Options trading, a captivating realm where risk and reward dance in delicate equilibrium, offers immense potential for savvy investors. Yet, to venture into this arena, one must navigate the intricate landscape of margin requirements, a crucial aspect that can make or break your trading aspirations. E*Trade, a titan in the brokerage industry, has meticulously crafted a set of margin requirements for options trading, tailored to empower traders of all levels. Join us on an in-depth exploration of these requirements, unveiling the secrets to unlock the gateway to options trading success.

Image: haipernews.com

Defining Margin Requirements: The Bedrock of Options Trading

Margin requirements, the cornerstone of options trading, serve as a safety net, ensuring that traders maintain a cushion of funds to cover potential losses. These requirements vary based on the type of option strategy employed, the underlying asset’s volatility, and the account type. By understanding and adhering to these requirements, traders can trade options with confidence, knowing that their financial well-being is safeguarded.

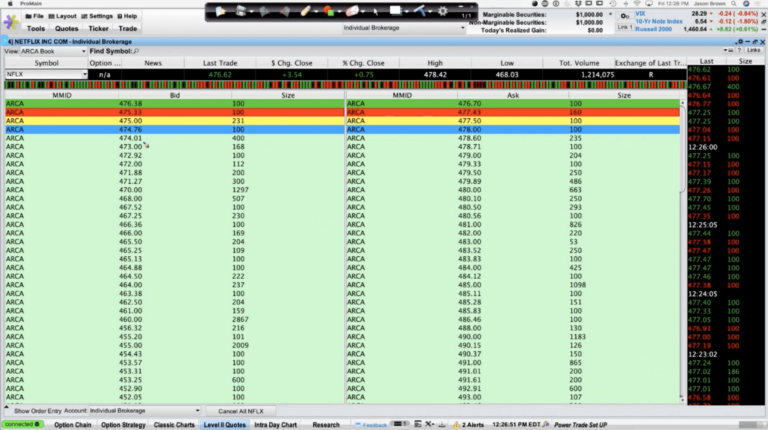

*ETrade’s Margin Requirements: A Trader’s Compass**

E*Trade, renowned for its user-friendly platforms and comprehensive trading tools, has established a robust set of margin requirements, designed to provide traders with a transparent and well-defined framework. These requirements are calculated using sophisticated algorithms that consider the aforementioned factors, ensuring fair and appropriate margins for each trade.

Navigating the Nuances: Margin Calculations Demystified

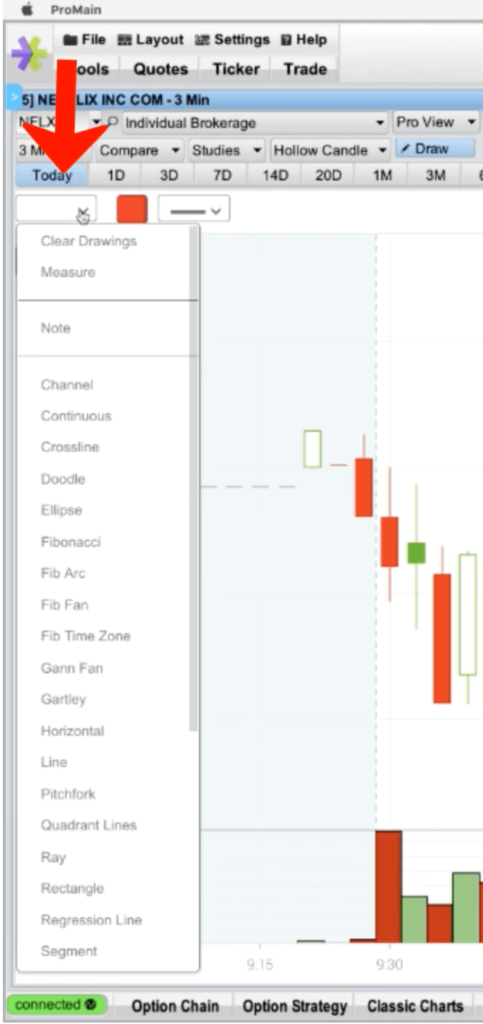

For stock options, E*Trade utilizes the Portfolio Margin (PM) method, a sophisticated approach that evaluates your entire portfolio to determine margin requirements. This method offers flexibility and can result in lower margin requirements compared to traditional methods.

Index options, on the other hand, are subject to the SPAN (Standard Portfolio Analysis of Risk) method, an industry-standard approach that calculates margin requirements based on the risk profile of the underlying index. SPAN considers factors such as volatility, correlation, and Greeks to provide accurate margin estimates.

Understanding these margin calculation methods is essential for traders to optimize their trading strategies and manage their risk exposure effectively.

Expert Insights: Unlocking the Secrets of Margin Management

Seasoned options traders emphasize the importance of disciplined margin management, urging traders to never trade with more than they can afford to lose. They recommend starting with smaller positions and gradually increasing trade size as experience and confidence grow. Monitoring account balances regularly and adjusting positions accordingly is crucial to maintain a healthy trading account.

Conclusion: The Path to Options Trading Success

Mastering E*Trade’s margin requirements for options trading is a fundamental step toward unlocking the potential of this captivating market. By understanding the calculations, adhering to the requirements, and implementing sound risk management strategies, traders can navigate the options trading landscape with confidence and poise. Remember, knowledge is the key that unlocks the gateway to success in this dynamic and rewarding arena.

Image: thebrownreport.com

Etrade Margin Requirements For Options Trading

Image: thebrownreport.com