The advent of electronic trading systems has revolutionized the financial landscape, introducing unprecedented speed, efficiency, and accessibility to the trading world. Among these systems, options trading stands out as a powerful tool for risk management and speculative strategies. Understanding the intricate interplay between electronic trading systems and options trading is crucial for navigating today’s dynamic markets. This comprehensive guide will delve into the intricacies of these systems, exploring their historical foundations, core concepts, and practical applications.

Image: investguiding.com

The Birth of Electronic Trading: Transforming the Market Landscape

Electronic trading systems emerged in the 1970s as an innovative solution to the complexities of traditional floor-based trading. The introduction of electronic platforms allowed traders to connect directly through computer networks, eliminating the need for physical exchanges. This transformative shift reduced transaction costs, accelerated execution speeds, and enhanced transparency, fundamentally altering the market dynamics.

Understanding Options Trading: The Art of Risk Management and Strategic Positioning

Options, a unique class of financial instruments, provide traders with the flexibility to speculate on and mitigate risk from underlying assets’ price movements. An option contract grants the buyer the right (not the obligation) to buy or sell a specified underlying asset at a predetermined price on or before a specific date. Options trading offers a diverse range of strategies, allowing traders to tailor their risk tolerance and optimize their investment outcomes.

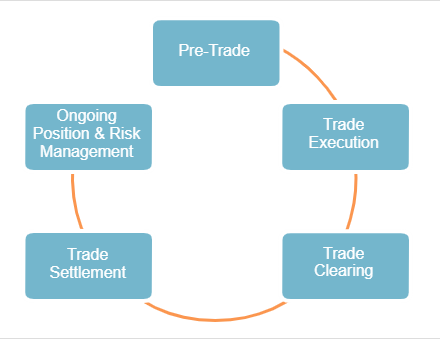

The Dynamic Trading Life Cycle: A Journey Through Order Flow

Every trade executed through electronic trading systems undergoes a well-defined life cycle. The process commences with the placement of an order by a trader, specifying the desired security, quantity, and price. The order enters the trading system, where it is matched against incoming orders from other participants. Upon successful matching, an execution occurs, and the trade is recorded for settlement. This seamless and efficient cycle underpins the smooth functioning of electronic trading systems.

Image: profitmust.com

Benefits of Electronic Trading: Embracing Efficiency and Flexibility

Electronic trading systems offer numerous advantages that have reshaped the trading landscape. Traders can execute trades virtually instantaneously from anywhere with an internet connection, eliminating geographical barriers. The reduced costs, increased transparency, and enhanced liquidity foster a more competitive and accessible trading environment, empowering individual traders and institutional investors alike.

Options Trading in Electronic Systems: Enhancing Risk Management and Opportunity

The integration of options trading within electronic systems further enhances the versatility and effectiveness of trading strategies. By providing real-time access to options markets, traders can swiftly adjust their portfolios, manage risk, and seize opportunities presented by market fluctuations. Options trading platforms empower traders with sophisticated tools for option pricing, risk assessment, and strategy optimization.

Recent Developments and Future Trends: Innovation in Electronic Trading and Options

The electronic trading landscape continues to evolve rapidly, with technological advancements driving innovation. Machine learning and artificial intelligence are transforming trade execution and risk management strategies, introducing new levels of efficiency and analytical capabilities. The integration of blockchain technology holds the potential to enhance settlement processes and further secure electronic trading systems.

Electronic Trading Systems With Options Trading And Trading Life Cycles

Image: rinacarrasco.blogspot.com

Conclusion: Empowering Traders with Knowledge and Tools

Electronic trading systems have transformed the financial markets, offering traders unprecedented speed, efficiency, and accessibility. Options trading, seamlessly integrated within these systems, provides a powerful tool for risk management and strategic positioning. Understanding the intricacies of these systems and the life cycle of trading is essential for navigating the complex and dynamic world of electronic trading. Embracing the latest developments and leveraging innovative tools empower traders with the knowledge and resources to thrive in today’s markets.