When exploring the vast landscape of investing, one strategy that stands out for its potential to reap exceptional returns is trading stock option premiums. Unlike traditional stock trading, which involves buying and selling actual shares, trading options involves speculating on the future price of these shares. This guide delves into the intriguing world of stock option premiums, empowering you with the knowledge and insights to navigate this complex yet potentially lucrative avenue.

Image: optionstradingiq.com

What Are Stock Option Premiums?

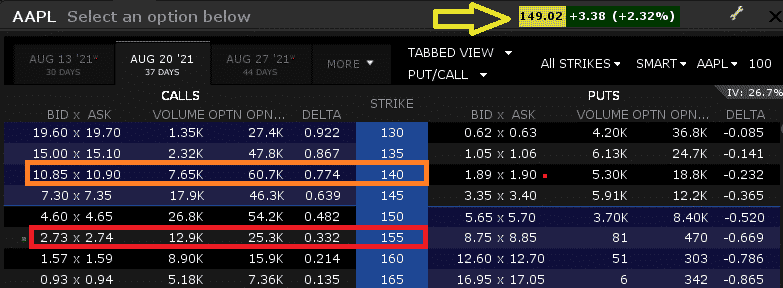

Imagine stock options as contracts that grant you the right, but not the obligation, to either buy (call option) or sell (put option) a specific number of shares of a particular stock at a predefined price (strike price) on or before a certain date (expiration date). These options are typically traded on an exchange, where buyers and sellers negotiate the price of the contract, known as the option premium.

The Significance of Trading Option Premiums

Trading option premiums presents a unique opportunity to enhance your returns in multiple ways. By speculating on the future price movements of a stock, traders can potentially profit from both rising and falling markets. Additionally, options offer leverage, enabling traders to control a significant number of shares with a relatively small investment.

The Anatomy of an Option Premium

Understanding the anatomy of an option premium is crucial for successful trading. It consists of two components:

-

Intrinsic Value: The intrinsic value represents the difference between the strike price and the current market price of the underlying stock. For call options, it becomes positive when the stock price exceeds the strike price, and vice versa for put options.

-

Time Value: This component reflects the market’s assessment of the likelihood that the option will become profitable before its expiration date. Factors such as time to expiration, volatility, and risk-free interest rates influence the time value.

Trading Strategies for Option Premiums

The world of option premiums offers a wide array of trading strategies to cater to different risk appetites and trading styles. From simple to complex, these strategies involve buying or selling call and put options at various strike prices to capture specific price movements.

-

Buy-and-Hold Strategy: This strategy involves buying an option premium and holding it until its expiration date or selling it before. It is suitable for traders with a long-term perspective who anticipate a significant price movement in the underlying stock.

-

Covered Call Strategy: In this strategy, an investor who owns the underlying stock sells a call option against it. The premium received provides additional income while also limiting potential gains should the stock price rise.

-

Bear Put Spread Strategy: This technique involves simultaneously buying a put option at a lower strike price and selling a put option at a higher strike price. It thrives in markets where a stock is expected to decline in value.

Seeking Expert Insights and Implementing Actionable Tips

To enhance your trading success, it is essential to tap into the invaluable insights and expertise of seasoned professionals in the field of options trading. Their wisdom can help you navigate the market’s complexities and make informed decisions.

-

Consult Financial Advisors: Experienced financial advisors can provide personalized recommendations based on your financial goals and risk tolerance, guiding you towards suitable option trading strategies.

-

Attend Industry Webinars and Seminars: These educational events often feature leading option traders who share their expertise and insights on the latest market trends and strategies.

-

Read Books and Articles: Delve into the wealth of knowledge available in books and articles dedicated to options trading. They offer comprehensive explanations, case studies, and practical tips to enhance your understanding.

Empowering Conclusion

Trading stock option premiums requires a thorough understanding of the underlying concepts, a keen eye for market trends, and the ability to execute carefully planned strategies. By embracing the knowledge and insights provided in this guide, you can unlock the potential to enhance your returns and become a more confident navigator of the financial markets.

Remember, successful option trading is not a sprint but a journey. It demands continuous learning, adaptability, and a willingness to embrace both rewards and challenges. With dedication and perseverance, you can master the art of trading option premiums and unlock financial success.

Image: www.youtube.com

Trading Stock Option Premiums

Image: www.meta-formula.com