In the dynamic world of finance, options trading offers a tantalizing avenue for experienced investors seeking to harness the power of leverage and amplify their returns. Among the various tiers available, Tier 2 Standard Margin stands out as a strategic option, providing a harmonious balance between flexibility and risk management.

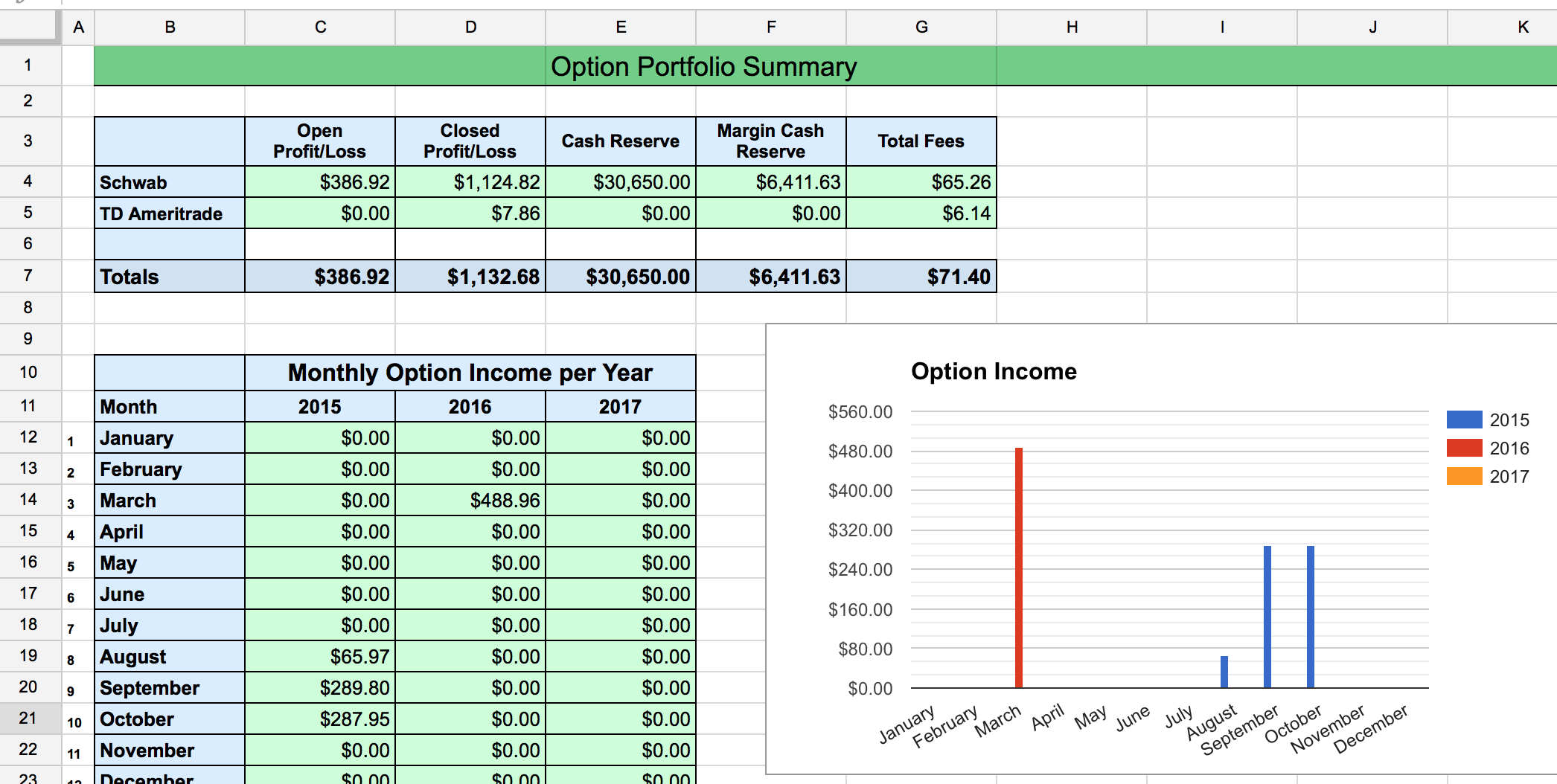

Image: www.twoinvesting.com

Embarking on the Tier 2 Journey

Option trading Tier 2 Standard Margin is a refined and time-tested strategy that confers the authority to trade options with greater leverage than Tier 1 while adhering to prudent risk measures. This tier is ideally suited for seasoned traders who possess a thorough understanding of options and risk management principles. It grants the ability to maximize profit potential by accessing higher leverage ratios, enabling astute investors to capitalize on market fluctuations with magnified efficiency.

The Intricacies of Standard Margin

The crux of Standard Margin lies in its utilization of portfolio margining, a sophisticated approach that harnesses the combined equity value of all eligible securities in the investor’s brokerage account. This holistic strategy encompasses stocks, bonds, and certain ETFs, thereby allowing the investor to unlock additional trading power and potentially enhance returns.

Balancing Flexibility with Risk

Tier 2 Standard Margin adeptly strikes a balance between flexibility and risk management. While it provides the freedom to trade options with amplified leverage, it also imposes essential safeguards to mitigate potential losses. This intricate balance empowers traders to navigate market dynamics confidently, knowing that their risk exposure is judiciously managed.

Image: blog.dhan.co

Maximizing Returns with Tier 2 Standard Margin

Trading options under Tier 2 Standard Margin presents a strategic opportunity to elevate returns. The judicious application of leverage enables traders to control a larger notional value with a relatively modest investment. By leveraging market movements effectively, Tier 2 traders can potentially generate substantial returns while maintaining a disciplined approach to risk management.

Mastering Tier 2 Standard Margin

To harness the full potential of Tier 2 Standard Margin, aspiring traders must possess a firm grasp of options trading fundamentals, including option premiums, Greeks, and volatility measures. A comprehensive understanding of risk management techniques, such as position sizing and stop-loss orders, is also paramount.

Prudent Practices for Tier 2 Success

-

Manage Risk Responsibly: Allocate capital judiciously, adhering to a predefined risk tolerance. Carefully consider position sizing and leverage ratios to maintain a prudent risk profile.

-

Monitor Positions Vigilantly: Constant monitoring of open positions is essential to identify and manage potential risks proactively. Close positions promptly when adverse market conditions arise to mitigate losses.

-

Embrace Continuous Learning: The financial landscape is constantly evolving. Stay abreast of market trends, regulatory changes, and new trading strategies to adapt effectively to evolving market dynamics.

Option Trading Tier 2 Standard Margin

Image: fintrakk.com

Cultivating Confidence in Trading

Option trading Tier 2 Standard Margin is a powerful tool that can empower experienced traders to amplify their returns and navigate market volatility with confidence. By adhering to sound risk management principles and continually honing their skills, traders can unlock the full potential of this strategic tier and achieve financial success.