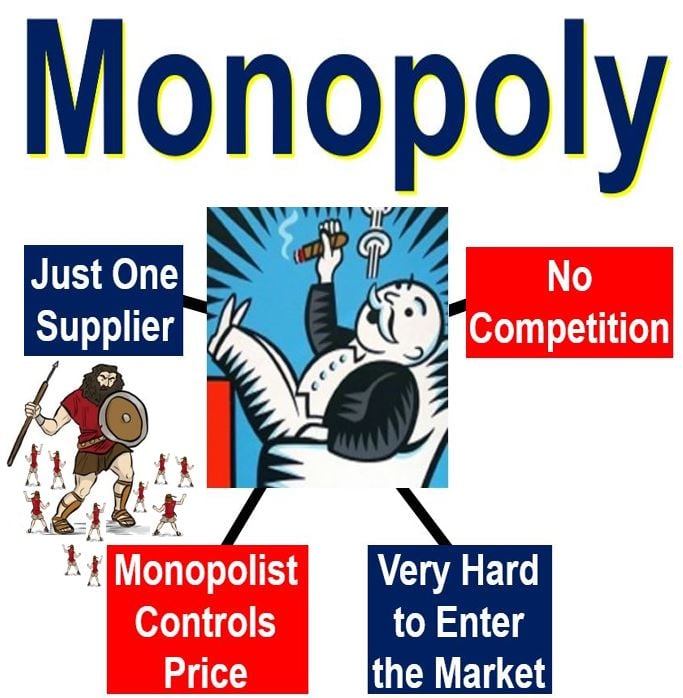

In the enigmatic realm of finance, where fortunes are made and lost with a click, hidden giants dictate the flow of markets. Options trading, once a labyrinth of complexities, has become the exclusive domain of select powerhouses, creating a stark monopoly that stifles competition and manipulates the system.

Image: homecare24.id

Like silent puppeteers, these monopolies wield enormous influence over the options market, commanding prices and controlling volumes. They extract exorbitant premiums while depriving investors of fair value, casting a long shadow over the once-dynamic landscape.

The Anatomy of Options Trading Monopolies

Options trading, a sophisticated form of investing, grants the holder the right to buy or sell an underlying asset at a specific price within a predetermined timeframe. In recent years, a handful of colossal market makers have emerged, consolidating their grip on the options market.

These behemoths dominate trading platforms, acting as the sole liquidity providers for many options contracts. This formidable concentration of power enables them to manipulate bid-ask spreads, dictating not only the cost of trading but also the opportunities available to investors. They have the dubious ability to suppress or spike volatility, shaping the market landscape to their whims.

The ramifications of this monopoly are far-reaching. By controlling the flow of information and setting the terms of engagement, these market makers create an opaque and unforgiving environment for retail investors.

The Perils of Market Manipulation

Beneath the veil of perceived stability, options trading monopolies pose serious risks to the integrity of the market.

- Predatory Pricing: Monopolies can exploit their market dominance by artificially inflating premiums, siphoning off the hard-earned money of unsuspecting investors.

- Pseudo-Liquidity: By controlling the majority of trading volume, monopolies can create the semblance of liquidity while masking the true depth of available options.

- Artificial Volatility: Through coordinated actions, monopolies can artificially manipulate volatility, setting up traps for both buyers and sellers.

Unveiling the Invisible Hand

The veil that cloaks options trading monopolies must be lifted, empowering investors with knowledge to challenge the entrenched forces that orchestrate the market.

- Promote Transparency: Demand greater transparency from trading platforms and market makers, including disclosure of trading algorithms and volume statistics.

- Cultivate Competition: Encourage the emergence of new players in the options market, fostering healthy competition that will break the monopoly’s stranglehold.

- Educate Investors: Empower retail investors with in-depth education on options trading, enabling them to discern the true value of contracts and protect themselves from predatory practices.

“United, we stand. Divided, we fall,” an astute adage that resonates in the fight against options trading monopolies. As we collectively raise our voices and demand accountability, we can shatter the shroud of monopoly, ushering in a fairer and more equitable options market for all.

Are you an investor who has encountered the insidious grip of options trading monopolies? Do you believe that it is paramount to break up these monopolistic structures to restore balance and integrity to the market? Share your thoughts and experiences in the comments section below. Together, we can amplify our voices and demand a market that serves all participants, not just the privileged few.

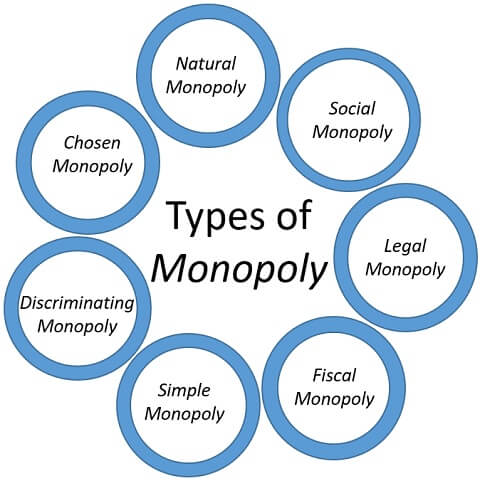

Image: studiousguy.com

Options Trading Monopolies

Image: eaglelana.weebly.com

FAQs on Options Trading Monopolies

Q: What are the primary concerns associated with options trading monopolies?

A: Options trading monopolies can lead to predatory pricing, pseudo-liquidity, and artificial volatility, which collectively undermine the fairness and efficiency of the market.

Q: What can individual investors do to combat options trading monopolies?

A: Investors can advocate for transparency, encourage competition, and educate themselves on options trading practices to make informed decisions and protect their investments.

Q: Are there any regulatory efforts underway to address options trading monopolies?

A: Yes, there have been ongoing discussions and investigations by regulatory bodies to examine the potential antitrust concerns and regulatory gaps related to options trading monopolies.

Q: What is the significance of breaking up options trading monopolies?

A: Breaking up options trading monopolies can foster a more competitive landscape, enhance market transparency, and reduce excessive premiums, ultimately benefiting all participants in the market.

Q: Is it possible for smaller market participants to compete with options trading monopolies?

A: While challenging, it is not impossible for smaller market participants to compete with options trading monopolies by focusing on niche markets, offering specialized services, and leveraging technology to provide innovative trading solutions.