Unveiling the Significance and Implications of Market Depth

When venturing into the realm of options trading, understanding the intricate tapestry of terminology is paramount. One such term that often sparks queries among traders is “mark.” This enigmatic concept plays a pivotal role in options evaluation and strategy formulation. Delve into this comprehensive guide as we unravel the enigma surrounding the term “mark” and explore its profound significance in the options arena.

Image: stockmaven.com

Understanding the Mark in Options Trading

In the dynamic realm of options trading, “mark” refers to the prevailing market price of an options contract at a specific moment. It’s the midpoint between the bid price (the highest price a trader is willing to pay for the contract) and the ask price (the lowest price a trader is willing to sell the contract). The mark provides a snapshot of the current market sentiment towards a particular option and its underlying security.

Importance of the Mark in Options Trading

The mark holds immense significance for options traders. It serves as a critical indicator of market demand and supply for a specificオプション契約. The closer the mark is to the intrinsic value of an option, the lower the implied volatility in the market. Conversely, a substantial deviation between the mark and the intrinsic value suggests higher implied volatility. This information can guide traders in making informed decisions regarding the pricing of options contracts and their potential for profit.

Applications of the Mark in Options Trading

The mark finds diverse applications in options trading strategies. In delta-neutral strategies, options traders strive to maintain a neutral delta by combining long and short positions in two or more options contracts. The mark provides the reference point for traders to adjust their delta exposure and maintain the desired hedging position. Additionally, the mark is crucial in calculating the Greeks, such as delta, gamma, theta, and vega, which measure the sensitivity of an options contract to various market factors.

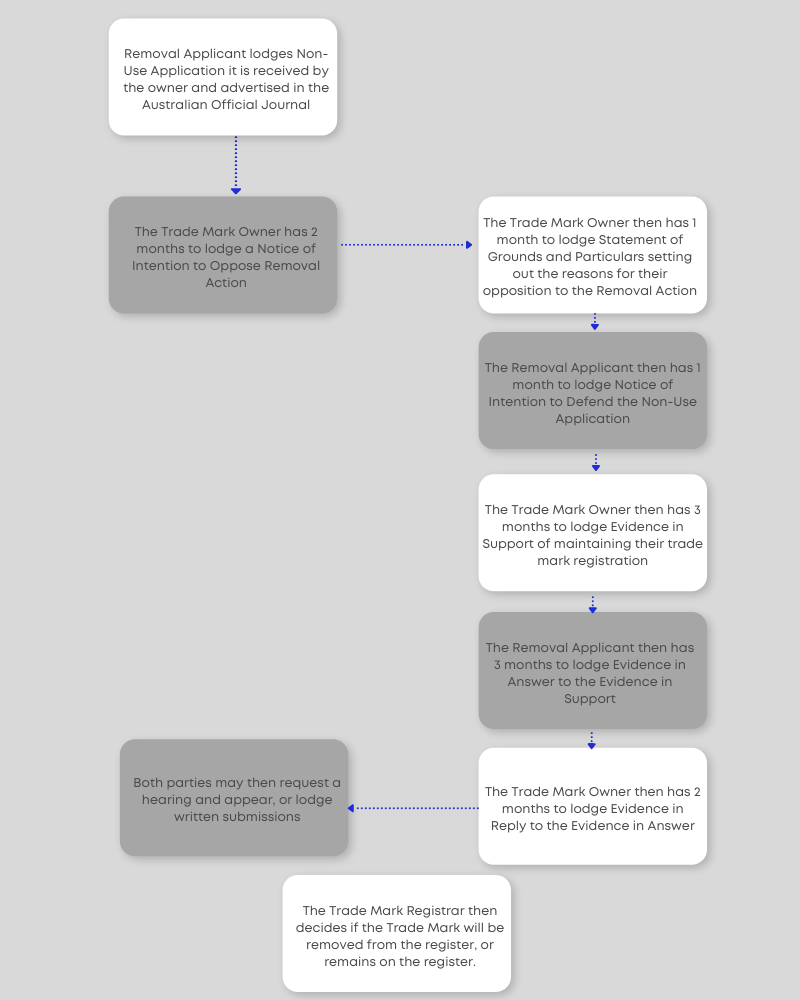

Image: www.coulterlegal.com.au

Real-World Example of Utilizing the Mark

Let’s consider a hypothetical scenario to solidify our understanding of the mark. Assume an options trader is considering purchasing a call option on a stock with a strike price of $100. The current stock price is $98, and the bid-ask spread for the call option with an expiration date of one month is $2.50 – $2.75. The mark for this option contract would be $2.625, representing the average of the bid and ask prices.

In this scenario, if the trader expects the stock price to rise above $100 before the expiration date, they may consider purchasing the call option. However, if they anticipate the stock price to remain below $100, they may opt for a different strategy. The mark, therefore, serves as a crucial reference point for traders to assess the potential profitability of an options contract based on their market expectations.

What Does Mark Mean Options Trading

Image: www.forex.academy

Conclusion

Comprehending the concept of “mark” is indispensable for gaining proficiency in options trading. It encapsulates the prevailing market price of an options contract, reflecting the interplay of demand and supply. The mark empowers traders with the knowledge to gauge market sentiment, price options contracts, and employ sophisticated trading strategies. By leveraging this knowledge, traders can navigate the complexities of options trading and enhance their chances of success in this dynamic and rewarding financial arena.