:max_bytes(150000):strip_icc()/index-funds-vs-etfs-2466395_V22-d288a73d28154c3c9df884f076f2f6af.png)

Image: www.thebalancemoney.com

Unveiling the Lucrative Landscape of Options Trading

Options trading presents an unparalleled opportunity for investors to harness the potential of the stock market’s volatility and uncertainty. By understanding the intricate dynamics of options contracts, savvy traders can craft strategies that maximize returns and minimize risks. This comprehensive guide delves into the top 10 ETFs and stocks that are ideal for options trading today, empowering traders with the knowledge and insights to navigate the market with confidence.

Main Body

Understanding Options Trading

Options contracts convey the right, but not the obligation, to buy or sell a particular stock at a predetermined price on a specific date. Call options grant the buyer the right to purchase the stock, while put options provide the right to sell. By analyzing market trends, volatility, and other factors, options traders can speculate on the future direction of stock prices and potentially reap substantial rewards.

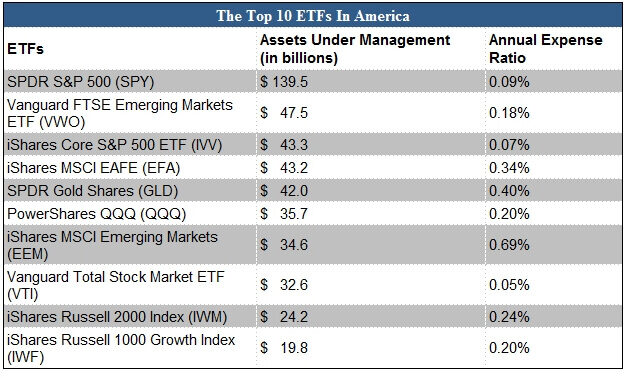

ETF Selection for Options Trading

Exchange-traded funds (ETFs) offer a diversified basket of underlying assets, making them an attractive choice for options trading. Here are the top 5 ETFs ideal for this purpose:

-

SPDR S&P 500 ETF (SPY): With its exposure to the broad market, SPY provides comprehensive exposure to the U.S. equity market.

-

Invesco QQQ Trust (QQQ): Focused on the Nasdaq 100 technology index, QQQ offers access to the growth potential of large-cap tech stocks.

-

Vanguard Total Stock Market ETF (VTI): VTI provides exposure to the entire U.S. stock market, ensuring broad diversification and risk reduction.

-

SPDR Gold Shares (GLD): As a physical gold ETF, GLD offers a hedge against inflation and provides diversification benefits.

-

iShares Russell 2000 ETF (IWM): IWM represents small-cap stocks, which often offer higher volatility and growth potential.

Image: investinganswers.com

Top Stocks for Options Trading

In addition to ETFs, individual stocks can also be targeted for options trading. Here are the top 5 stocks that offer compelling opportunities:

-

Apple Inc. (AAPL): As a global tech giant, AAPL is highly liquid and exhibits strong price trends, making it suitable for both bullish and bearish options strategies.

-

Tesla Inc. (TSLA): TSLA’s innovative electric vehicles and cutting-edge technology make it a volatile stock with significant options trading potential.

-

Amazon.com, Inc. (AMZN): AMZN dominates the e-commerce market and benefits from a loyal customer base, offering ample liquidity for options trading.

-

UnitedHealth Group Inc. (UNH): UNH is a leading healthcare provider with a reliable revenue stream, providing stability and downside protection.

-

Nvidia Corporation (NVDA): As a leader in artificial intelligence and chip design, NVDA’s shares exhibit high growth potential and volatility, making them a popular choice for options traders.

Trading Strategies and Considerations

When trading options, it’s crucial to employ a well-defined strategy. Some common approaches include:

-

Bullish Strategies: Using call options to profit from a stock’s expected rise in value.

-

Bearish Strategies: Utilizing put options to capitalize on a stock’s anticipated decline in price.

-

Hedging Strategies: Employing options to reduce the risk of existing stock positions.

-

Covered Call Strategy: Selling covered calls involves selling call options against stocks you own to generate income while maintaining upside potential.

-

Margin Trading: Amplifying trading potential by utilizing borrowed funds, but with increased risks and potential losses.

Understanding the nuances of these strategies and tailoring them to specific market conditions is essential for successful options trading.

Top 10 Etfs And Stocks For Trading Options Today

Image: www.thestockdork.com

Conclusion

Options trading offers unparalleled opportunities to unlock the potential of the financial markets. By leveraging the top-rated ETFs and stocks outlined in this guide, investors can craft tailored options strategies that align with their risk tolerance and investment objectives. Remember, thorough research, diligent monitoring, and a well-defined trading plan are the cornerstones of successful options trading. Embrace the dynamic world of options and unlock the potential for substantial returns on your investment journey.