Weekly SPY options trading has emerged as a popular and agile approach in the options market, providing traders with opportunities to capitalize on short-term market movements. SPY, tracking the S&P 500 index, offers a versatile underlying asset for options trading, allowing traders to speculate on the direction of the broader market. By understanding the ins and outs of weekly SPY options trading, traders can refine their trading strategies and enhance their chances of success in this dynamic market.

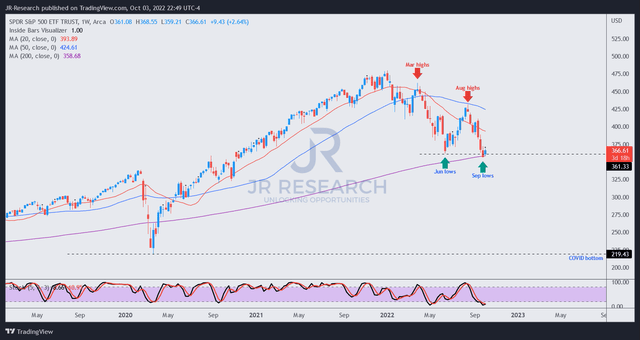

Image: seekingalpha.com

Understanding Weekly SPY Options

Weekly SPY options contracts have a life span of one week, expiring every Friday. Unlike monthly options, which expire on the third Friday of each month, weekly options provide traders with increased flexibility and adaptability to changing market conditions. This shorter duration enables traders to take advantage of short-lived market trends and potentially generate quicker returns.

Types of Weekly SPY Options

There are two primary types of weekly SPY options: calls and puts. Call options give the holder the right, but not the obligation, to buy a specified number of SPY shares at a predetermined price (strike price) on or before the option’s expiration date. Put options, on the other hand, grant the holder the right to sell a specified number of SPY shares at the strike price.

Trading Weekly SPY Options

Trading weekly SPY options involves selecting a suitable strike price and option type (call or put) based on your market outlook. If you anticipate the price of SPY to rise, you would purchase a call option; conversely, if you expect a decline, you would trade a put option. The premium paid for the option represents the cost of this right.

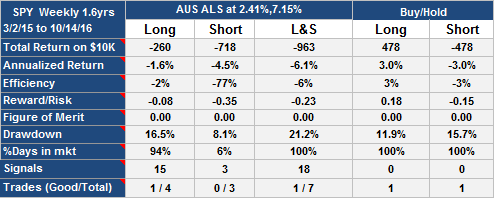

Image: www.myoptionsedge.com

Advantages of Weekly SPY Options

Weekly SPY options offer several advantages to traders:

- Increased flexibility: The shorter lifespan allows traders to quickly adjust their positions in response to market developments.

- Risk management: Weekly options enable traders to manage risk on a shorter time frame, limiting potential losses.

- Potential for rapid profits: Short-term market movements can provide significant profit opportunities for traders.

- High liquidity: SPY options are highly liquid, ensuring ease of entry and exit from trades.

Considerations in Weekly SPY Options Trading

While weekly SPY options provide various benefits, traders should also consider the following:

- Higher premiums: Weekly options typically carry higher premiums compared to longer-term options due to their shorter duration.

- Time decay: The value of weekly options decays rapidly as the expiration date approaches, impacting potential profits.

- Suitability: Weekly SPY options may not be suitable for all traders, especially those with longer-term investment horizons.

Weekly Spy Options Trading

Image: www.signalsolver.com

Conclusion

Weekly SPY options trading offers traders a flexible and potentially lucrative approach to capitalizing on short-term market movements. By understanding the concepts, types, and considerations involved in weekly SPY options trading, traders can enhance their trading strategies and increase their chances of success in this dynamic and fast-paced market. Remember, thorough research, a sound understanding of market dynamics, and prudent risk management are crucial for successful weekly SPY options trading.