. By leveraging the flexibility of options contracts, you can generate income, hedge against risk, and enhance your overall investment performance. With Fidelity’s trusted guidance, advanced platform, and comprehensive resources, you can navigate the options market with confidence and create a secure financial future for your retirement years.