In the labyrinthine world of finance, options trading stands out as a powerful tool for savvy investors seeking to navigate market volatility and potentially enhance their returns. Amid the myriad of options trading systems available, discerning the creme de la creme can be a daunting task. This comprehensive guide will delve into the intricacies of the best options trading systems, empowering you to make informed decisions and optimize your trading strategies.

Image: messots.blogspot.com

Navigating the Options Trading Landscape: An Overview

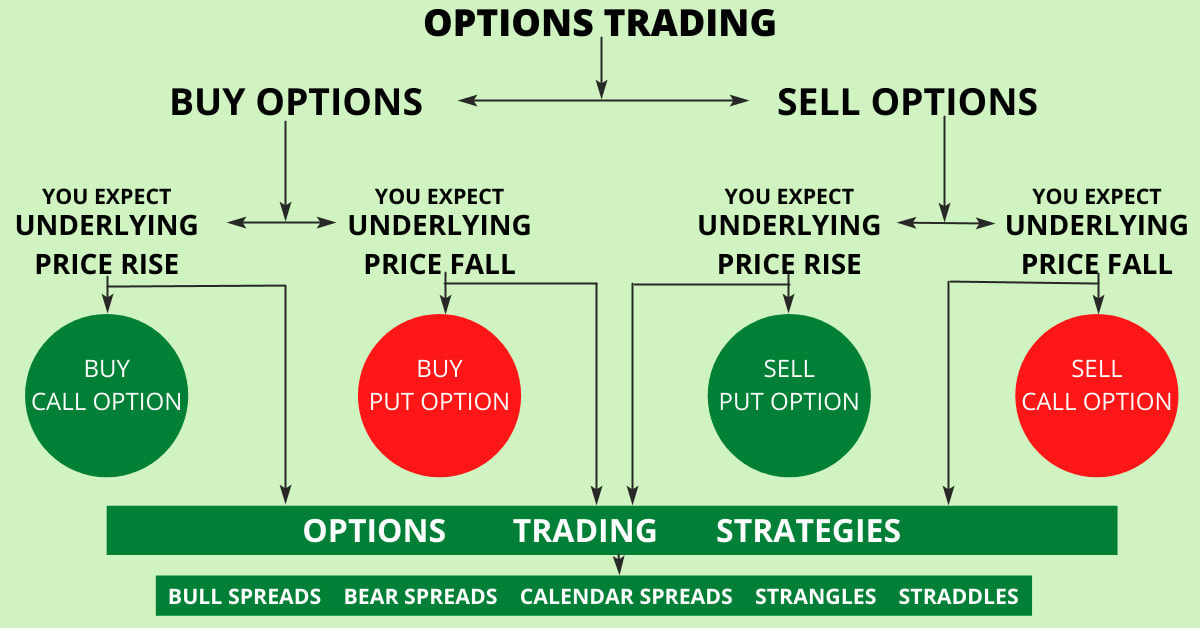

Options, derivatives that grant the holder the right but not the obligation to buy or sell an underlying asset at a predetermined price and time, offer a versatile array of potential opportunities and risks. The choice of an appropriate options trading system is paramount to unlock the full potential of these financial instruments.

Demystifying the Elements of an Effective Options Trading System

Effective options trading systems possess distinct characteristics:

- Historical Backtesting: The system should demonstrate consistent profitability over a substantial historical period, ensuring robustness and adaptability to changing market conditions.

- Objective Criteria: The system should be based on objective criteria, such as technical indicators or fundamental analysis, rather than subjective judgments or hunches.

- Risk Management: A well-rounded system prioritizes risk management through prudent position sizing, stop-loss orders, and clearly defined entry and exit points.

- Scalability: The system should be adaptable to various market conditions and account sizes, ensuring ongoing viability as your trading capital evolves.

Exploring the Taxonomy of Options Trading Systems

A diverse spectrum of options trading systems exists, each employing unique methodologies and strategies:

- Trend Following Systems: Capture market momentum by identifying and exploiting prevailing trends.

- Mean Reversion Systems: Exploit price fluctuations by anticipating the return of an underlying asset to its historical mean value.

- Volatility-Based Systems: Benefit from changes in implied volatility by trading options based on predicted volatility levels.

- Technical Analysis Systems: Leverage technical indicators and chart patterns to identify trading opportunities.

- Fundamental Analysis Systems: Incorporate fundamental factors, such as company financials and economic data, into trading decisions.

Image: stewdiostix.blogspot.com

Identifying the Ideal Options Trading System: A Framework

Choosing the optimal options trading system requires a holistic evaluation considering:

- Risk Tolerance: Determine your comfort level with potential losses, as different systems entail varying levels of risk.

- Time Horizon: Consider the duration you are willing to commit to trades, as systems vary in their holding periods.

- Trading Style: Identify your preferred trading style, whether aggressive, conservative, or somewhere in between, and seek systems that align with your approach.

- Trading Account Size: Ensure the system aligns with the capital you have available for trading.

Leveraging Technology for Enhanced Options Trading

Technological advancements have revolutionized options trading, introducing invaluable tools for analysis and execution:

- Trading Platforms: Provide a streamlined interface for trade execution, historical data analysis, and real-time market monitoring.

- Option Pricing Models: Calculate the fair value of options based on variables like underlying price, volatility, and time to expiration.

- Backtesting Software: Test the performance of trading systems using historical data, enabling objective evaluations and optimizations.

Case Study: Unveiling the Power of a Trend-Following Options Trading System

The Bollinger Band Squeeze system epitomizes the effectiveness of trend-following options trading systems:

- Strategy: Buys call options when the Bollinger Bands constrict, indicating potential for an upward breakout, and sells when the bands expand, signaling a potential trend reversal.

- Historical Performance: Backtesting over a significant time frame has demonstrated consistent profitability, showcasing the robustness of the system’s underlying principles.

- Risk Management: Employing stop-loss orders, position sizing based on account size, and clearly defined entry and exit triggers provides robust safeguards against excessive losses.

Nurturing Trading Proficiency: Continuous Education and Refinement

Mastering options trading necessitates ongoing learning and refinement:

- Education: Engage in educational seminars, webinars, or courses to expand your knowledge base and stay abreast of industry advancements.

- Practice: Simulate trading through paper trading or small live trades to hone your skills and gain practical experience.

- Self-Reflection: Regularly evaluate your trading performance, identify areas for improvement, and refine your system accordingly.

Best Options Trading System

Conclusion: Empowering Traders with the Best Options Trading Systems

Comprehending the nuances of the best options trading systems empowers investors with a valuable tool for navigating the financial markets. By embracing a comprehensive approach, considering individual needs, leveraging technology, and continuously seeking knowledge and refinement, you can enhance your trading acumen and potentially unlock the doors to increased profitability. Remember, responsible and prudent trading practices remain the cornerstone of long-term success in the realm of options trading.