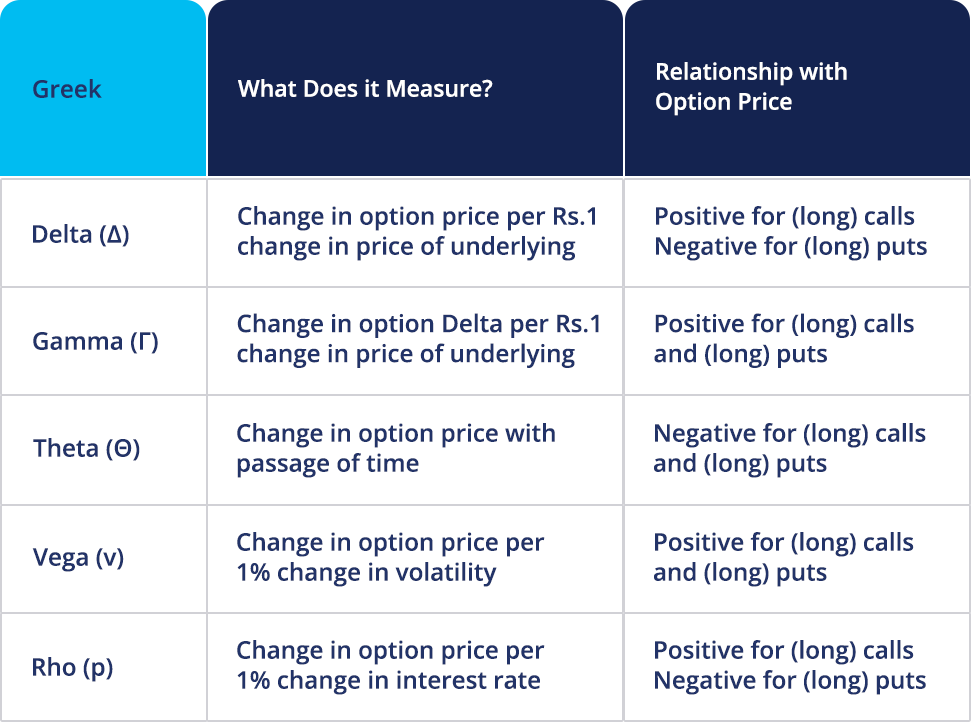

For those seeking to venture into the realm of options trading, grasping the intricacies of Greeks can be a daunting task. These enigmatic letters – Delta, Gamma, Theta, Vega, and Rho – embody the sensitivity of an option’s price to various underlying factors. However, by harnessing the power of visual examples, we can unravel the secrets of the Greeks and unlock their potential for informed trading decisions.

Image: tradingqna.com

Embracing Delta’s Impact: A Visual Odyssey

Imagine a stock trading at $50 with an option contract expiring in one month. Delta represents the rate of change in the option’s price relative to changes in the stock price. Suppose the Delta of the call option is 0.5. If the stock price increases by $1, the option’s price will climb by $0.50. Conversely, a $1 decrease in the stock price would lead to a $0.50 decline in the option’s value.

Gamma’s Role: Visualizing the Acceleration

Gamma measures the rate of change in Delta for every $1 movement in the underlying stock price. A higher Gamma indicates a quicker acceleration in Delta, making the option more sensitive to stock price fluctuations. Consider an option with a Gamma of 0.1. As the stock price moves from $50 to $51, Delta increases from 0.5 to 0.55. This enhanced sensitivity can amplify gains or losses significantly.

Theta’s Stealthy Influence: A Time-Lapse Perspective

Theta captures the decline in an option’s value as time passes. It reflects the fact that an option has a limited lifespan and its value decays as it approaches expiration. Imagine an option with a Theta of -$0.05. Every day, the option’s price will decrease by $0.05, irrespective of the stock price movement. This underscores the importance of understanding Theta’s impact, especially for options close to expiration.

Vega’s Volatility Dance: A Symphony of Unpredictability

Vega measures an option’s sensitivity to changes in implied volatility. When implied volatility increases, Vega-positive options (call options with the stock price below the strike price and put options with the stock price above the strike price) gain value. Conversely, Vega-negative options lose value. Think of Vega as a risk amplifier, magnifying potential gains and losses when volatility fluctuates.

Rho’s Steady Rhythm: Adjusting to Interest Rate Changes

Rho represents the change in an option’s value due to a 1% shift in the risk-free interest rate. For call options, positive Rho indicates that the option’s value will increase with rising interest rates, while for put options, it’s the reverse. A Rho of 0.1 implies that a 1% interest rate increase would lead to a $0.10 increase in the option’s price, emphasizing the significance of considering interest rate movements in option trading.

Conclusion: Unlocking the Power of Visualized Greeks

Visual examples provide a powerful tool for comprehending the complexities of Greeks in option trading. By visualizing the impact of Delta, Gamma, Theta, Vega, and Rho, traders can gain a deeper understanding of how options behave under varying market conditions. This knowledge empowers them to make informed decisions, navigate market uncertainties, and unlock the full potential of the options market.

Image: www.paytmmoney.com

Visual Examples Of Greek Option Trading

Image: www.youtube.com