Introduction

Options trading can be an intricate but potentially lucrative area of investing, and understanding bullish trades is fundamental for successful navigation. In this post, we’ll explore the concept of bullish options trading, its significance, and various strategies to capitalize on positive market trends.

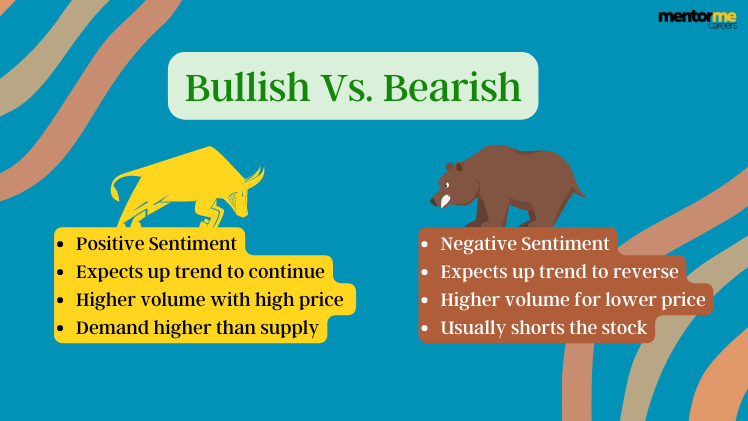

Image: s3.amazonaws.com

Bullish Options Trading: An Overview

Options are financial instruments granting the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price known as the strike price. Bullish options trades denote a belief that the underlying asset’s price will rise. In these trades, the investor holds a right to buy (call option) the asset at a lower strike price than the current market price.

Understanding Bullish Options Strategies

Various bullish options strategies are available, each with its unique characteristics and risk-reward profiles. Below are some widely used strategies:

- Call Options: The buyer of a call option acquires the right to buy an underlying asset at the strike price on or before the expiration date. If the underlying asset’s price rises above the strike price, the call option gains value.

- Bull Call Spreads: This involves purchasing a call option at a lower strike price and simultaneously selling another call option at a higher strike price with the same expiration date. The strategy benefits from limited risk and profits from a moderate increase in the underlying asset’s price.

- Bull Put Spreads: Similar to bull call spreads, this strategy entails purchasing a put option at a higher strike price and selling a put option at a lower strike price. It allows investors to benefit from a decline in implied volatility while capturing potential gains from a rising underlying asset’s price.

Latest Trends and Developments

The options trading landscape is continuously evolving, with innovations and updates emerging regularly. Here are some notable trends and developments:

- Expansion of Exchange-Traded Options (ETOs): ETOs have gained popularity due to their standardized contracts, increased liquidity, and ease of access. This has broadened the range of underlying assets available for options trading.

- Rise of Mobile Trading Platforms: Advancements in mobile technology have made it convenient for traders to access options markets in real-time. This has democratized trading and enabled investors to seize opportunities more quickly.

- Integration with Algorithmic Trading: Algorithmic trading tools automate options trading strategies, allowing for faster execution and optimized risk management. This has enhanced efficiency for both retail and institutional traders.

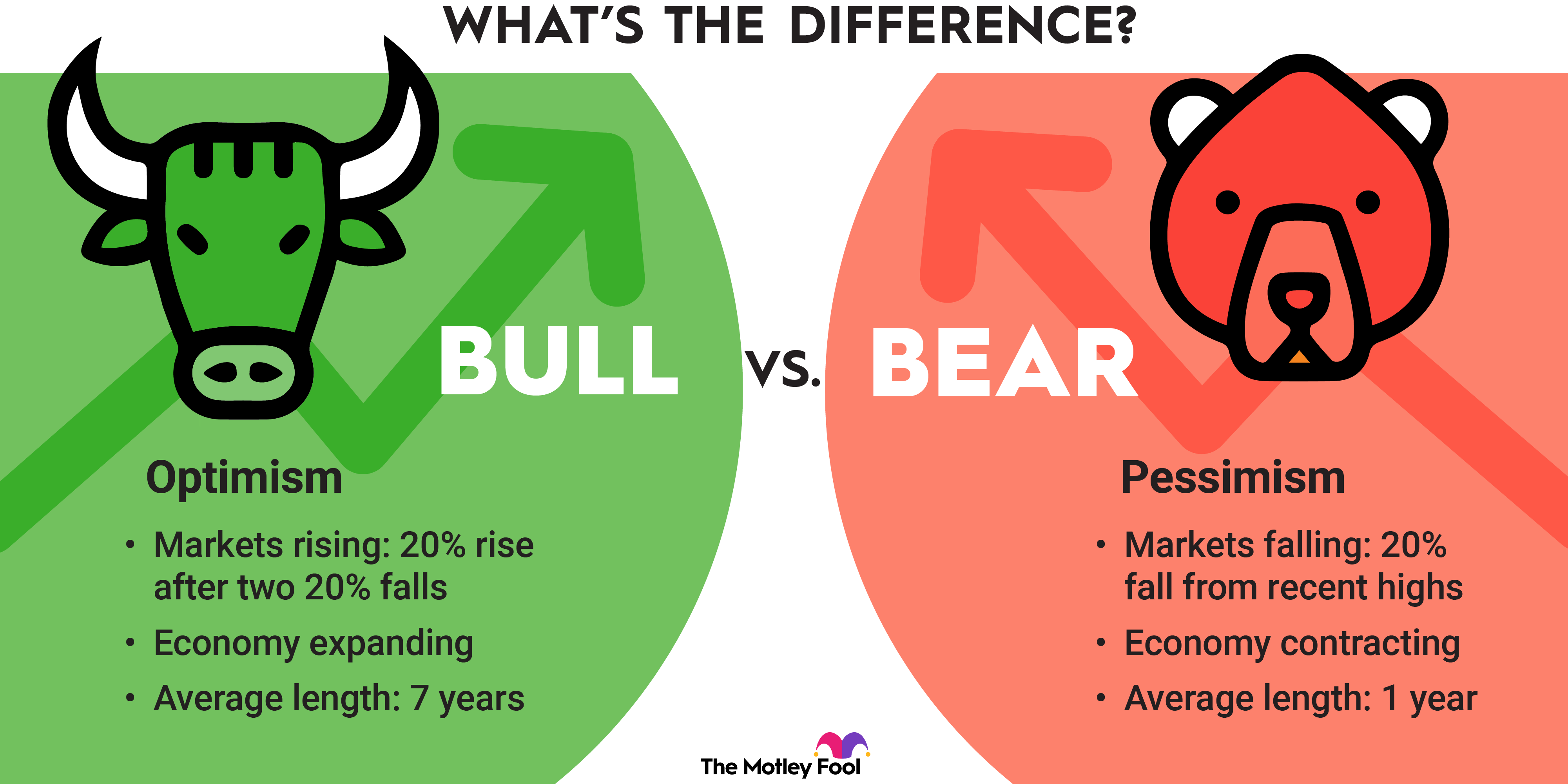

Image: atelier-yuwa.ciao.jp

Tips and Expert Advice from a Seasoned Blogger

As an experienced blogger in the world of options trading, I have gained valuable insights over the years. Here are a few tips to enhance your bullish options trading strategy:

- Understand the Underlying Asset: Conducting thorough research on the underlying asset is crucial before initiating any options trade. This includes analyzing market trends, earnings reports, and industry news.

- Manage Risk Effectively: Options trading involves inherent risk, so proper risk management is paramount. This includes setting clear stop-loss levels, diversifying your portfolio, and trading within your financial capabilities.

- Consider Time Decay: Options have a limited lifespan, so be mindful of time decay (theta). Trades should be tailored to align with market expectations, and positions adjusted or closed before significant value erosion occurs.

FAQs on Bullish Options Trading

Q: What is the difference between buying and selling a call option?

A: Buying a call option allows you to purchase the underlying asset at the strike price, whereas selling a call option obligates you to sell the asset at that price.

Q: When is it appropriate to use a bull call spread?

A: Bull call spreads are suitable when the underlying asset is expected to experience a moderate increase in price, with limited downside risk.

Q: What are the risks associated with bull put spreads?

A: Bull put spreads carry the risk of loss due to a sharp decline in the underlying asset’s price or a surge in implied volatility.

What Does It Mean When Options Trading Are Bullish

Image: ceg.edu.vn

Conclusion

Bullish options trading can be a powerful tool for investors seeking to profit from rising markets. By understanding the strategies, leveraging the latest trends, and implementing risk management best practices, traders can increase their chances of success. Embrace the world of bullish options trading and uncover the potential to enhance your investment portfolio.

Would you like to delve deeper into the world of bullish options trading? Join our exclusive community and gain access to exclusive insights, expert guidance, and the latest market updates. Register today and take the next step in your trading journey.