**

Image: fxeareview.com

**

With the advent of more accessible financial markets, the allure of options trading has capsized the investment landscape, tempting both novice and seasoned investors alike. Options contracts, derivatives that confer the right (not the obligation) to buy or sell an underlying asset at a predetermined price within a specified time frame, have emerged as potent tools for risk management, speculation, and income generation. Embark on this thorough exploration as we delve into the intricacies of options trading, equipping you with the foundational knowledge and practical strategies to harness the transformative power of options contracts.

Understanding Options Contracts: A Foundation for Success

An options contract encapsulates an agreement between two parties, the buyer and the seller, whereby the buyer acquires the right to exercise the option, either to buy (call option) or sell (put option) the underlying asset at a price stipulated in the contract (the strike price) before the expiration date. This flexibility distinguishes options from traditional investments, empowering investors to capitalize on price fluctuations without the obligation to execute the trade. Options contracts are versatile instruments, allowing for nuanced risk-reward profiles, catering to diverse investment objectives and market conditions.

Navigating the Options Market: Key Concepts

To navigate the options market effectively, it is essential to comprehend several fundamental concepts:

- Call Option: Grants the buyer the right to buy the underlying asset at the strike price on or before the expiration date.

- Put Option: Offers the buyer the right to sell the underlying asset at the strike price on or before the expiration date.

- Strike Price: The predetermined price at which the buyer can buy (call option) or sell (put option) the underlying asset.

- Expiration Date: The date on which the option contract expires, rendering it worthless.

- Option Premium: The price paid by the buyer to the seller for the option contract, representing the cost of the option.

- Underlying Asset: The security or instrument on which the option contract is based (e.g., stock, index, ETF).

Real-World Applications of Options Contracts: Maximizing Investment Potential

Options contracts offer a plethora of applications, empowering investors with versatile trading strategies:

- Hedging: Mitigating portfolio risk by offsetting potential losses on existing positions.

- Speculation: Capitalizing on anticipated price movements of the underlying asset.

- Income Generation: Selling options premiums to generate income while assuming varying degrees of risk.

- Advanced Strategies: Employing complex strategies like spreads and combinations to enhance returns and manage risk.

Trends and Developments in Options Trading: Staying Ahead of the Curve

The options market is constantly evolving, with new trends and developments emerging to provide investors with innovative opportunities:

- Growth of ETF Options: The burgeoning exchange-traded fund (ETF) market has led to a surge in ETF options, providing investors with exposure to a diversified basket of underlying assets.

- Rise of Binary Options: Binary options, which offer a fixed payout based on whether the underlying asset price is above or below a certain level at expiration, have gained popularity due to their simplicity and potential for high returns, albeit with significant risks.

- Technological Advancements: The advent of online trading platforms and mobile applications has democratized access to options trading, facilitating real-time order execution and market analysis.

- Growing Institutional Participation: Institutional investors are increasingly embracing options trading as a means to manage portfolio risk and enhance returns, leading to increased market liquidity and stability.

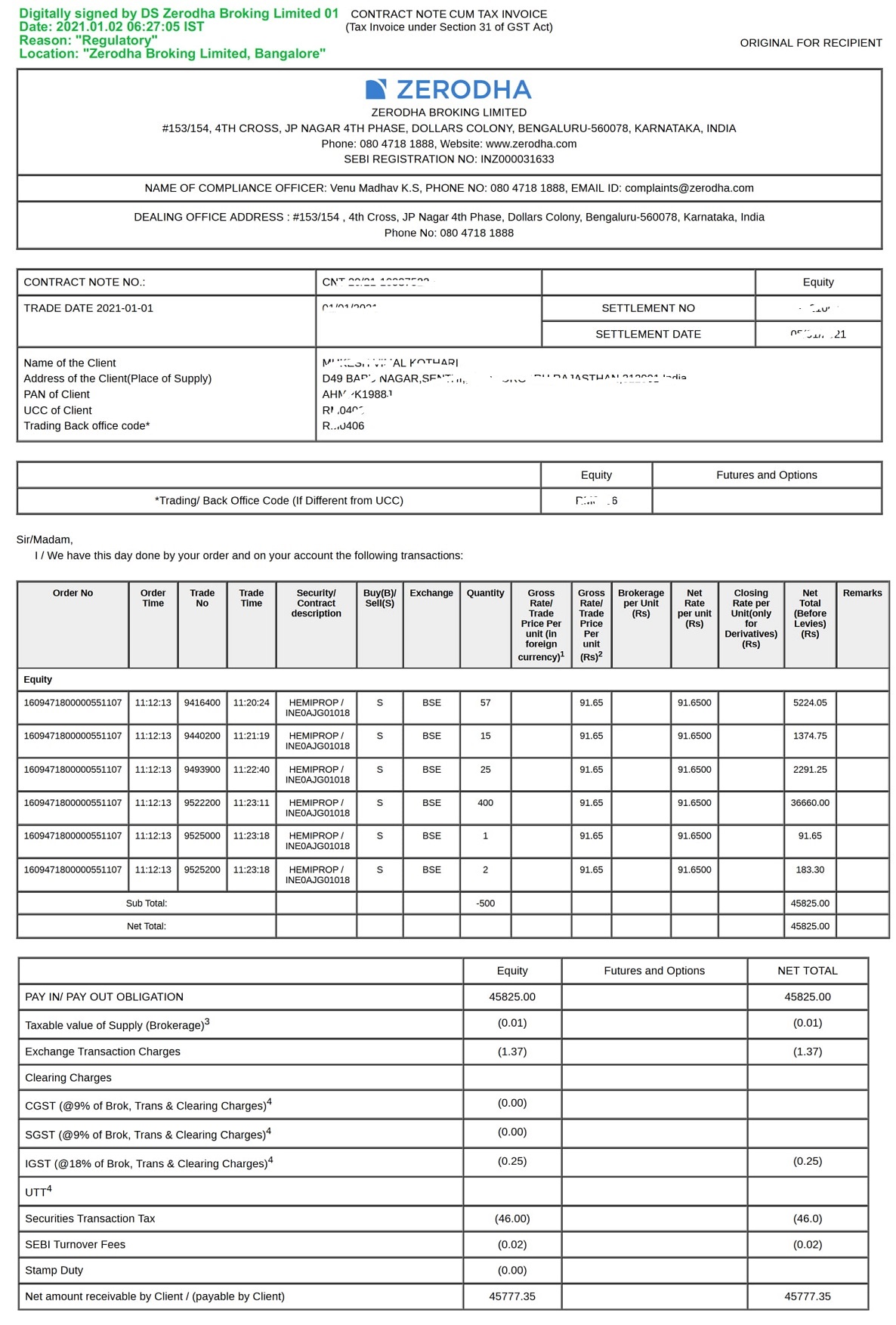

Image: www.chittorgarh.com

Trading Contract Options

Image: speedtrader.com