Over the past few years, option trading has emerged as a popular investment strategy, offering potentially higher returns compared to traditional stock trading. However, mastering the complexities of option trading can be a daunting task, requiring a deep understanding of market dynamics and risk management. To address this challenge, sophisticated option trading robots have been developed, designed to automate the complex decision-making involved in option trading. In this comprehensive guide, we will delve into the world of option trading robots, exploring their benefits, types, and how to choose and use them effectively.

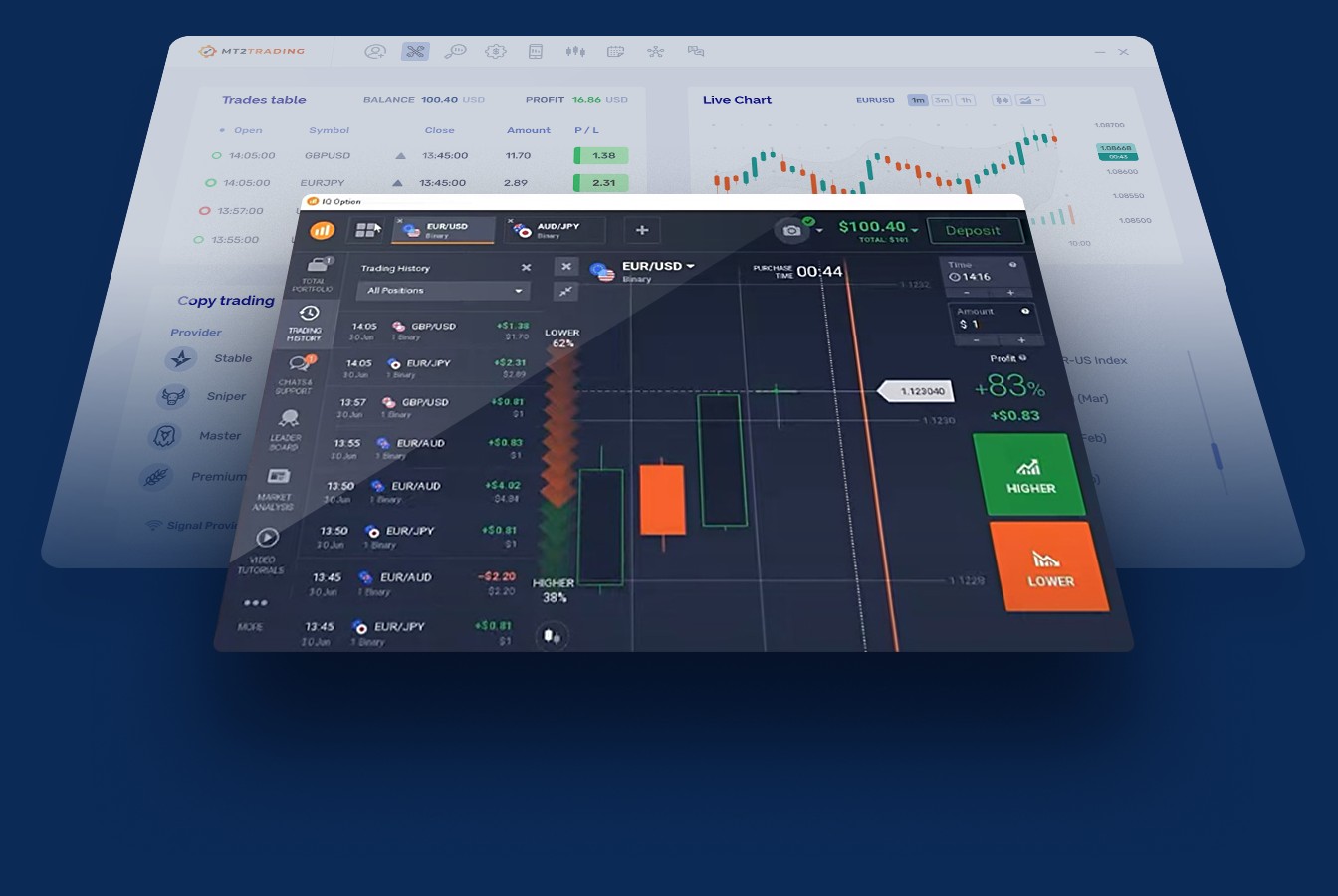

Image: www.mt2trading.com

What is an Option Trading Robot?

An option trading robot is a software program that leverages advanced algorithms and machine learning capabilities to analyze market data, identify trading opportunities, and execute trades automatically within an online trading platform. These robots are designed to remove the human element from the equation, eliminating the influence of emotions and biases, and ensuring consistent execution of preset trading strategies.

Types of Option Trading Robots

There are several types of option trading robots available, each with its unique approach and strategy:

- Trend-Following Robots: Analyze market trends and identify opportunities based on the assumption that trends tend to continue.

- Mean Reversion Robots: Capitalize on market fluctuations, buying when prices dip below historical averages and selling when they rise above.

- News-Based Robots: Monitor news events and market sentiment to identify potential price movements and trigger trades accordingly.

- Volatility-Based Robots: Analyze market volatility and adjust strategies based on the level of price fluctuations.

- Black-Box Robots: Utilize proprietary algorithms and advanced mathematical models, offering a “set it and forget it” approach.

Benefits of Using Option Trading Robots

- Automation: Remove the need for constant monitoring and manual trading, freeing up time for other activities.

- Discipline: Robots execute trades according to pre-defined rules, mitigating the impact of emotions and impulsive decisions.

- Speed and Accuracy: Robots analyze vast amounts of data and execute trades in a fraction of a second, optimizing trading opportunities.

- Backtesting: Most robots come with backtesting capabilities, allowing traders to test strategies on historical data and refine them before deployment.

- Risk Management: Robots can be programmed with risk-management parameters, ensuring that trades are executed within acceptable loss limits.

Image: www.youtube.com

How to Choose and Use Option Trading Robots

Selecting and utilizing an option trading robot requires a thoughtful approach:

- Identify Your Goals: Determine your specific investment objectives and risk tolerance before selecting a robot.

- Research and Evaluate: Compare different robots based on their strategies, track records, and user reviews.

- Test Before Deployment: Utilize the backtesting capabilities of the robot to test its performance on historical data.

- Monitor and Adjust: Regularly monitor the robot’s performance and adjust its settings or strategies as needed.

Option Trading Robot That Is Profitable

Image: www.dolphintrader.com

Conclusion

Option trading robots offer a compelling solution for investors seeking to enhance their option trading performance. By automating complex decision-making, removing emotional influences, and providing real-time analysis, robots can streamline the trading process and optimize profitability. However, selecting and using a robot wisely is crucial for success. By conducting thorough research, aligning your goals with the robot’s strategy, and implementing proper monitoring, you can harness the power of automation and unlock the potential for profitable option trading.