An Introduction to the CE vs. PE Saga

In the bustling arena of finance, options trading occupies a pivotal position, offering traders an array of opportunities for both profit and potential loss. Among the most fundamental aspects of options strategies lie the two opposing forces: calls (CE) and puts (PE). Grasping the nuances between these two instruments is crucial for aspiring traders seeking to navigate the labyrinth of options trading.

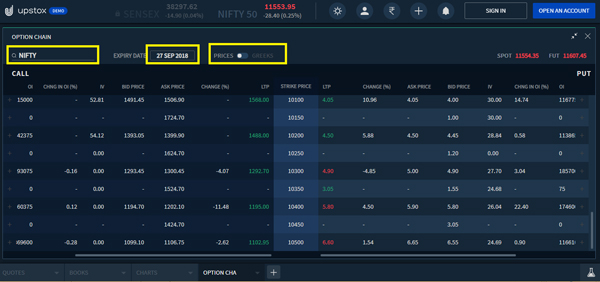

Image: www.youtube.com

Call options empower traders with the right, but not the obligation, to purchase an underlying asset at a predefined price (strike price) on or before a specified expiration date. Conversely, put options grant traders the right, but not the obligation, to sell an underlying asset at the strike price on or before the expiration date.

Unveiling the Purpose of Calls and Puts

The Allure of Call Options:

Call options thrive in bullish markets, where the underlying asset’s price is anticipated to rise. By acquiring a call option, traders gain the potential to profit from this upward trajectory. If the underlying asset’s price surpasses the strike price, the call option becomes increasingly valuable, as traders can exercise their right to purchase the asset at the predetermined strike price, effectively locking in a profit.

Call options serve a multifaceted role, enabling traders to capitalize on market rallies, hedge existing stock positions, or create speculative plays. Seasoned traders often employ call options to exploit market inefficiencies or capitalize on anticipated events that may propel the underlying asset’s price.

The Protective Nature of Put Options:

Put options, on the other hand, flourish in bearish markets, where the underlying asset’s price is expected to decline. Traders who anticipate a downturn in the market may purchase put options to protect themselves from potential losses. Put options grant traders the right to sell the underlying asset at the strike price, regardless of the market’s performance.

Put options are not solely confined to bearish markets; they also play a critical role in income-generating strategies and portfolio hedging. Advanced traders leverage put options to capitalize on market volatility or to create complex trading strategies that yield potential returns.

Image: financefundaa.com

Navigating the Tides of Volatility

Volatility, the unpredictable fluctuations in the market, presents a double-edged sword in options trading. Elevated volatility can amplify the potential returns of both call and put options, but it can also exacerbate the risks associated with these instruments.

Traders must meticulously assess the volatility of the underlying asset and the prevailing market conditions before venturing into options trading. Careful consideration of factors such as economic data, company announcements, and geopolitical events can empower traders to make informed decisions and mitigate potential risks

Empowering Traders with Expert Advice

Succeeding in options trading demands a discerning eye, a comprehensive understanding of market dynamics, and the ability to discern valuable opportunities amid market fluctuations. To assist aspiring traders in navigating this complex landscape, seasoned experts offer the following nuggets of wisdom:

- Comprehend the Basics: A solid foundation in options trading concepts, including terminology, strategies, and risk management techniques, is paramount.

- Study Market Trends: Monitoring market movements, analyzing company fundamentals, and staying abreast of economic news are essential for making informed trading decisions.

- Manage Risk Prudently: Risk management is the cornerstone of responsible options trading. Traders should meticulously calculate their potential losses and devise strategies to minimize the impact of adverse market conditions.

- Seek Professional Guidance: Consulting with experienced financial advisors can provide invaluable insights and tailored guidance, enhancing traders’ chances of success.

Deciphering the Expert’s Wisdom:

These expert recommendations serve as guiding principles for traders seeking to thrive in the dynamic world of options trading. Understanding the basics provides a roadmap for navigating the intricacies of options contracts, while market analysis empowers traders to identify potential trading opportunities and anticipate market movements.

Practicing prudent risk management ensures that traders do not overextend themselves, enabling them to manage their capital effectively and mitigate the impact of adverse market conditions. Moreover, seeking professional advice from experienced practitioners can accelerate traders’ progress and enhance their understanding of complex trading strategies.

Frequently Asked Questions: Delving Deeper into Options Trading

- Q: What is the key difference between a call and a put option?

A: Call options provide the right to purchase an underlying asset, while put options provide the right to sell an underlying asset. - Q: How do I determine the profitability of an options trade?

A: The profitability of an options trade depends on the difference between the strike price and the underlying asset’s price, minus the premium paid for the option. - Q: What are the risks associated with options trading?

A: Options trading carries the risk of losing the entire premium paid for the option, as well as the potential for unlimited losses if the underlying asset’s price moves significantly against the trader’s position. - Q: How can I learn more about options trading?

A: Educational resources such as books, online courses, and seminars can provide valuable insights into the intricacies of options trading.

Options Trading Ce Vs Pe

Image: libraryoftrader.net

Conclusion: Embarking on the Options Trading Journey

Options trading presents a potent yet intricate avenue for market participation. Understanding the fundamental differences between call and put options is crucial for aspiring traders seeking to harness the full potential of these instruments.

By diligently researching market trends, managing risk prudently, and seeking professional guidance, traders can equip themselves with the necessary knowledge and skills to navigate the ever-changing landscape of options trading. Remember, the financial markets are a vast and ever-evolving realm. Embrace the opportunity to learn, adapt, and refine your trading strategies, and you will be well-positioned to capture the rewards that options trading has to offer.

Are you intrigued by the world of options trading and its multifaceted nature? If so, I encourage you to delve deeper into this captivating subject. The journey may present challenges along the way, but with persistence and a thirst for knowledge, you can unlock the potential that awaits you in the realm of options trading.