**Introduction**

For those seeking to delve into the world of options trading, Option Robot.com once served as a popular destination. However, recent developments have led to trading being no longer available on the platform, leaving traders searching for alternative solutions. In this comprehensive article, we unravel the reasons behind this change, explore viable alternatives, and provide expert advice to guide informed decision-making.

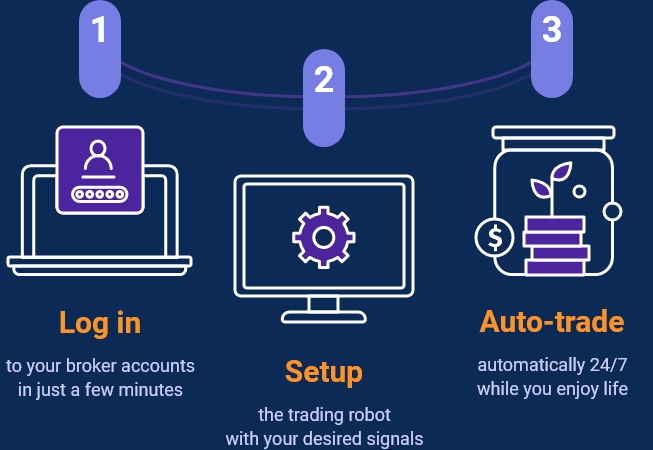

Image: www.mt2trading.com

**Reasons for Un availability of Trading on Option Robot.com**

The discontinuation of trading services on Option Robot.com stems from strategic shifts within the company. In an effort to focus on the core aspects of their automated trading platform, the decision was made to redirect resources away from direct trading operations. This move allows Option Robot.com to concentrate on enhancing its algorithmic trading offerings, providing traders with advanced tools and technologies.

**Regulatory Considerations**

Regulatory oversight in the financial industry has played a role in Option Robot.com’s decision. Regulators worldwide have taken a more stringent approach to governing automated trading platforms, requiring them to adhere to stringent compliance protocols. To comply with these regulations, Option Robot.com made the strategic choice to cease offering direct trading services.

**Alternatives to Option Robot.com**

Traders seeking a reliable platform to engage in options trading have an array of alternatives to choose from. These platforms offer diverse features tailored to the needs of traders with varying experience levels and trading styles.

- Thinkorswim: TD Ameritrade’s Thinkorswim provides a comprehensive suite of tools and resources for both beginner and advanced traders.

- Tastyworks: Known for its user-friendly interface and its focus on options trading, Tastyworks offers customizable platforms and educational content for traders at every level.

- Interactive Brokers: One of the leading online brokers globally, Interactive Brokers boasts a vast array of trading products, including options.

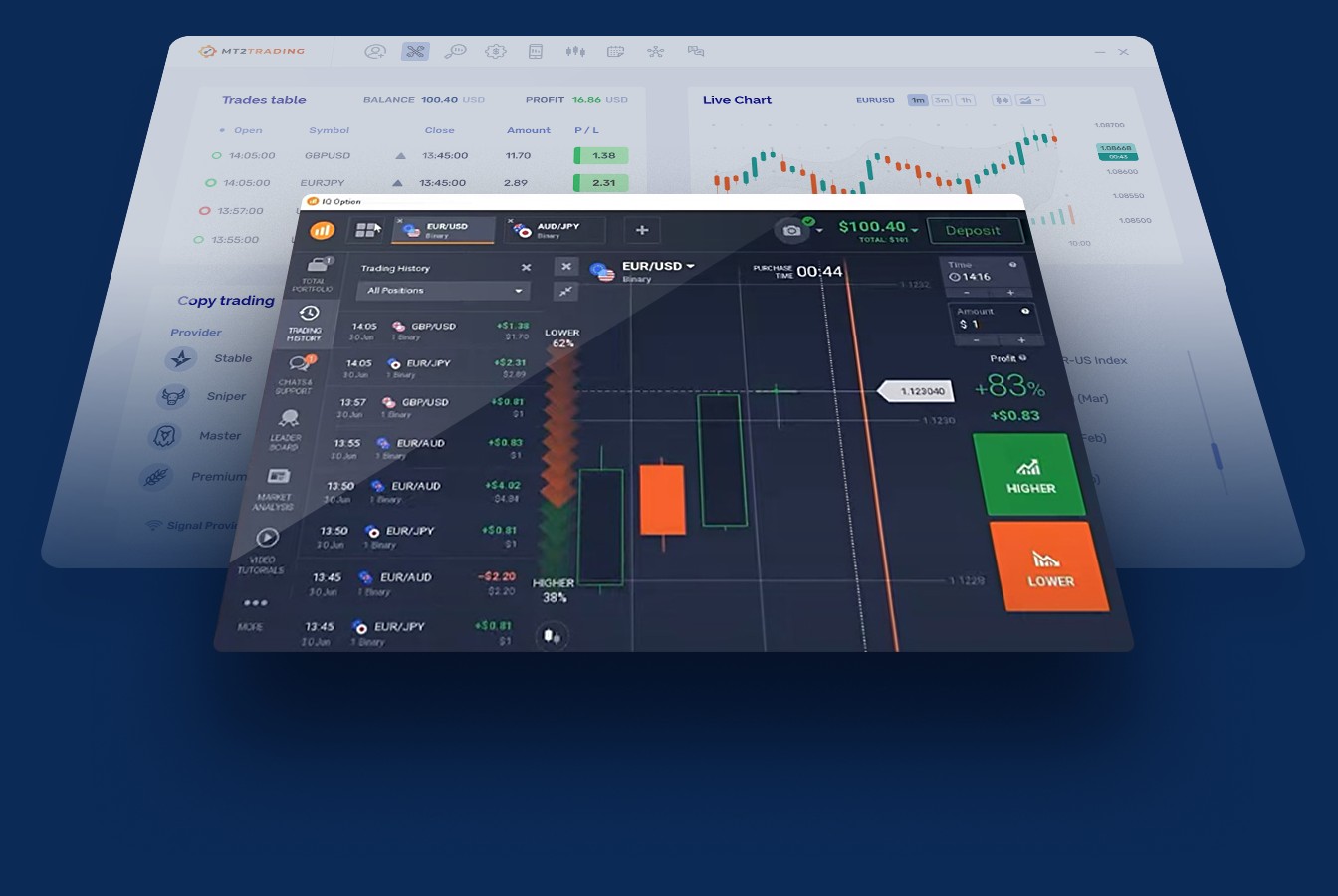

Image: www.mt2trading.com

**Expert Advice for Traders**

Navigating the options trading landscape requires careful consideration. Seasoned traders offer the following insights to enhance your trading journey:

- Understand the Underlying Asset: Before diving into options trading, grasp the dynamics of the underlying asset. This knowledge forms the foundation for making informed trading decisions.

- Choose the Right Strategy: Options trading offers a wide spectrum of strategies to adapt to varying market conditions. Selecting the appropriate strategy aligns with your trading goals and risk tolerance.

- Manage Risk: Risk management is paramount in options trading. Employ techniques to mitigate potential losses, such as position sizing and protective orders like stop-loss and take-profit levels.

**Frequently Asked Questions**

Q: Why can’t I trade on Option Robot.com anymore?

A: Option Robot.com has discontinued direct trading services to focus on enhancing its automated trading platform.

Q: What are some reputable alternatives to Option Robot.com?

A: Thinkorswim, Tastyworks, and Interactive Brokers are well-established platforms offering robust options trading capabilities.

Q: How can I improve my options trading skills?

A: Study the underlying asset, research trading strategies, manage risk effectively, and seek educational resources to enhance your knowledge and decision-making abilities.

Trading Not Available In Option Robot.Com

Image: www.youtube.com

**Conclusion**

While trading is no longer available on Option Robot.com, the options trading landscape remains vibrant with a host of reputable alternatives. Understanding the reasons behind this change and exploring viable platforms empower traders to continue their pursuit of options trading strategies. By embracing expert advice and navigating the market with informed decisions, traders can navigate the complexities of options trading and achieve their financial goals.

Are you interested in delving deeper into the world of options trading? Share your thoughts and experiences in the comments below, and let’s engage in a dialogue to expand our collective knowledge.