Introduction

In a financial market brimming with complexities, options trading offers both allure and anxiety to aspiring investors. Enter “the wheel,” a multifaceted trading strategy that deftly navigates the often-choppy waters of options markets. By deftly combining selling covered calls and cash-secured puts, this approach seeks to capture premium income while mitigating risk. Allow me to unravel the intricacies of this technique and empower you to make informed decisions on your financial journey.

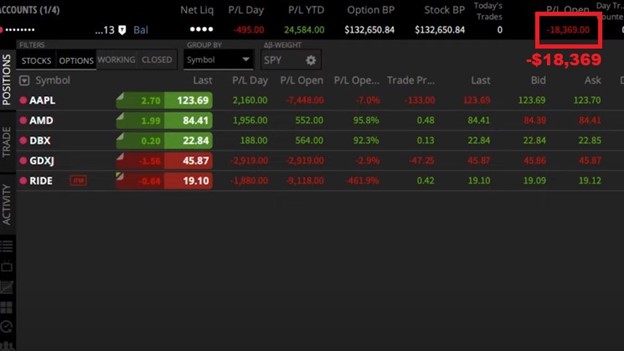

Image: haikhuu.com

Before diving into the specifics of the wheel strategy, it’s imperative to lay a solid foundation. Options are contracts that grant the buyer the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price (the strike price) on or before a specified date (expiration date). These contracts, derived from the underlying asset, allow investors to speculate on its future price movements, hedge against potential losses, or generate income through premium.

The Mechanics of the Wheel

The wheel strategy essentially involves selling (or writing) both covered calls and cash-secured puts on the same underlying asset. Here’s a step-by-step breakdown:

- Selling a Covered Call: You sell a call option against a stock you already own. By doing so, you grant the buyer the right to buy those shares from you at the strike price on or before the expiration date. In return, you receive a premium, which reduces your cost basis in the stock.

- Selling a Cash-Secured Put: You sell a put option against cash you possess. By writing this contract, you obligate yourself to buy the underlying asset if the price falls below the strike price on or before expiration. Again, you collect a premium for assuming this commitment.

The beauty of the wheel lies in its ability to generate income in both bullish and bearish markets. If the stock price rises, your covered call may be exercised, forcing you to sell your shares at the strike price. However, you would have already profited from the premium received when you initially sold the call. Conversely, if the stock price falls, you may be obligated to buy the underlying asset through your cash-secured put. However, the premium received provides a cushion against potential losses.

Advantages and Considerations

Like any trading strategy, the wheel comes with its own set of advantages and considerations:

Advantages:

- Income Generation: The strategy provides opportunities for consistent income through premium collection.

- Risk Management: By selling both calls and puts, the wheel allows investors to hedge against both upside and downside price movements.

- Cost-Effectiveness: Unlike other options strategies, the wheel requires minimal capital outlay, making it accessible to a wider range of investors.

Image: www.moneyshow.com

Considerations:

- Loss Potential: While the wheel helps mitigate risk, losses can still occur, especially if the underlying asset experiences extreme price swings.

- Time Commitment: The strategy requires active monitoring and timely adjustments to maximize returns.

- Volatility Sensitivity: The wheel strategy performs best in markets with moderate volatility, excessive volatility may erode profitability.

Expert Tips for Success

To enhance your odds of success when employing the wheel strategy, consider these expert tips:

- Select Liquid Assets: Choose underlying assets with high trading volume and open interest to ensure ample liquidity for option trading.

- Manage Risk Prudently: Choose strike prices that align with your risk tolerance and investment goals.

- Monitor Market Conditions: Stay abreast of market news, economic events, and the performance of your underlying asset.

- Avoid Emotional Trading: Stick to your trading plan and avoid making impulsive decisions based on short-term price fluctuations.

- Seek Professional Advice: Consult with a financial advisor if you lack experience or need personalized guidance.

Options Trading The Wheel

Image: optionstradingiq.com

Conclusion

Options trading the wheel is a versatile strategy that can provide income generation, risk management, and capital efficiency for savvy investors. By understanding the mechanics, advantages, and considerations involved, you can harness the power of the wheel to navigate the ever-changing landscape of financial markets. Remember, consistent education, sound risk management, and unwavering discipline are the keys to unlocking success in the world of options trading.

Are you intrigued by the complexities of options trading the wheel? Share your thoughts and experiences in the comments below. Together, let’s explore the intricacies of this strategy and unlock its potential for financial growth.