Introduction

In the burgeoning realm of digital finance, crypto options trading has emerged as a game-changer, providing savvy investors with a powerful tool to navigate the volatility of cryptocurrency markets and potentially maximize their earnings. While crypto options trading has gained traction globally, its recent introduction in the United States has ignited excitement among investors seeking to tap into the immense potential of this innovative investment strategy.

Image: www.tokenmetrics.com

Understanding Crypto Options Trading in the US

Crypto options trading involves contracts that grant traders the right, but not the obligation, to buy or sell a specific cryptocurrency at a predetermined price (strike price) on or before a specified date (expiration date). Options contracts offer traders the flexibility to speculate on future price movements without directly owning the underlying asset, making them a popular tool for risk management and strategic investing.

The US market for crypto options has witnessed exponential growth in recent years, driven by the increasing institutional adoption of cryptocurrencies, the emergence of regulated exchanges like Cboe and CME Group, and the launch of several retail trading platforms. This growth has fueled the development of a robust ecosystem, providing traders with access to a wide range of crypto options products and services.

The Advantages of Crypto Options Trading in the US

For those seeking to invest in the rapidly evolving crypto market, crypto options trading offers several compelling advantages:

-

Risk Management: Options contracts allow traders to mitigate downside risk by hedging their positions, limiting potential losses while preserving the opportunity for profit.

-

Flexible Strategies: Crypto options empower traders with a diverse range of strategies, from conservative hedging techniques to sophisticated speculative plays, catering to different risk appetites and investment goals.

-

Access to Leverage: Options trading enables traders to leverage their capital, potentially amplifying both profits and losses, making it an attractive tool for experienced investors comfortable with higher-risk scenarios.

-

Enhanced Liquidity: The growth of US-based crypto options exchanges has significantly improved liquidity, facilitating seamless trading and reducing bid-ask spreads, providing investors with competitive pricing and efficient execution.

Expert Insights and Actionable Tips for Crypto Options Trading in the US

To maximize their success in crypto options trading, investors should heed the advice of experienced market professionals:

-

Seek Knowledge and Education: Educate yourself thoroughly on crypto options trading concepts, strategies, and market dynamics to make informed decisions and avoid costly mistakes.

-

Choose a Reputable Exchange: Select a regulated and well-established crypto options exchange with a track record of security, reliability, and liquidity to ensure a safe and transparent trading environment.

-

Manage Risk Properly: Exercise caution when employing leverage and thoroughly assess the potential risks of each trade, utilizing stop-loss orders to limit losses.

-

Understand the Tax Implications: Consult with a qualified tax professional to navigate the taxation of crypto options trading to optimize your tax strategy and avoid unnecessary liabilities.

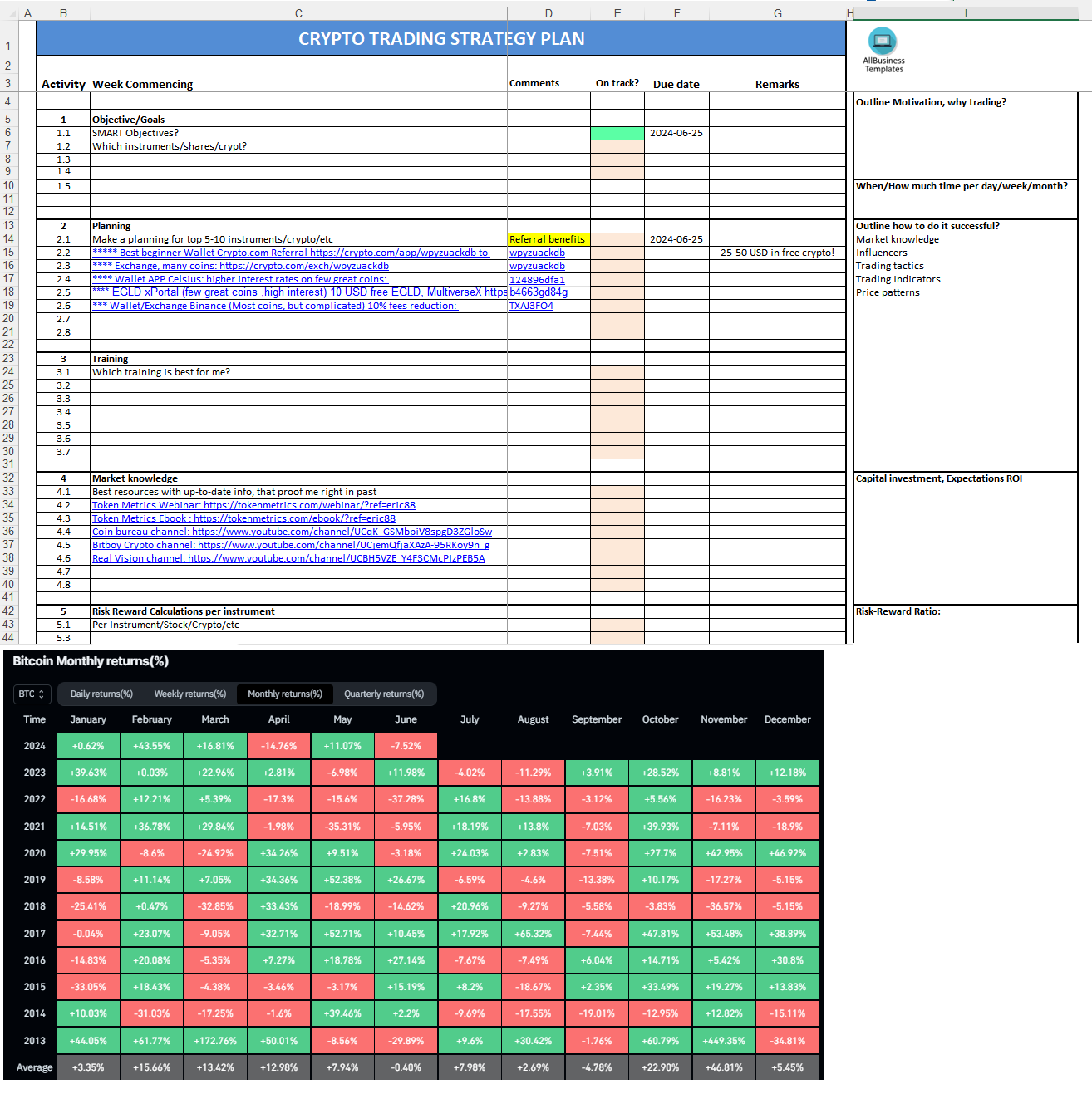

Image: www.allbusinesstemplates.com

Crypto Options Trading Us

Image: salesianspectator.com

Conclusion

Crypto options trading in the US has opened up a world of possibilities for investors seeking to navigate the volatile waters of cryptocurrency markets. With its inherent advantages of risk management, flexible strategies, and enhanced liquidity, crypto options empower traders with the tools to potentially maximize their earnings and achieve their financial goals. By embracing sound trading practices, seeking expert guidance, and investing wisely, individuals can harness the power of crypto options to unlock the full potential of digital asset investing in the United States and beyond.