Introduction

In the realm of financial markets, options trading stands as a potent tool, offering a myriad of opportunities for savvy investors. Advanced options strategies, however, take this potential to new heights, empowering traders to refine their risk-reward profiles and capture market opportunities with greater precision.

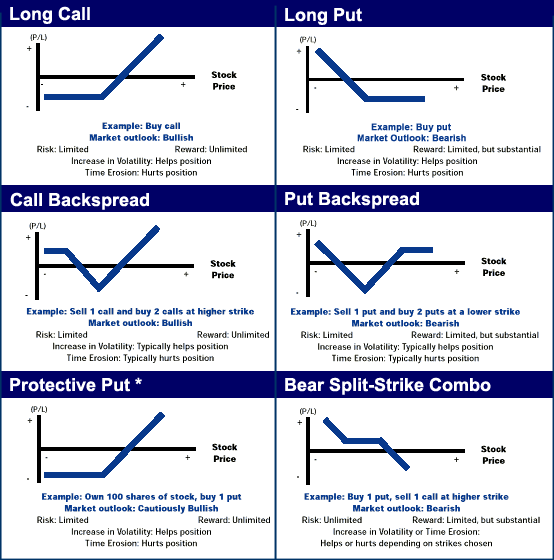

Image: seekingalpha.com

Embark on this comprehensive guide as we delve into the intricate world of advanced options trading strategies. Learn the foundational principles, unravel the latest advancements, and harness the insights of industry experts to elevate your trading game. Discover the keys to unlock substantial returns and navigate the financial markets with confidence.

Delving into Advanced Options Strategies

Advanced options trading strategies introduce a sophisticated layer to the trading landscape, providing traders with versatile tools to mitigate risk, enhance returns, and capitalize on market fluctuations. At the core of these strategies lie complex mathematical models and in-depth analysis techniques.

Covered Call Strategy

A covered call strategy involves selling call options against an underlying stock that you own. This strategy generates income from the sale of the call options while limiting potential upside gains in the underlying stock. It is suitable for investors who expect moderate price appreciation in the underlying asset while receiving a premium for assuming the obligation to sell.

Cash-Secured Put Strategy

Similar to a covered call, a cash-secured put strategy involves selling put options against a certain amount of cash capital. This strategy generates income from the sale of put options while giving the trader the potential obligation to buy the underlying asset at a predetermined price. It is appropriate for investors who believe the asset’s value will remain stable or increase.

Image: rmoneyindia.com

Bull Call Spread

A bull call spread involves buying a lower-priced call option and simultaneously selling a higher-priced call option with the same expiration date. This strategy is suited for investors who expect the underlying asset to experience a moderate increase in value within a specific time frame. The potential profit lies in the difference between the premiums of the two options.

Bear Put Spread

A bear put spread is designed for investors who anticipate a decline in the value of the underlying asset. It involves selling a lower-priced put option and buying a higher-priced put option with the same expiration date. The profit potential arises from the difference between the premiums of the two put options.

Iron Condor Strategy

An iron condor strategy combines both bull call and bear put spreads with different strike prices. This strategy is best suited for investors expecting the underlying asset to remain within a specific range. It generates income by selling options at various strike prices while limiting potential profit and loss.

Expert Insights: Unlocking Market Success

Mike Bellafiore, author of “One Good Trade,” emphasizes the importance of defining clear trading objectives before implementing any advanced options strategy. He advises traders to have a deep understanding of risk management principles and to develop a disciplined trading plan.

Traders who excel in advanced options trading strategies often employ robust research and analytical tools. According to Brian Overby, founder of the Options Institute, mastering technical analysis techniques helps identify market trends and potential trading opportunities.

Harnessing the Power of Advanced Strategies

Mastering advanced options trading strategies empowers investors to:

-

Enhance risk-reward profiles by tailoring strategies to their individual risk tolerance and profit objectives.

-

Expand profit potential by leveraging options strategies that capture various market scenarios.

-

Diversify trading portfolio by incorporating options strategies that complement existing investment strategies.

-

Hedge portfolio against potential risks by employing options strategies that protect against adverse market conditions.

Options Trading Advanced Strategies

Conclusion

The world of advanced options trading strategies presents a vast and intricate landscape, offering both opportunities and challenges. By embracing the foundational principles, exploring the latest advancements, and harnessing the wisdom of industry experts, investors can unlock the potential for substantial returns. Remember to approach trading with prudence, manage risks judiciously, and continuously seek ways to refine your knowledge and skills.

Trade with confidence, embrace the transformative power of advanced options trading strategies, and elevate your financial journey to new heights.