Introduction

Navigating the world of options trading can be daunting, especially for beginners. Fidelity, a renowned financial institution, offers a user-friendly platform tailored to both seasoned traders and those just starting out. In this article, we’ll delve into the intricacies of trading options on Fidelity, providing insights into its features, strategies, and expert advice.

Image: bdteletalk.com

Choosing the Right Options Strategy

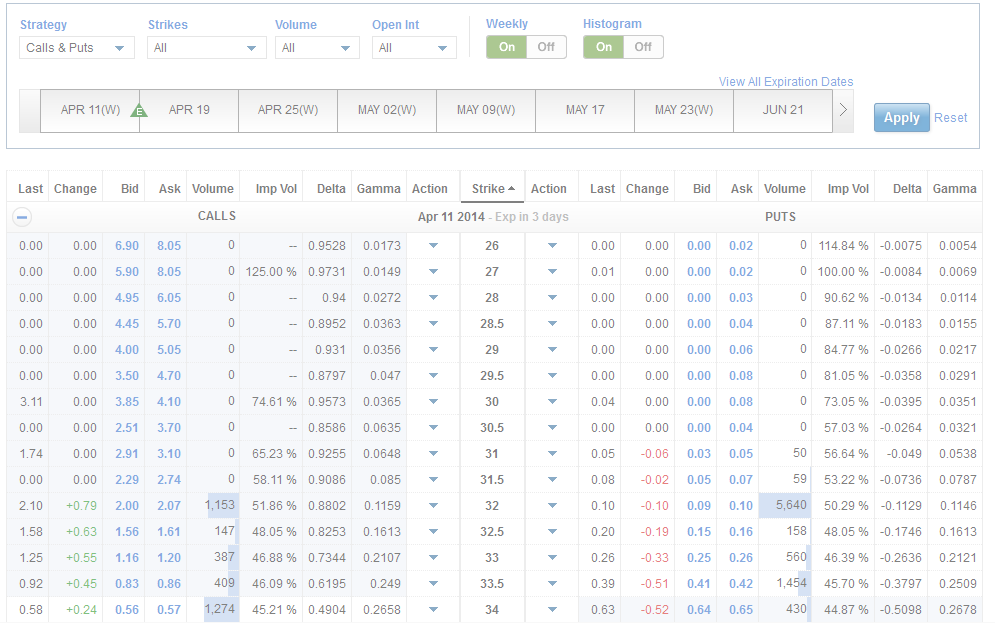

Options trading involves predicting the movement of an underlying asset like a stock or an index. As a trader, your goal is to choose an options strategy that aligns with your market view and risk tolerance. Fidelity’s platform offers a wide range of options strategies, enabling you to customize your trades.

To select the appropriate strategy, consider the following factors: expected movement of the underlying asset, time horizon, and risk-reward ratio. For instance, if you anticipate a significant increase in stock price, you might opt for a call option. Conversely, a put option can hedge against price declines.

Understanding Option Greeks

Once you’ve chosen your strategy, it’s crucial to understand the concept of option Greeks. These are numerical values that measure the sensitivity of an option’s value to changes in underlying price, time, volatility, and interest rates. By interpreting these Greeks, you can fine-tune your trades and make informed decisions.

For example, the delta measures the option’s price change relative to the underlying asset. A positive delta indicates that the option’s value will rise as the underlying price increases, while a negative delta suggests the opposite. Understanding these Greeks empowers you to adjust your positions and manage risk effectively.

Capitalizing on Market Volatility

The level of volatility in the financial market plays a significant role in options trading. Volatility measures the fluctuation of an asset’s price over time. Higher volatility typically leads to increased option prices, making it an opportune time to trade options.

Fidelity provides tools and resources to analyze volatility and identify trading opportunities. By understanding market sentiment and incorporating volatility into your strategy, you can capitalize on market swings and enhance your profitability.

Image: tradingplatforms.com

Tips for Successful Trading

To maximize your chances of success in trading options on Fidelity, follow these expert tips:

- Educate yourself: Dedicate time to understanding the basics of options trading and the intricacies of different strategies.

- Practice with a paper-trading account: Fine-tune your skills without risking actual capital.

- Manage risk: Employ stop-loss orders to limit potential losses and maintain a disciplined approach.

- Stay up-to-date: Keep abreast of market news and developments that could impact your trades.

- Seek professional guidance when needed: Consult with a financial advisor if you encounter complex situations or require personalized advice.

Frequently Asked Questions (FAQs)

Q: What type of options trading account do I need to open on Fidelity?

A: Most retail investors will require an Options Level 1 account, which permits basic options trading strategies.

Q: How do I determine the premium for an option?

A: The premium includes intrinsic value, which is determined by the difference between the strike prices and the underlying asset’s price, as well as time value.

Q: What happens if an option expires in the money?

A: If you hold a call option that expires in the money, you have the right to purchase the underlying asset at the strike price, while a put option grants you the right to sell.

Trading Options On Fidelity Reddit

Conclusion

Trading options on Fidelity empowers individual investors to expand their investment strategies and pursue advanced financial goals. By understanding options basics, employing effective strategies, and managing risk prudently, you can harness the potential of options trading and increase your chances of achieving long-term success.

Are you ready to delve into the world of options trading on Fidelity? Take the next step and open an account today to explore the exciting possibilities and enhance your investment journey.