Title: Master the Volatility Market: Unveiling the Secrets of UVXY Options Trading

Image: www.tradingview.com

Introduction:

“The market never sleeps,” they say. For those seeking to ride the ever-churning waves of volatility, there lies a powerful tool in the realm of options trading: the UVXY. This article takes you on an immersive journey into the world of UVXY options trading, empowering you with the knowledge and strategies to navigate the unpredictable waters of market fluctuations.

In the financial world, volatility is often regarded as a measure of risk. The higher the volatility, the greater the potential swings in the underlying asset’s price. UVXY (a ticker symbol for an exchange-traded note) taps into the volatility of the S&P 500 index, providing investors with a way to profit from market turmoil.

Understanding UVXY Options:

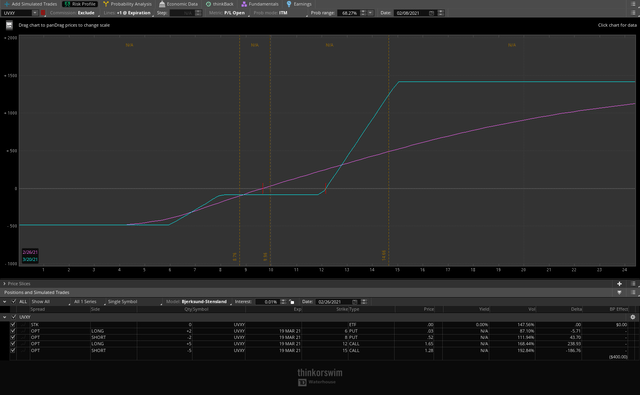

Options contracts grant the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price, known as the strike price, on or before a particular date, known as the expiration date. UVXY options allow you to speculate on the future direction of volatility.

Trading UVXY Options:

To trade UVXY options effectively, a solid understanding of the Greeks, particularly Delta and Theta, is crucial. Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price, while Theta measures the decay rate of an option’s value as time passes.

Utilizing options strategies like buying long-term calls or puts can allow you to potentially capitalize on sustained market volatility. Conversely, trading short-term options, such as day trading, requires a higher level of expertise and agility.

Expert Insights and Actionable Tips:

Renowned traders like Peter Cecchini emphasize the importance of understanding the interplay between Delta and Theta when trading UVXY options. They advise monitoring the VIX (Volatility Index), a measure of investor fear, to gauge market sentiment and potential opportunities.

For those considering UVXY options trading, it’s paramount to establish clear trading goals and risk tolerance. Start with small positions and gradually increase your stake as you gain confidence and experience.

Conclusion:

Navigating the tumultuous seas of UVXY options trading demands a blend of knowledge, strategy, and emotional discipline. By mastering the concepts outlined in this article, you can enhance your understanding of volatility markets and empower yourself to make informed decisions. Remember, the path to options trading success lies not merely in knowing the risks but in cultivating the skills and mindset to master the art of volatility.

Image: fairvaluestocks.blogspot.com

Uvxy Options Trading

Image: seekingalpha.com