Understanding Options

In the world of investing, options occupy a unique position. They offer investors both excitement and potential risk, providing a powerful tool to enhance portfolios or speculate on future price movements. However, understanding the complexities of options trading can be daunting, especially for those new to the game. This comprehensive guide will demystify options trading in layman’s terms, making it accessible to anyone eager to venture into this thrilling arena.

Image: www.theartofsimpletrading.com

Options are financial instruments that grant buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. This feature bestows a great deal of flexibility and strategic possibilities upon investors. By leveraging options, you can tailor your investment strategy to your specific risk tolerance and financial objectives.

Types of Options

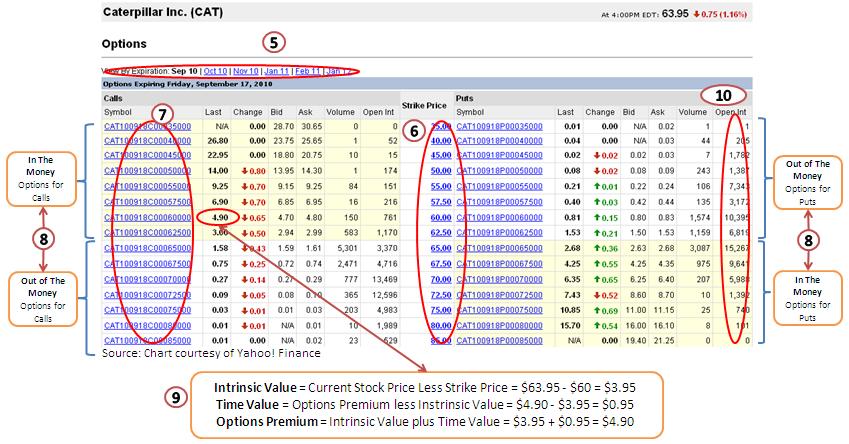

There are two primary types of options: calls and puts. Call options provide buyers with the right to purchase an underlying asset at a predetermined price, known as the strike price, on or before the option’s expiration date. Put options, on the other hand, confer the right to sell the underlying asset at a predetermined strike price on or before the expiration date.

Call Options – A Deeper Dive

To further illustrate the concept of call options, let’s consider an example. Imagine you have your eyes set on acquiring shares of a particular stock currently trading at $50 per share. You believe the stock’s value will soar in the coming months and want to capitalize on this anticipated appreciation.

Purchasing the stock outright would require you to pay $50 per share, but what if you lack the available funds or prefer a more measured approach? This is where call options come into play. You could buy a call option with a strike price of $52.50 and a six-month expiration.

By paying a premium, which is essentially a fee for purchasing the option, you gain the right to purchase the stock at $52.50 any time before the expiration date. If the stock’s price rises to $60, you can exercise your option to buy it at $52.50, netting a profit of $7.50 (the difference between the market price and the strike price) per share.

Put Options – Another Dimension

Now, let’s explore the world of put options. Imagine you have a different stock in your portfolio that you anticipate declining in value. You decide to hedge your risk by purchasing a put option with a strike price of $47.50 and an expiration date three months in the future.

This strategic move allows you to sell the stock at $47.50 per share, regardless of how low the stock’s price might fall. This protection comes at a cost, as you’ll need to pay a premium for the put option.

However, if the stock’s price drops to $40, you can exercise your put option, selling the stock at $47.50 and mitigating your losses. Essentially, put options function as insurance policies, safeguarding your investments against adverse price movements.

Image: yzypohu.web.fc2.com

The Importance of Expiration Dates

Options are time-sensitive instruments. They come with specific expiration dates, which refer to the timeline within which the option can be exercised. If the option is not exercised before its expiration date, it will become worthless. Therefore, it’s crucial to carefully consider the expiration dates of options when making investment decisions.

The Complex World of Premiums

The cost of an option is known as its premium. Premiums are influenced by various factors, including the underlying asset’s volatility, the strike price, and the time remaining until expiration. Options with higher strike prices and shorter expiration dates tend to command higher premiums. The premium can be a significant investment expense, so it’s essential to factor it into your decision-making process.

Unveiling the Greeks

Navigating the realm of options trading involves understanding the “Greeks.” The Greeks represent a set of metrics that measure the risk and sensitivity of an option to different variables, such as the price of the underlying asset, the time to expiration, and the volatility of the asset. Although the Greeks can initially seem overwhelming, they provide valuable insights into the intricacies of options.

Avoiding Common Pitfalls

Options trading, fraught with its attractions, can also be treacherous. Unwary investors may fall into common traps that jeopardize their profits. One prevalent pitfall is overtrading. Attempting to monopolize too many trades simultaneously can lead to hasty decisions and financial losses. It’s prudent to adopt a disciplined approach, limiting your trades and exercising caution.

Another pitfall to steer clear of is ignoring the time value of options. The time value of an option reflects the diminishing worth of that option as it nears its expiration date. This means that options lose value even when the underlying asset’s price remains constant.

Lastly, the allure of leverage can be enticing but equally perilous. Options possess inherent leverage. This leverage, while potentially lucrative, can magnify both gains and losses. Options trading is not a suitable endeavor for individuals with a low-risk tolerance.

Options Trading Layman’S Terms

Image: www.youtube.com

The Rewards and Cautions

Options trading unlocks a world of opportunities for investors. It presents avenues for income generation, hedging, and speculative gains. However, it’s critical to acknowledge the inherent risks associated with options. As with any investment venture, conduct thorough research and comprehend the risks involved before committing capital.