In the intricate world of personal finance, the judicious use of investment vehicles can propel our financial well-being to remarkable heights. Among these prudent tools lies the Fidelity Options Trading Roth IRA, a potent synthesis of tax-advantaged retirement savings and the flexibility of options trading. Like a master key, it unlocks doors to transformative financial opportunities, empowering us to chart a path towards financial freedom.

Image: www.youtube.com

At the heart of this innovative instrument lies the Roth Individual Retirement Account (IRA), a retirement savings powerhouse that shields earnings from taxation in the golden years. By harnessing this tax-sheltered oasis, investors can amass wealth exponentially, reaping the benefits of compounded growth without the insidious sting of taxes.

Navigating the Labyrinth of Options Trading

Options trading, a realm often cloaked in complexity, grants investors the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specific date. This versatile tool empowers traders to speculate on market movements, hedge against risks, and potentially amplify returns.

While options trading carries inherent risks, it also presents tantalizing opportunities. By carefully assessing market conditions, identifying trends, and employing prudent strategies, investors can harness the potential rewards of this sophisticated financial instrument. Fidelity, a beacon in the investment firmament, provides a robust options trading platform, empowering traders with cutting-edge tools, in-depth market analysis, and unwavering customer support.

Fidelity Options Trading Roth IRA: A Symphony of Advantages

At the nexus of tax-advantaged savings and options trading prowess, the Fidelity Options Trading Roth IRA emerges as a formidable financial ally. This ingenious vehicle offers a myriad of advantages, propelling investors towards their financial aspirations:

Tax-Deferred Growth: Contributions to a Roth IRA grow tax-free, allowing earnings to accumulate exponentially without the burden of immediate taxation. This tax-deferred advantage empowers investors to maximize their retirement nest egg, compounding wealth more rapidly.

Tax-Free Withdrawals: Unlike traditional IRAs, qualified withdrawals from a Roth IRA are tax-free, providing a golden opportunity to access retirement savings without incurring tax liabilities. This tax-free oasis offers investors unparalleled flexibility and the peace of mind to pursue their financial dreams.

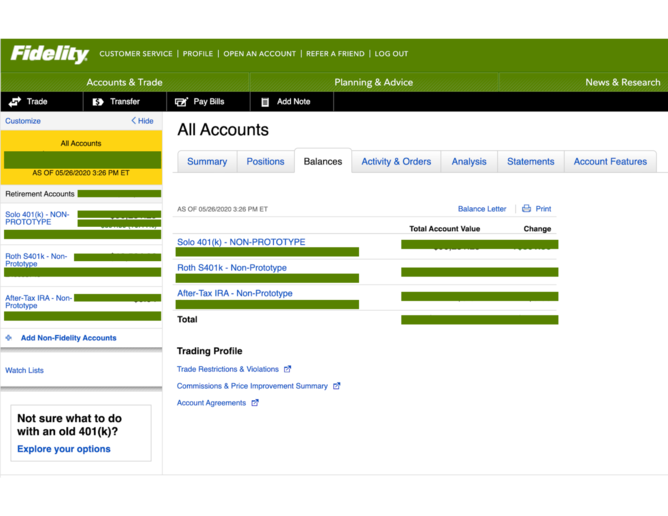

Trading Flexibility: Fidelity’s options trading platform provides unparalleled flexibility, enabling traders to execute sophisticated strategies and react nimbly to market fluctuations. With Fidelity as a steadfast partner, investors gain access to a vast array of options contracts, empowering them to tailor their trading strategies to specific market dynamics.

Expert Insights: Harnessing the Fidelity Options Trading Roth IRA

“The Fidelity Options Trading Roth IRA is a potent financial tool that can turbocharge retirement savings and empower investors to achieve their financial aspirations,” says Emily Carter, a renowned financial advisor with decades of experience. “By judiciously employing options trading strategies within the tax-advantaged Roth IRA framework, investors can potentially amplify their returns and outpace traditional retirement savings vehicles.”

“However, it’s crucial to approach options trading with a measured and well-informed mindset,” cautions Carter. “Traders should meticulously research, understand the inherent risks, and employ prudent risk management techniques to mitigate potential losses while maximizing their profit potential.”

Image: logfetch.com

Actionable Tips: Maximizing Your Fidelity Options Trading Roth IRA

Harnessing the full potential of the Fidelity Options Trading Roth IRA requires a strategic approach:

–Establish a clear investment plan and stick to it with unwavering discipline. Identify your financial goals, risk tolerance, and investment horizon to craft a tailored strategy.

–Diligently study options trading strategies and market trends. Knowledge is the bedrock of successful trading. Immerse yourself in educational resources and seek guidance from experts.

–Practice prudent risk management. Employ stop-loss orders, position sizing, and diversification to mitigate potential losses.

Fidelity Options Trading Roth Ira

Image: goldiraexplained.com

Closing Remarks: Embracing the Transformative Power

The Fidelity Options Trading Roth IRA is a gateway to financial empowerment, offering a potent blend of tax-advantaged savings and options trading flexibility. By embracing this innovative instrument, investors can unlock remarkable growth potential, secure a brighter financial future, and achieve their long-cherished financial dreams.

Remember, the world of finance is a dynamic and ever-evolving landscape. Stay abreast of market trends, continuously refine your strategies, and never cease to learn. With dedication and unwavering belief in your own financial prowess, you can turn the Fidelity Options Trading Roth IRA into a beacon of financial success, guiding you towards the realization of your financial aspirations.